One of the most important things SaaS companies need to think about to be successful is financial modeling.

To succeed in the increasingly competitive SaaS space, finance teams need to carefully consider a wide variety of KPIs and find ways to effectively manage present and future cash flows. Cash flows and liquidity are two of the most common challenges faced in this industry. But if effectively addressed, your company can position itself for long-term success.]

A robust SaaS financial plan can help give your business a lasting competitive edge.

In this article, we’ll discuss the most important things you should know about SaaS finance, including the keys to financial modeling and the financial metrics all SaaS teams need to pay attention to. Additionally, we will discuss some of the most useful software that can help your team address its growing financial needs.

What Is SaaS Finance?

SaaS Finance is a term used to describe the financial plans and operations of any company involved in the SaaS space. Many companies in this space offer software that is billed monthly or annually. Regardless of the pricing model employed, SaaS Finance remains abundantly important to ensure profitability regardless of the pricing model employed.

Two key components of SaaS finance are financial modeling and key performance indicators (KPI). As the terms might suggest, financial modeling helps firms forecast future financial changes and discover ways to improve their bottom line. Furthermore, KPIs can help firms develop greater insight into their financial operations and identify opportunities to improve.

As the Corporate Finance Institute states, “Building a financial model for a Software as a Service (SaaS) company typically requires creating a monthly model that forecasts users, subscription rates, churn rates, and average revenue per user (ARPU).” These models are designed to address the unique challenges inherent to the broader SaaS industry.

SaaS finance, like most types of professional finance, relies on three key accounting statements: the income statement, the balance sheet, and the statement of cash flow.

Each of these statements plays a crucial role in the reporting and decision-making process and can help enterprises address various challenges, such as liquidity, profitability, tax obligations, expansion, and more.

Ideally, a good SaaS financial model can help firms answer a variety of important questions:

- What is the cost of acquiring a new customer? What is the cost of maintaining an already existing customer?

- What are the costs and benefits of switching from a licensing to a subscription payment model?

- What are the marginal benefits of obtaining a new subscription?

- How financially sensitive is our company to the status quo?

- What is the current value of our organization?

- What are the most apparent changes our organization can make to create a better financial position?

Of course, answering each of these pivotal questions is not always easy. Sudden changes in supply and demand, new regulations, and other variables can all make it difficult to predict what the future has in store.

However, what remains clear is that with better data, finance teams can put themselves in a position to make better long-term decisions. This is why financial modeling for SaaS firms is so fundamentally important.

What Financial Models Are Used in SaaS?

As suggested, the three key financial statements will typically be used to base financial modeling in the SaaS industry — as is the case in most industries.

The balance sheet offers a “snapshot” of the company’s assets (which can include subscriptions, licenses, patents, and other “digital entitlements”), liabilities, and equity. The income statement will report the company’s revenue and expenses over a specific period of time, typically the year. The statement of cash flows will illustrate how cash has moved into and out of the company and will categorize each of these cash flow movements.

From there, the company will need to forecast its future activities, including changes in users and subscribers (whether positive or negative), churn rates, and expected revenues from each user.

It is not always possible to know these figures with certainty, but a good model will make it possible to “plug and chug” different scenarios and see how your business might be affected. For example, suppose your company was to double subscribers. Would that also double your bottom line?

Sensitivity analysis is a key component of SaaS finance. Essentially, sensitivity analysis aims to determine how changes in one variable (the input) will cause changes in another variable (the output). Sometimes, this sort of analysis is called the “What-If” analysis.

Discounted Cash Flow Valuation (DCF) is also commonly used by CFOs and other key decision-makers within the SaaS industry. It accounts for the value of all expected future cash flows, adjusted for the time value of money (TVM). Because the subscription model used throughout the SaaS industry makes cash flows rather predictable, DCF valuation is usually rather straightforward.

Having reliable financial models will not only help companies make better internal decisions, but they will also be used by other relevant parties, such as venture capitalists, lenders, tax authorities, investors, and more.

What SaaS Finance Metrics Should Finance Teams Monitor?

By now, it should be clear that what enables SaaS finance to thrive is monitoring the right financial metrics. Though the metrics that make the most sense for your business will depend on your specific needs and business model, these are twelve of the most common:

1. Monthly users

For your financial models to be accurate, you will need to accurately forecast how many people will be subscribed to your SaaS in any given month.

2. Churn rates

The churn rate is the percent of customers that abandon (or unsubscribe from) the service within a given period. High churn rates might indicate there is something fundamentally wrong with the software.

3. Average revenue per user

Understanding each user’s revenue will make it easier to make decisions regarding expansions, entering new markets, and consumer outreach.

4. Customer acquisition cost

Customers, unfortunately, are not free. How much is your business spending for one additional user?

5. Customer lifetime value

Higher lifetime customer values will make it easier to expand the company and find new growth opportunities.

6. LTV/CAC

The ratio between the lifetime value (LTV) and the customer acquisition cost (CAC) is a crude way for CFOs to determine the return on investment for each customer.

7. Payback period

The payback period simply, illustrates how long someone will need to remain a customer for you to “break even.”

8. Market size

While some software might be used by just about everyone, others will have a much more targeted possible audience. Understanding who might eventually be a customer can help you develop a better marketing model.

9. Discount rate

Applying an industry-consistent discount rate will help make it easier to determine how much future cash flows are worth in the status quo.

10. Net profit margin

Ultimately, your enterprise was created to produce a profit someday. Even if you won’t break even for several more years, the net profit margin is always worth keeping in mind.

11. Unit cost

For SaaS, unit cost may include cost per feature, per customer, per product, per message, or even cost per dev team. It’s important to understand the unit metrics that matter to you most and how they map to your cloud costs so your team can make engineering decisions that ensure profitability.

12. Cost of goods sold (COGS)

Finding ways to reduce the cost of goods sold is often one of the most effective ways to improve profit margins and potentially lower prices.

13. Burn rate

Monitoring burn rate helps ensure a business scales efficiently and avoids running out of cash, especially during growth or tough market conditions. There are two types:

- Gross burn rate: Total monthly cash outflows.

- Net burn rate: The difference between cash inflows and outflows.

14. Monthly recurring revenue (MRR)

MRR tracks the predictable monthly revenue from subscriptions. It’s critical for forecasting cash flow and business growth. MRR includes:

- New MRR: Revenue from new customers.

- Expansion MRR: Additional revenue from existing customers.

- Churned MRR: Revenue lost from cancellations.

How To Use SaaS Metrics For Decision-Making

The right data can help a business make informed decisions that drive growth and operational efficiency.

Here are key ways to use SaaS metrics effectively:

- Identify growth opportunities. Metrics provide insights into where your business is thriving or lagging. This helps you pinpoint areas for expansion or improvement.

- Optimize resource allocation. Data-driven decisions enable organizations to prioritize efforts and allocate resources where they will have the greatest impact.

- Improve financial forecasting. Metrics help in creating accurate financial models. They ensure that future cash flows and expenditures are well-planned and managed.

- Improve customer strategies. Regularly reviewing data helps businesses adjust their customer acquisition and retention strategies based on trends and performance.

- Measure business performance. Continuous tracking of key metrics enables teams to assess progress and adapt to market changes. They also refine strategies to meet business goals.

But while metrics guide decisions, benchmarking adds valuable context for growth.

The Importance Of Benchmarking Your Metrics Against Industry Standards

Benchmarking against industry standards helps put your metrics in perspective. It enables you to do the following:

- Set competitive goals. Ensure that your targets align with industry expectations.

- Identify gaps. Pinpoint areas where you may be underperforming or excelling.

- Improve efficiency. Use benchmarks to drive decisions that lead to better resource allocation and cost management.

Check out CloudZero’s cloud cost benchmarking report to see how your cloud spend compares to others in the industry.

SaaS Finance Software to Explore

Anyone who is familiar with SaaS knows just how valuable software can be. Here are some of the most popular platforms used across the industry:

1. For SaaS accounting: Quickbooks

As the most popular accounting software currently in use, QuickBooks makes it easy to generate financial statements, track accounts, plan your taxes, and plan for the future.

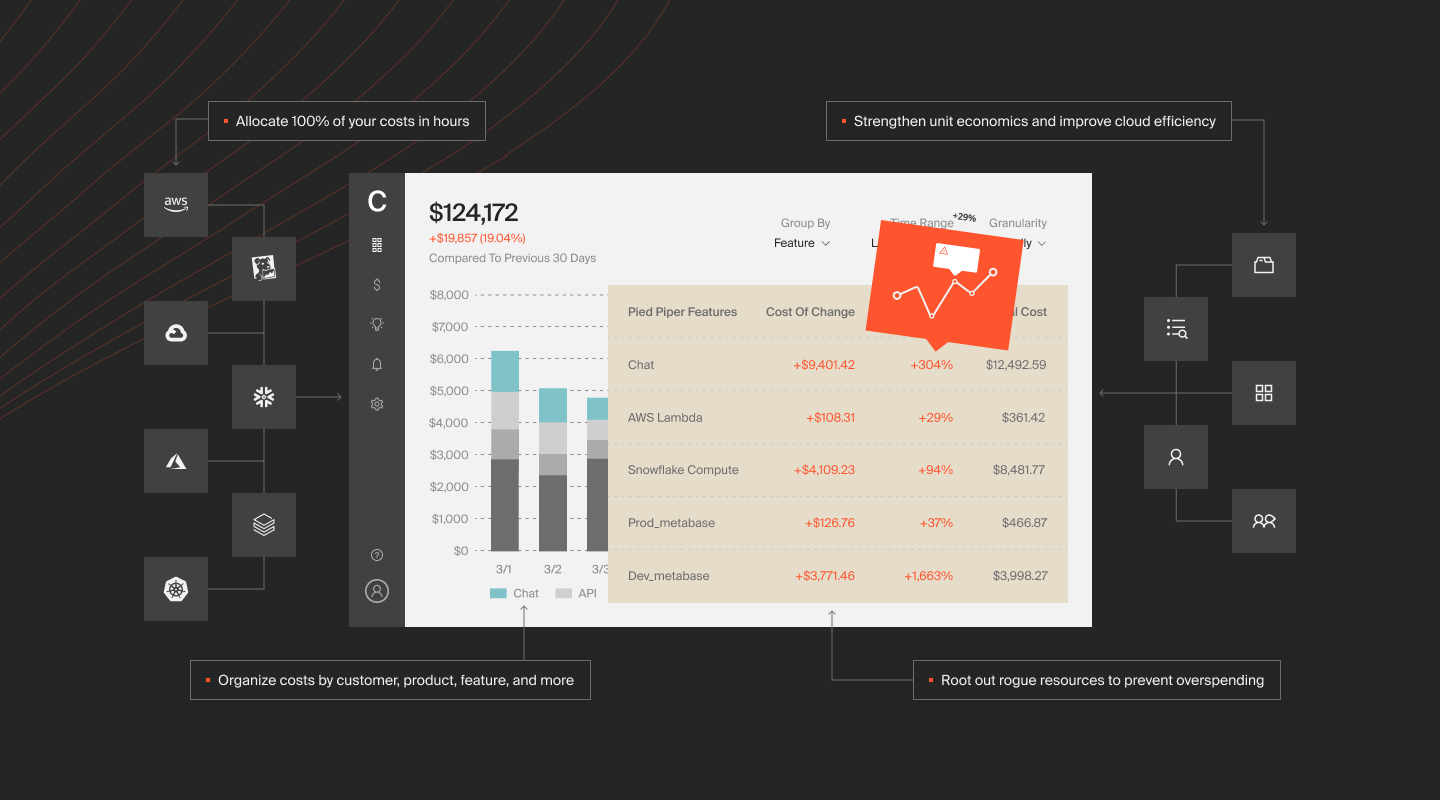

2. For understanding SaaS COGS and unit metrics: CloudZero

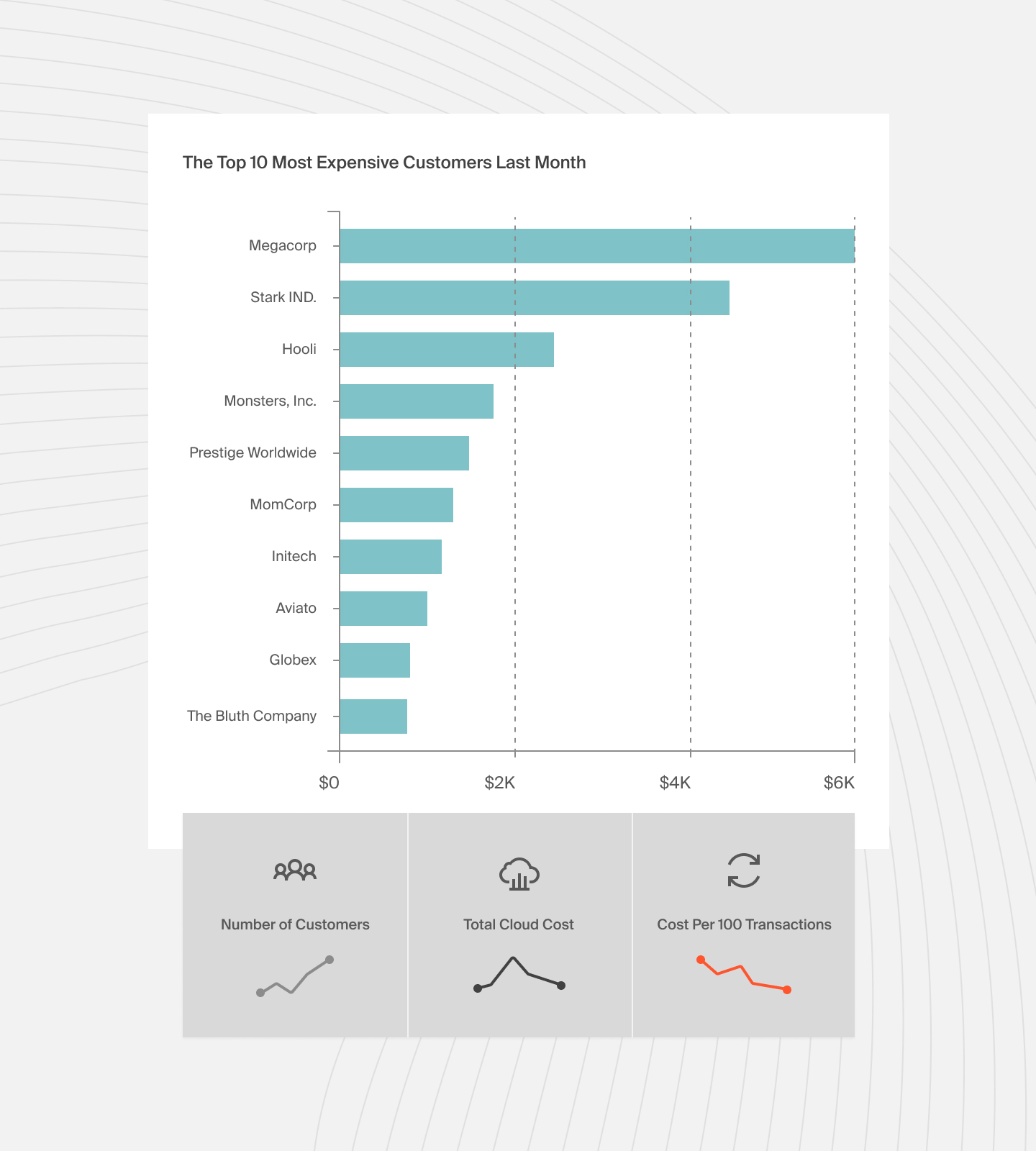

Cloudzero’s cloud cost intelligence platform enables SaaS companies to understand exactly how their AWS costs drive their specific features and products. By mapping cloud costs to products, features, dev teams, and more, engineering and finance alike can identify unit costs like cost per customer (e.g., answering questions like, “Who are our most expensive customers?”) and understand their SaaS COGS.

3. For building flexible financial models: Microsoft Excel

An oldie but a goodie, Microsoft Excel is a standard tool for anyone hoping to build flexible financial models and test various “What-If” scenarios.

4. For analyzing invoices: Oracle NetSuite

Oracle NetSuite is useful for analyzing invoices, streamlining compliances, making calculations, and adjusting your general ledger.

5. For monitoring SaaS metrics: ChartMogul

ChartMogul, which uses a monthly subscription model, is a useful platform for tracking key SaaS metrics, such as LTV, MRR, cashflows, and churn rates.

Take Control Of Your SaaS Brand’s Finances

As the SaaS industry continues its impressive rate of growth, more financial software and tools are likely to emerge. The industry presents tremendous potential, and those who are willing to invest in better financial models will be in a position to succeed.

Using some or all of the tools mentioned above will help put your brand in a position to have a strong understanding of the financial metrics that matter to you most. When it comes to identifying unit cost, SaaS COGS, and seeing how your AWS bill maps to your specific products and features, CloudZero’s cost intelligence platform provides SaaS teams the data and cloud cost visibility to find the answers they need.

to see how CloudZero can help your team answer questions about your cloud spend and uncover the cloud cost metrics that matter to your bottom line.

to see how CloudZero can help your team answer questions about your cloud spend and uncover the cloud cost metrics that matter to your bottom line.