Introduction: What You'll Learn In This Guide

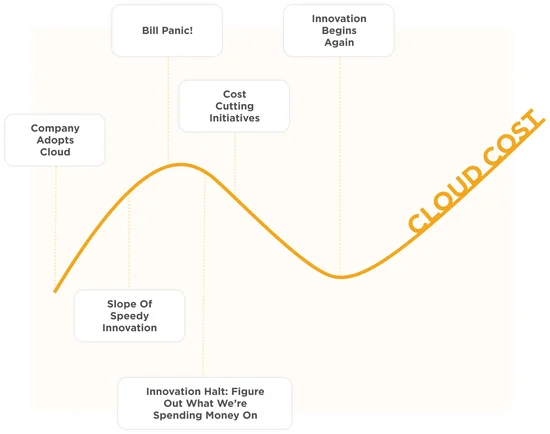

We have a term we like to use when we meet finance teams who have just gotten their biggest AWS bill ever: bill shock.

Bill shock is when finance suddenly rings the alarm that the bill is “too high” and gets everyone scrambling to explain what they’re spending money on. It often happens when the bill reaches a new milestone (the first million, ten million, or hundred million) or growth trajectory (it doubled in a quarter!?).

The problem with bill shock is that it can be highly disruptive.

Engineers are pulled off their roadmaps to investigate costs. Optimization projects are kicked off. Innovation slows as teams become hesitant to spend at the same rapid clip as before.

Then, once a significant amount of money has been saved, the innovation resumes — until next time.

We call this: the vicious cycle of cloud cost billing.

However, the problem is that finance often lacks context. They see a large number, without visibility into the business initiatives driving it.

With more granularity and context, finance can be less reactive, ask better questions, and cause less disruption.

In this guide, we’ll cover five important questions finance teams should ask themselves when evaluating their organization’s cloud cost. Then, we’ll discuss how you can better understand, manage, and optimize costs — as well as best practices for operational success.

5 Questions Every Finance Team Should Ask When Evaluating Cloud Spend

1. Is the cost really too high?

Understandably, a large AWS bill will provoke a feeling of sticker shock for a finance team who wants to make sure cloud spend is under control. But sometimes, upon further examination, finance may find that an AWS bill of that size is actually normal for a business at their company’s level.

The best way to put cloud cost into perspective is unit cost.

To start, pick a metric that represents your business, like cost per customer, user, API call, message sent — whatever aligns with the growth of your business. Partner with engineering to track unit cost over time. This will give you a shared understanding of spend in context, help engineering prioritize optimization only when it’s impactful, and even make it easier to predict how cost will change as you grow.

2. Which costs are fixed, and which scale up when we add a new customer or as users interact with our products?

If you are at an earlier stage company, or maybe just the earlier stages of a newly launched product, your unit costs will naturally be high. You’ve built a product with only a few customers using it.

Work with your engineering team to understand which costs are fixed, which will scale up with each customer added, and how the economics of those costs may improve over time. This will help you control spend as you grow while creating shared goals.

3. What is our cost per customer? How does that cost differ by segment, geography, package purchased, etc.??

Similarly, it’s important to know your average cost per customer. For many companies, it’s also crucial to know the cost of your individual customers and how your margins differ for each one.

It’s not uncommon that companies we work with are surprised to find they’re actually losing money on a few of their customers, who might be power users or have an unusually high amount of data.

Once you get to cost per customer, you can start breaking that into segments, giving you visibility into the profitability of each.

For example, the way customers utilize your features can vary significantly.

Perhaps you work at a social media app that markets to all age ranges, from college students to older generations. Your customers will have a completely different way of interacting with your platform and will therefore impact your costs differently. In this case, the solution to your problem may be to focus your marketing efforts on a particular demographic and spend less effort catering to others.

Similarly, if you are a B2B company and your EMEA segment profitability pales in comparison to APAC, you’ll want to investigate why and figure out how to correct it. It could be something unexpected. Maybe EMEA’s customer success team is phenomenal at driving feature adoption compared to APAC, driving up both your customer satisfaction and cost. You’ll want to consider how you could reduce cost or adjust pricing to continue driving that great customer satisfaction and profitability.

4. Which features are driving the increases in spend, and are they worth it?

Before you can make any adjustments, you have to understand which features are the primary reasons behind the cost increases.

Often, new features are well worth the higher price tag. If new upgrades mean your platform is now twice as fast, or you’ve just added a whole new section with additional features, you likely don’t want to slash spending and undo these improvements.

However, if the feature your customers hardly ever use is driving 50% of your cost, you might want to reconsider whether to sunset it or turn it off, except for the few who use it.

5. What is the opportunity cost of optimization?

Optimization isn’t free. It’s important to consider lost time, effort, money, and the features themselves before making a major change based on cloud cost alone.

Have conversations with your engineering leadership about the tradeoffs that will be made before you start demanding cost cuts. Together you can make the decision that’s best for your business.

How Can Cloud Financial Management Help?

Cloud Financial Management, or CFM, is the process of identifying, measuring, monitoring, and optimizing cloud costs. It may also be referred to as “cloud cost management” or “cloud cost optimization”.

CFM consists of procedures and tools that enable organizations to manage their cloud spend — in a way that maximizes their investment in the cloud.

Why is this important?

Unexpected cloud spending remains one of the top barriers to realizing business value. In a research survey by IDG, cloud users admitted their rising service bills consistently disrupted their cloud operations.

According to 40% of the enterprises surveyed, a lack of adequate cost control was the leading obstacle to gaining value from the public cloud.

This comes as more than two-thirds of organizations across all industries have already adopted cloud computing. Many of them focused so much on cloud innovation that they neglected to consider the real cost implications of scaling cloud resources from the start.

That’s precisely what Cloud Financial Management tries to remedy.

The goal of this strategy is to maintain a favorable balance between improving customer experiences and managing cloud resource usage costs. Cloud Financial Management aims to optimize not only cloud costs, but also usage and resource scaling.

Cloud Financial Management is not solely about cutting cloud costs. Reducing cloud costs is only one objective. It can also improve business agility, operational resilience, and staff productivity.

In 2020, 451 Research surveyed 500 enterprise decision-makers. The firm found that organizations that proactively implemented CFM increased revenue (67%), profitability (64%), staff productivity, and operational resilience.

The study was done in collaboration with Amazon Web Services (AWS), the world’s largest public cloud provider. Among the findings were:

- When companies practiced CFM on AWS for 2-3 years, they saw a 51% reduction in costs

- Cloud billing reduced by 60% for those with over 5 years of AWS cloud financial management

AWS’ involvement is interesting. Let’s talk more about it.

Implementing cloud financial management properly offers the following benefits:

1. Keep track of your cloud spend

With Cloud Financial Management, you can monitor not only your service usage bills, but also the operations, tasks, and resources that underlie them.

This should enable you to monitor a broad range of cost factors related to your cloud environment. You can use this insight to identify the specific applications, projects, teams, and departments that are driving your cloud costs.

Budgeting is another area where you could use this insight. You can take past usage patterns and cost information and review it to help you predict future usage patterns.

2. Cloud cost optimization

Once you’ve identified key metrics from your usage bills and cloud operations, CFM can help you control, optimize, or reduce cloud-related costs.

Optimizing costs involves identifying and removing unutilized resources, redundant integrations, and wasteful processes. Yet if you don’t have enough visibility into your cloud resources, you won’t be able to know where you can pull strings to cut costs without sacrificing system performance. But full visibility can help you identify multiple options for cost minimization.

With this granular cost insight, you can easily group and consolidate different resources, downscale packages, share resources across different departments, or even build a cost-efficient hybrid system.

3. Create and stick to a cloud budget

You can define an accurate cloud budget based on your past usage patterns and business growth plans. Once you set a budget, automated tools check your spending against your predefined limit to ensure you don’t exceed your budget.

But in case costs increase, some CFM platforms, like AWS, provide cost anomaly detection. This is an alerting feature that detects trending cost metrics in your infrastructure, flags them, and sends an email alert to the designated individual or team.

Other advanced platforms like CloudZero, let engineers, finance, or DevOps teams receive timely cost alerts on Slack, email, or via text messages.

What Cost Factors Should Teams Consider?

Finance teams should prioritize the following the cost factors and key performance indicators (KPIs) listed below:

The business value of the cloud

The primary objective of Cloud Financial Management (CFM) is to help organizations realize the business value of the cloud. So your system needs to be designed to achieve a balance between quality, cost, and performance.

For example, rather than reducing costs by randomly downscaling resources, you’ll want to target specific areas that, when cut, will still ensure optimal performance, operational resilience, and business agility.

Avoid overspending

You need a budget to guide your cloud services usage. Cloud budgets can be tricky to create because there are many unknowns. For example, the cloud is highly dynamic, with parameters and resource needs that are constantly changing.

However, you can use a cost tool to collect cost and usage metrics in your cloud environment. By analyzing that historical data, you can better allocate resources at the start of the next cloud billing cycle to avoid guessing how the following bill will turn out.

To further prevent overspending, you can set up an automated alert system that’ll inform you of changing cost indicators in real-time before you exceed your budget.

About shared costs

Cloud Financial Management isn’t just about optimizing costs for dedicated resources and assets. It should also encompass shared resources. Yet cloud platforms typically don’t provide functionality for viewing and managing shared costs.

AWS offers some tools for tracking shared costs. However, finance teams can use advanced solutions like CloudZero to track separate user groups, review each group’s usage costs, and allocate resources accordingly.

Cloud waste

The more you track resource use and corresponding bills, the more you’ll be able to spot cloud waste. Cloud waste refers to underutilized, overutilized, or unused cloud resources that are progressively adding to your bills.

While some cloud waste instances are obvious, others are not. You might see a resource allocation as underutilized, only to see it have a negative impact on your overall performance after terminating it.

Be careful not to jump to conclusions. Instead, you’ll want to rely on solid data to inform your decisions.

Best Practices For Cloud Cost Success

Organizations never follow the same CFM procedures. They differ quite considerably in terms of structure, architecture, scope, tools, and goals among different cloud users. Still, there are some standard best practices that any organization in any industry can use to improve their cost management efforts:

1. Establish clear goals

Each organization has different goals and priorities. So, the first step is to establish a clear set of goals based on your business’s unique needs, such as operational scale, technical expertise, and budget.

As a startup, you might need a CFM plan that focuses on how to launch products cost-effectively to drive market penetration.

A fast-growing company on AWS may want to create a CFM strategy that prioritizes scalability with cost controls to protect margins.

More established enterprises in highly competitive industries might prioritize cost savings and feature release optimization.

There are countless possibilities here. So, don’t settle for a generic plan when you can create a plan that caters to your specific growth and profitability needs.

2. Always collaborate

It takes more than one person to implement a solid CFM strategy. It isn’t an operation for a single team or department, either. It is an entire organization’s effort.

As an example, the cloud strategy team determines what business results will come from adopting the cloud.

The cloud governance manager mitigates cloud risks by developing and managing cloud usage policies. Engineers innovate new features to attract and keep customers. Finance teams are responsible for ensuring cloud investments return a healthy ROI. Yet these interests tend to conflict, especially between.

One way to solve that is to ensure different stakeholders in the organizations are in alignment.

Read how to effectively align engineering and finance teams here.

3. Automate your way to increased productivity, fewer errors, and quicker cost savings

As public clouds grow, they become more complex and dynamic. For example, AWS offers On-Demand Instances, Spot Instances, and Reserved Instances, which are all different pricing models for AWS compute services.

While users appreciate these choices and the resulting flexibility, taking advantage of the right plans for their specific needs in real-time can be challenging. Automated software tools can help here.

A good cost tool can help you automate cloud cost monitoring, reporting, and cost anomaly alerting. That’s not all.

You can also automate the entire lifecycle — from goal setting and resource tracking to cost optimization and incident resolution — when you combine a cloud provider’s native tools with advanced third-party tools.

4. Trade traditional cost management for cloud cost intelligence

The majority of cloud cost management tools get a bad rap for over-relying on clunky traditional approaches that do not make CFM easier, faster, or more actionable.

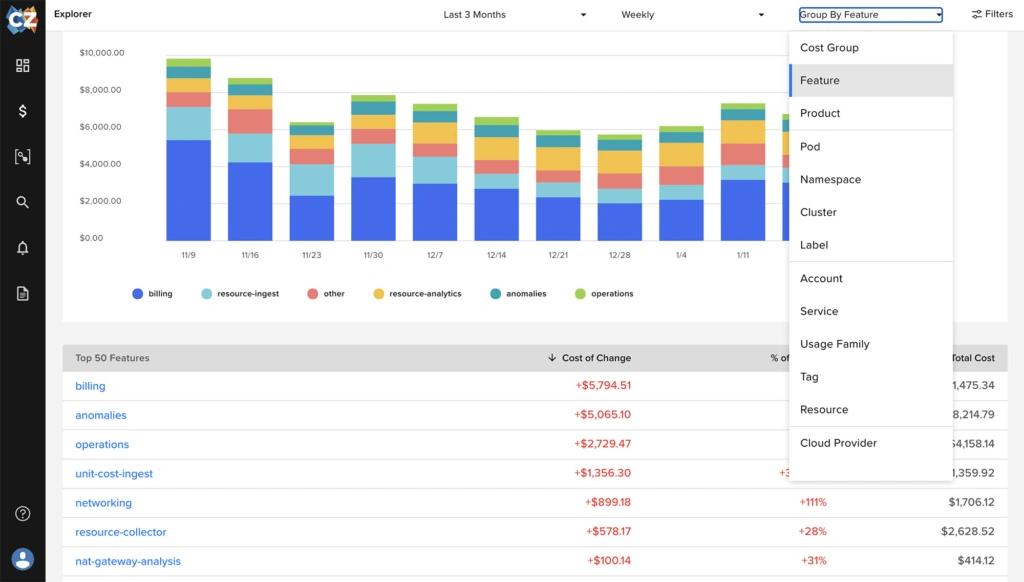

In contrast, cloud cost intelligence is a modern approach to Cloud Financial Management that enables cost-conscious teams to detect, monitor, and control cloud costs with precision.

Instead of simply viewing their total cloud costs, teams can use this method to view how much each individual customer, development team, engineering project, or product feature cost them in a given month.

AWS does offer several native tools that can be helpful for CFM. Notable examples include AWS Cost and Usage Report (CUR), AWS Budgets, and AWS Cost Explorer. These are also free if you operate in the AWS cloud.

The problem with them is they do not provide granular costs that can help:

- Engineers to identify which engineering projects, teams, or product features are driving cloud cost changes.

- Finance professionals to tell how to set the right pricing to cover their cost of goods sold (COGS) and improve profitability.

- CTOs and CFOs to identify who, what, where, and how their cloud budget is spent.

- Executives to compare their cloud costs with other similar companies so that they can improve their gross margins to attract investors.

AWS billing and usage reports are also quite complex, particularly when tracking shared resources and tenants. AWS cost management tools also struggle to analyze cost metrics coming from untagged and untaggable resources, and multi-tenant environments.

But, there is a better way.

Leverage cloud cost intelligence to modernize your Cloud Financial Management

With a full-featured cloud cost intelligence platform, such as CloudZero, you can uncover cost metrics that are difficult to measure with traditional cloud cost management tools.

The CloudZero platform empowers engineers, finance, and executives to measure unit costs, such as COGS, cost per customer, cost per product, cost per feature, cost per development team, and more.

CloudZero’s real-time cost analysis helps engineers identify the cost impact of their architectural decisions while they are building, so they can develop cost-effective solutions. Cost-conscious engineers are also easier to align with finance and participate in cloud decision-making.

As engineers almost always notice cloud cost anomalies before finance teams do, CloudZero empowers engineers to understand costs and receive anomaly alerts to know what to do when they notice abnormal indicators — rather than waiting until finance can no longer do anything about it.

You also receive access to an expert Cost Intelligence Analyst who can support you with setting up and getting the most out of CloudZero.

CloudZero’s approach fits every budget and scale, whether you are a startup seeking revenue growth, a scaleup trying to attract investors, or an enterprise striving for higher profitability.

Schedule a demo today to see how CloudZero can help you reap the benefits of the cloud without burning a hole in your cloud budget.