We might like to think we love our customers like we love our children — equally.

And while we might love them all, the reality is, they’re not all equal. To a SaaS business, some customers are vastly more valuable than others.

You may have sold your products to some customers with special enterprise packaging, while others are paying a legacy price. Some customers use every integration and maximize your data retention policies — driving up your costs — while other lighter users keep costs low, but might be churn risks. Each of these customers have different margins and SaaS cost of goods sold (COGS).

At CloudZero, we talk to leadership teams at SaaS companies every day. When it comes to individual customer profitability, the vast majority of them fall into two camps: they’re either taking their best guess or they have no idea.

Typically only the largest companies — those with the resources to dedicate a 5–10 person engineering team to calculating cost — have this level of insight. And you can be sure they yield that knowledge to their competitive advantage!

For any SaaS business, it’s absolutely vital to understand which of your customers are the most and least profitable. Otherwise you’re leaving your most important strategic metrics to chance — jeopardizing your next fundraising round, your ability to withstand competitive pressure, or to make key product decisions.

Why SaaS Customer Costs Are More Difficult to Calculate and Control

If you’re selling a physical good (that’s not connected to the internet), your cost to deliver that product stops as soon as you hand it over to the customer. With SaaS, it’s the opposite. Your costs are living and breathing — and can change drastically as your customer behavior changes. In a year like 2020, when the whole world’s behavior changed in a week, those costs can make even bigger swings.

The beauty of AWS is that it’s consumption based, which enables you to tightly align your costs with the value your customers get by utilizing your product. It’s also dangerous. When your pricing is misaligned, you run the risk of losing money.

Here’s an example.

We recently spoke with a software company about their cloud costs and when they began to really focus on it. To help keep their anonymity, we won’t get specific, but let’s just say that one of the things they do is help power mobile apps.

They sold a huge enterprise deal to a major restaurant chain for a flat annual rate. That restaurant chain then ran a Super Bowl ad, which sent orders through the roof — along with the software company’s AWS bill. Suddenly, the margin on the customer vanished and their celebrated deal turned into lost revenue.

Cloud Cost Intelligence Helps Control Margins and Drives Resiliency

While not every company is dealing with Super Bowl commercial sized cost spikes, variability in cost across customers is happening every day — often in minor ways that can add up over time. What’s worse, is that too often it only becomes an area of focus after margins are already poorly impacted.

However, we don’t need to accept this as the status quo. With a deep understanding of customer profitability, you can build a stronger company with higher margins.

Here are four ways cloud cost intelligence enables you to understand the profitability of each of your customers.

Reason #1: It will help you make better pricing and packaging decisions.

Are only a few of your customers using your sophisticated new AI features — disproportionately driving up your cost? Maybe you could consider making them an add-on, instead of including them with your standard package.

Is the most compelling feature in your freemium tier driving up your cost to run free trials — and therefore your cost of customer acquisition? You could prioritize tackling the associated tech debt by rewriting the feature.

The decisions you could make to improve your financial metrics are endless, but without cost intelligence about how your customer product utilization is driving cost, you won’t know where to start.

In the story about the Super Bowl commercial, the company lost out because the package they sold to their enterprise customer was misaligned with the cost to deliver it. Had they better aligned their packaging with their cost, they actually could have charged the customer more and made a profit during the spike.

Reason #2: You can approach renewals informed with data.

When you know how much each customer costs you, you’ll know whether you can reduce churn risk by letting them stay on that sweetheart deal they got two years ago — or whether you really need to push them toward an enterprise plan.

If you know a customer is hurting your margins — or worse, you’re losing money — you can make an educated decision to let them go if they won’t agree to an upgraded contract.

Reason #3: You’ll be more prepared at your next fundraise.

Whether you’re ready to raise your B round or about to IPO, investors will want to see that you are well versed in customer profitability.

Itay Sagie, a strategic adviser to startups and investors, recommends that you’re ready to answer these four questions before you fundraise:

- How much money are you spending to get each client?

- What is each client worth to you?

- What percentages of your clients will churn?

- When do you expect profitability?

“The outcome will determine if you have potential for sustainable growth and if your company has the potential to be valued at eight or 10 times your revenues upon exit, meaning Enterprise Value (EV) / Revenue will be eight or above,” Sagie suggests.

A deep understanding of your customer costs will not only give potential investors confidence that you understand your business, but allow you to have more strategic conversations about the ideal customers and markets you could potentially target.

Reason #4: You can focus on driving the right kind of utilization and make your customers happier.

Customer utilization is a good thing. It means your customers are getting value from your product and is a good signal when it comes time for renewals.

However, some kind of utilization can also be more valuable than others.

For example, you might know that if your customer is hooked on your rich set of APIs and depends on them for their business operations, their risk of leaving your for your competitor is low, even if your competitor offers them a great deal.

But if your APIs are incredibly expensive to run and negatively impact your margins — they should be at the top of engineering’s list to optimize. Then, you can incentivize your Customer Success team to rally around getting every customer to use your APIs, without any fear of financial consequence.

Getting Visibility Into SaaS Customer Profitability With CloudZero

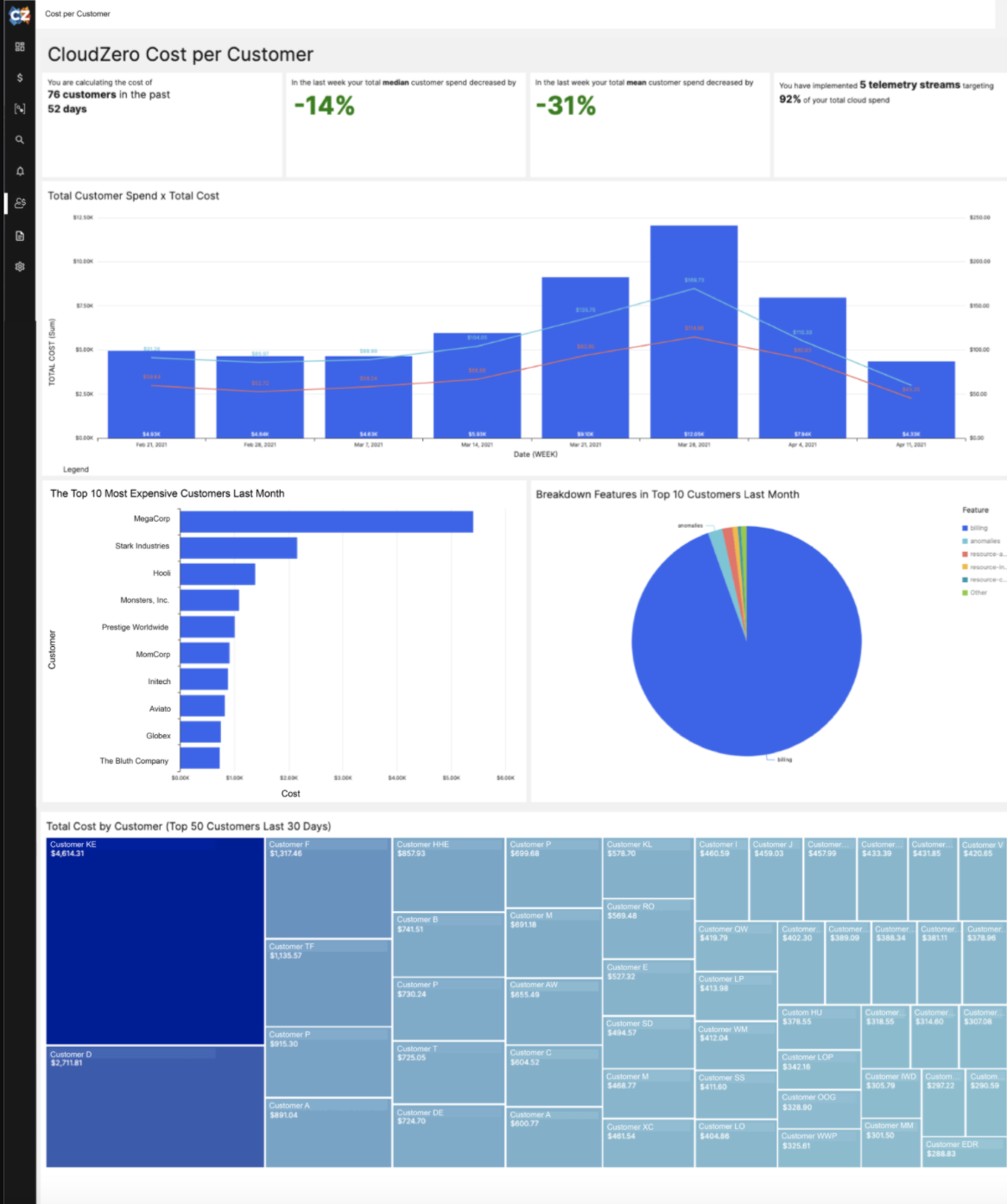

CloudZero helps you measure the profitability of each of your customers, so you can make more informed cost-based decisions. With rich context and granularity, CloudZero aligns cost to your product features, so you can also see how much you’re spending per feature in different accounts.

Pictured: The CloudZero cost per customer dashboard