2024 Report

How Cloud Efficient Are Software Companies In 2024?

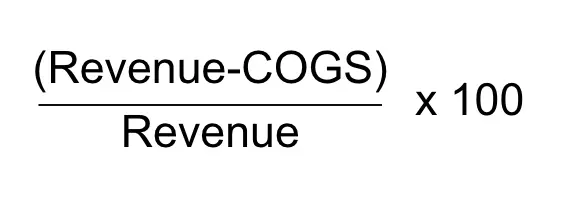

New report finds 61% of companies have no formalized cloud cost management program in place — and they’re leaving significant levels of profit on the table.

Introduction

For the last 18 years — through pandemic times, boom times, pullbacks, and more — little has been predictable except one thing: Worldwide cloud spending is going to be higher this year than last year, and a lot higher next year.

After exceeding half a trillion dollars for the first time in 2023, cloud spending in 2024 is expected to hit $675 billion (Gartner). AI spending will only compound this issue; by 2027, cloud spend should eclipse $1 trillion. This, as companies preach a new gospel of efficiency, as investors value profitability more highly than growth for the first time since the abbreviation “SaaS” was coined, and while a majority of companies acknowledge that their cloud costs are too high (CloudZero).

Why, when companies know they need to get more efficient, does their cloud spending continue to accelerate? What levers can companies pull to get more efficient — and what metrics should they use to quantify efficiency?

CloudZero created this report in partnership with Benchmarkit, a B2B SaaS research firm, to find out. We surveyed hundreds of cloud operations and finance professionals to define the cloud efficiency trends, challenges, and opportunities for this rapidly changing landscape.

Consistent with the FinOps Foundation’s State of FinOps 2024, our study shows a general lack of maturity with regard to cloud cost management (CCM). This is highlighted by the small portion of SaaS companies that have a formalized CCM process in place — just 39%.

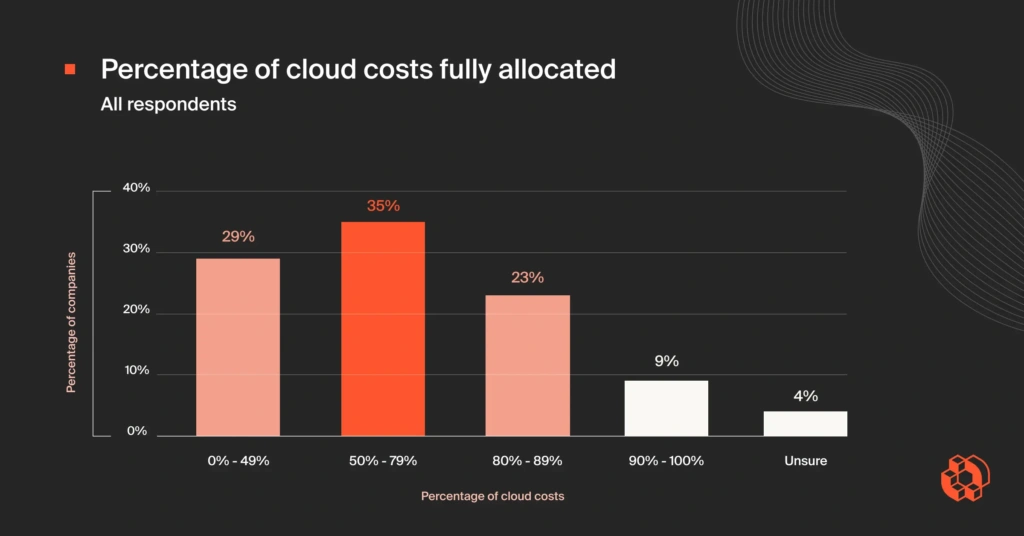

The low incidence of formalized CCM programs also means companies rarely make the most of the most advanced, powerful approaches to CCM. These methods include complete or near-complete cost allocation (just 9%), cloud cost chargeback (under half), and software code optimization (just 28%).

Moreover, there are as yet no industry-wide benchmarks for cloud cost efficiency. Companies measure a range of metrics — including cloud cost as a percentage of COGS, of R&D, and of revenue — but no single one has yet emerged as the efficiency standard. Part of our goal in creating this report is to put forth and gather data around a unifying benchmark: Cloud Efficiency Rate (CER).

For SaaS companies, the cloud is typically a top-three budget line item — yet most don’t have rigorous processes for quantifying and optimizing their cloud efficiency. Without it, they’re leaving a substantial amount of gross profit on the table.

CloudZero helps customers drive unprecedented levels of cloud efficiency. We work with the world’s largest and most sophisticated cloud spenders, providing the visibility and unit economic clarity they need to maximize their cloud efficiency. This way, we give our customers a path to sustainable innovation, and we’re giving the cloud-driven industry a universal barometer for efficiency.

Key Takeaways

COGS Hunters: A material opportunity for gross profit

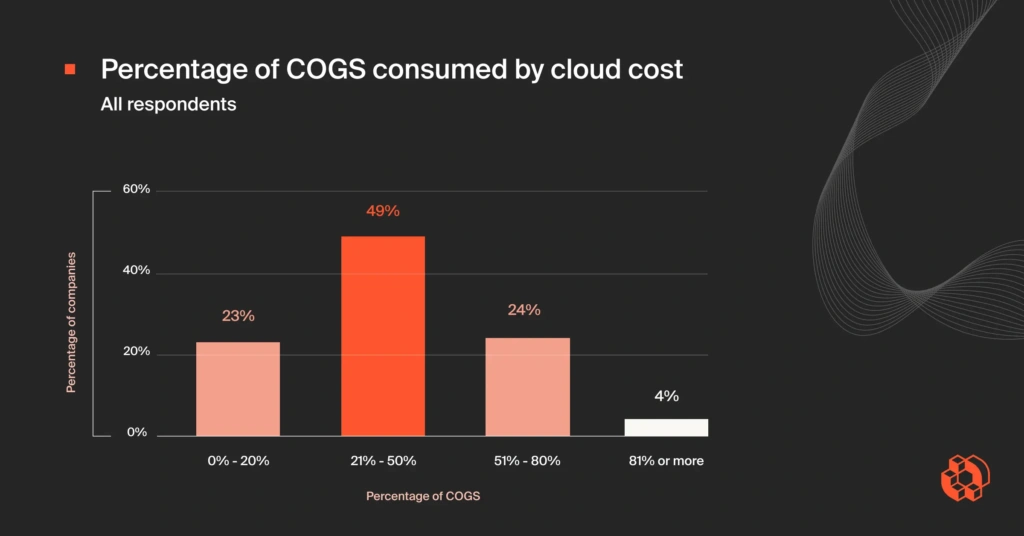

73% of companies report that cloud service provider costs represent at least 20% of their total COGS, and 28% report cloud costs accounting for more than half of their COGS. With the cloud as such a major contributor to COGS, and COGS as such a major factor in profitability calculations, companies that drive higher levels of cloud efficiency stand to make material profitability gains.

Most companies don’t proactively manage cloud costs

Just 39% of companies have implemented formalized CCM programs. These programs consist of activities like cost allocation (assigning cloud costs to specific products, features, teams, microservices, and more), budgeting, forecasting, and chargeback, all of which have material impacts on companies’ overall cloud efficiency.

Few companies use the most powerful CCM methods

CCM programs give companies access to the most powerful CCM methods, including software code optimization and unit cost metric calculation. Given the low percentage of companies with formalized CCM programs, it’s not surprising that few companies use these methods to manage their costs — or that a major opportunity exists for those who adopt them.

Elite Cloud Efficiency Rate (CER): 92%+

Drum roll, please: CloudZero has pioneered the industry’s first unifying benchmark for cloud cost efficiency, the Cloud Efficiency Rate (CER). This report shows that top-quartile CER is 92% — meaning that only $0.08 of every dollar of revenue goes to their cloud service provider(s).

The Profit Opportunity: How Cloud Spend Hits Companies’ Bottom Lines

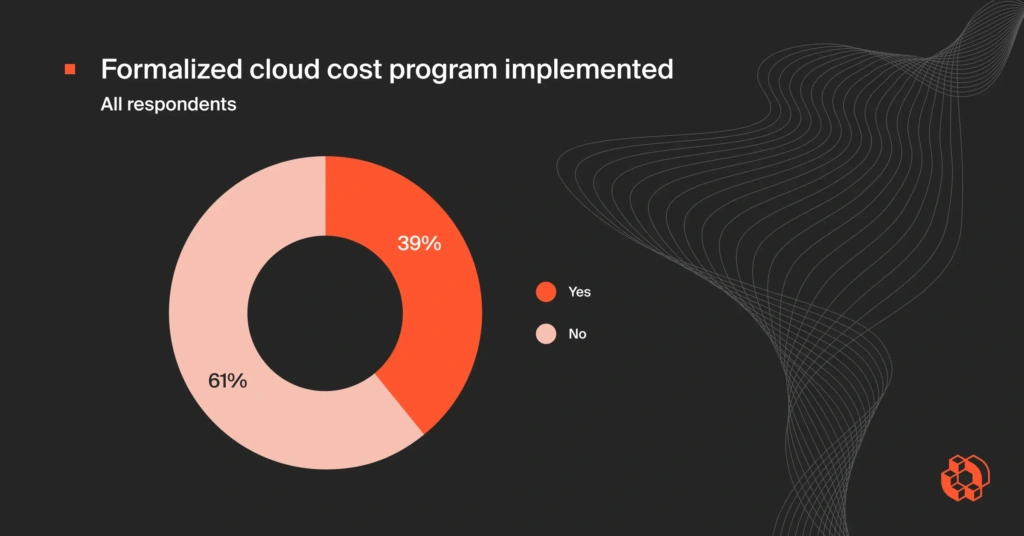

77% of respondents reported that cloud spend represents at least 20% of their COGS; 28% indicated that it’s more than half. As COGS is a major factor in gross profit calculations, this represents a substantial opportunity for companies to raise their profits without sacrificing any value. As a reminder, the formula for gross profit is:

A company with $100M in revenue and $25M in COGS would have a gross profit of 75% — good, in SaaS terms. So, there are two ways to increase your gross profit: Increase your revenue, or decrease your COGS. Let’s look at the latter through a cloud spend lens.

Let’s imagine that this company’s cloud costs represent 20% of that COGS figure — $5M. Conservatively, CCM programs can reliably reduce those costs by 30% in a matter of months — from $5M to $3.5M. Right away, this would raise their gross profit from 75% to 76.5%.

Now, let’s imagine that their cloud costs represent 50% of their COGS — $12.5M. The same reduction would reduce their cloud costs to $8.75M, and their overall COGS to $21.25M. Their gross profit grows to 78.75%.

The engineering-led savings opportunities CloudZero finds — and which elude traditional CCM platforms — leave companies with much healthier COGS. Take it from Upstart, who used CloudZero to cut their cloud costs by $20M, or Symphony Talent, who used CloudZero to reduce their AWS costs by 48%.

Most Companies Don’t Proactively Manage Cloud Costs

This one came as a bit of a surprise, particularly since survey responses came from SaaS companies: Just 39% of companies have a formalized CCM program in place. Despite how severely the cloud impacts companies’ COGS — and by extension, their gross profit — the majority of companies don’t have a formalized process for managing cloud costs.

This statistic is mirrored eerily by the State of FinOps 2024, which found that 61.8% of companies are in the “Crawl” (least mature) stage of FinOps. Given that these percentages are so low, it’s not surprising that most companies score poorly in CCM-related objectives like cost allocation, budgeting, and chargeback.

“Cost allocation” refers to the process of tracing every penny of your cloud spend to the correct source(s). Sources could (and should) include customers, products, features, teams, microservices, and/or whatever other dimensions are integral to running your business.

Cost allocation is often challenging due to the sheer number of cloud resources companies consume, and is further complicated by obstacles like shared costs, containerized costs, multi-tenant costs, and multi-cloud costs.

For 9 out of 10 companies, at least 10% of their costs can’t be traced to the correct sources. Imagine if you didn’t know where 10% of your headcount budget was going — how could you make informed personnel decisions? Let alone 20%, 30%, 50%?

Cost allocation is one of CloudZero’s superpowers. CostFormation® allows companies to quickly and programmatically use tags and other metadata to overcome common challenges and reach 100% cost allocation — all within a matter of hours. Learn more →

At first glance, this might not look so concerning. But again, consider the fact that cloud costs are typically rivaled only by people costs in the landscape of SaaS companies’ top expenses.

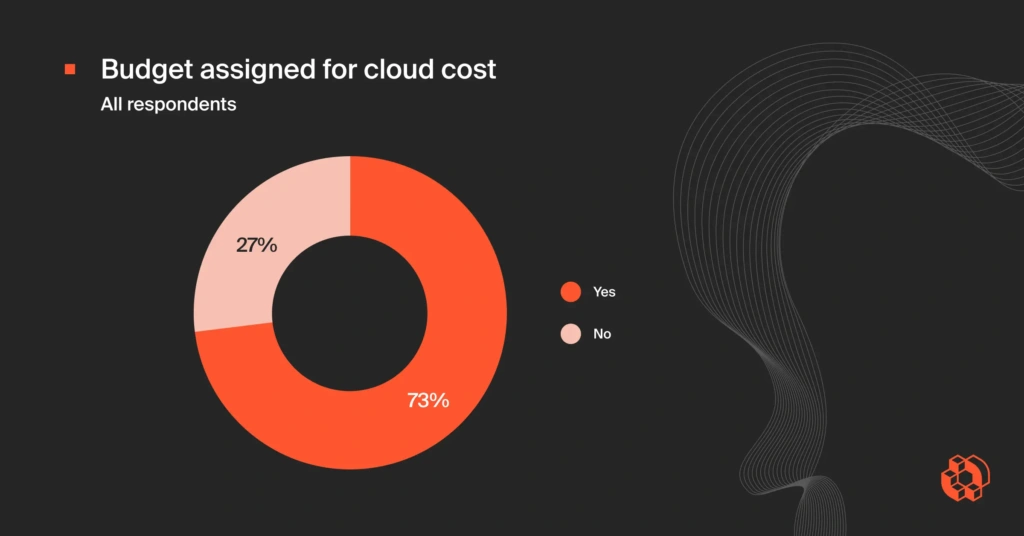

A single leader who didn’t have a headcount budget would struggle — let alone an entire company. That nearly a third of SaaS companies still don’t assign budgets for cloud costs shows how far behind the curve companies are when it comes to proactively managing cloud costs.

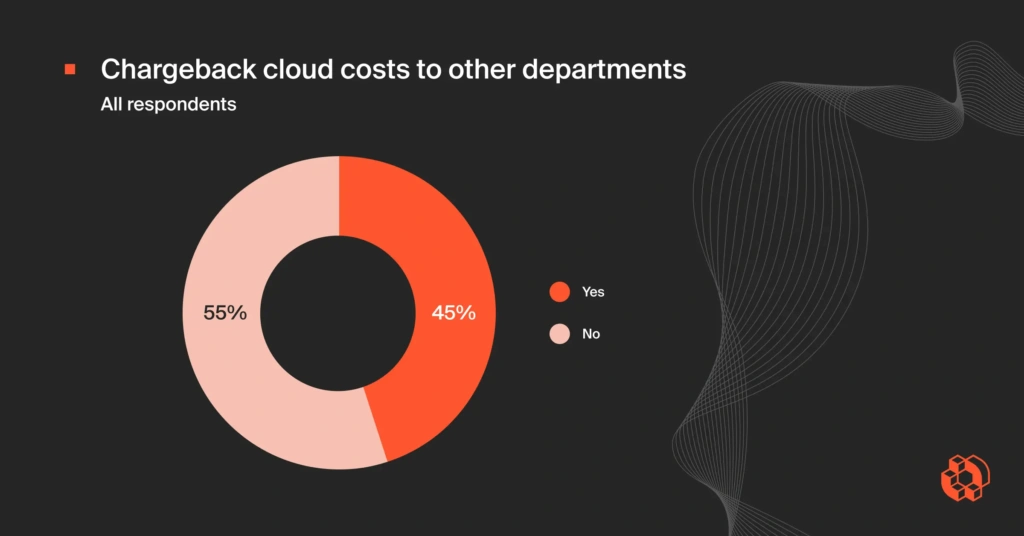

“Chargeback” refers to the process by which companies deduct real cloud costs from specific departmental budgets. Chargeback is a challenging process, largely due to the aforementioned allocation challenges companies face.

So, what we see here is a ripple effect: Companies with poor cloud cost allocation and/or budgeting will necessarily struggle to charge cloud costs back to the appropriate departments.

This ripples out into accountability challenges — if you can’t send individual departments accurate cloud bills, how can you hold them accountable for their cloud costs? Even if they want to be accountable for cloud efficiency, what resources do they have?

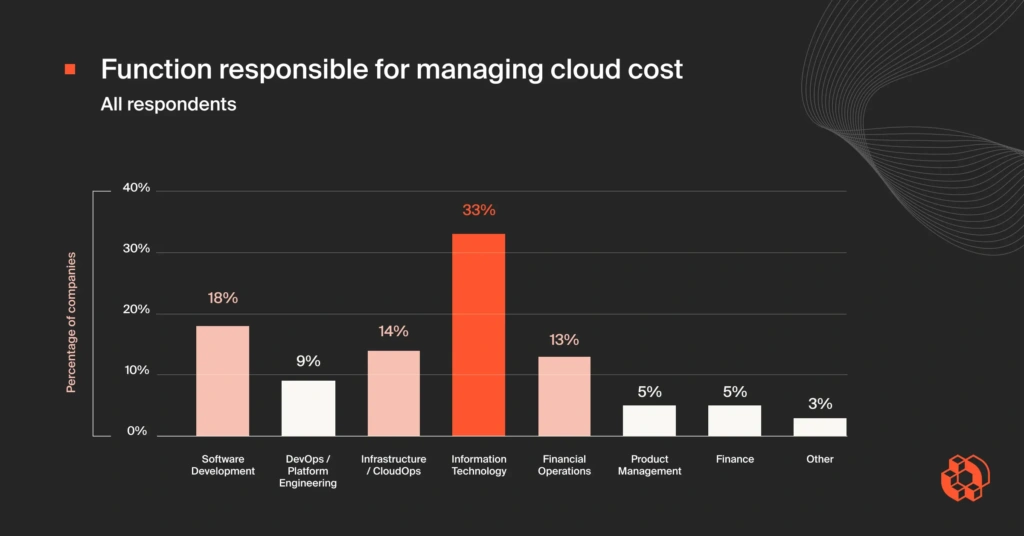

We highlight this slide to show who exactly will benefit most from relevant, real-time cloud cost data. 79% of companies — roughly three out of four — hold technical teams responsible for managing cloud costs (including Software Development, DevOps/Platform Engineering, Infrastructure/CloudOps, Information Technology, and Product Management).

What this means is that technical leaders are overwhelmingly the ones with whom the buck stops — and who, therefore, have the most urgent need for accurate cloud cost data.

These leaders need to know which engineering teams are responsible for which costs. They need to know which products and features have the greatest/least impact on COGS.

They’ll benefit by knowing when their S3, or CloudTrail, or Databricks, or Snowflake, or any other major cloud cost center spikes — and how to manage the spike. Technical leaders overwhelmingly manage cloud costs, so they need the most accurate, granular technical cost data possible.

Few Companies Use The Most Powerful CCM Approaches

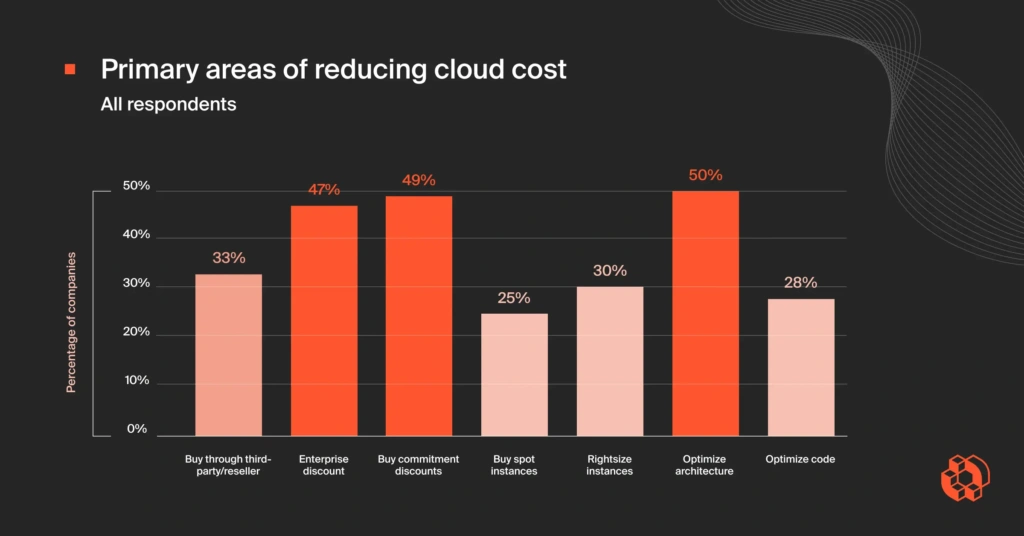

Most of the optimization strategies in the graph above will be familiar to companies who have taken early CCM steps. A similar principle applies to shopping both in the cloud and at Costco: If you buy in bulk, you tend to spend less per unit. This is where we get “Enterprise discount” and “Buy commitment discount,” and buying through a third-party reseller imparts similar savings.

But bulk discounts only get you so far, and of particular note here is how few companies selected the “Optimize code” option — just 28%. Software code optimization is one of the most powerful methods of maintaining cloud efficiency, but making use of it takes extremely sophisticated, real-time cloud cost data.

One CloudZero customer — a digital workout brand — saved more than $3M through software code optimization. The story: An engineer had inadvertently changed a line of code that caused all of the workout brand’s hardware to make 40 API calls per day, when they had previously been making just one. This change instantly caused the brand’s cloud costs to skyrocket — an anomaly which CloudZero flagged within hours.

Had CloudZero not surfaced the anomaly, the brand’s cloud costs would have risen by millions of dollars with no clear indication as to why. As it was, CloudZero sent an anomaly alert to the relevant engineer, who fixed the code and got the brand’s costs back down to normal levels.

CloudZero made this software code optimization possible through a combination of hourly cost data, a rigorous anomaly detection system, and complete cost allocation, which let us send the alert to the right engineer. Learn more →

Elite Cloud Efficiency Rate: 92%+

In what represents the first SaaS-wide benchmarking of cloud cost efficiency, we’ve identified that an elite (top-quartile) Cloud Efficiency Rate (CER) is 92% or above. This means that for every dollar companies make in revenue, the most efficient send $0.08 or less to their cloud service providers.

This number is roughly consistent with CloudZero’s own postulation. After analyzing our public customers’ CER data, we suggested that ~95% seemed like an elite CER. 95% CER is the mean for public CloudZero customers, indicating a clear tendency for CloudZero to keep customers in elite CER territory.

A great example is HighRadius, whose CER was at 89% and trending toward 87% before engaging CloudZero. CloudZero reversed the trend and got HighRadius back to a 92% CER — elite SaaS territory.

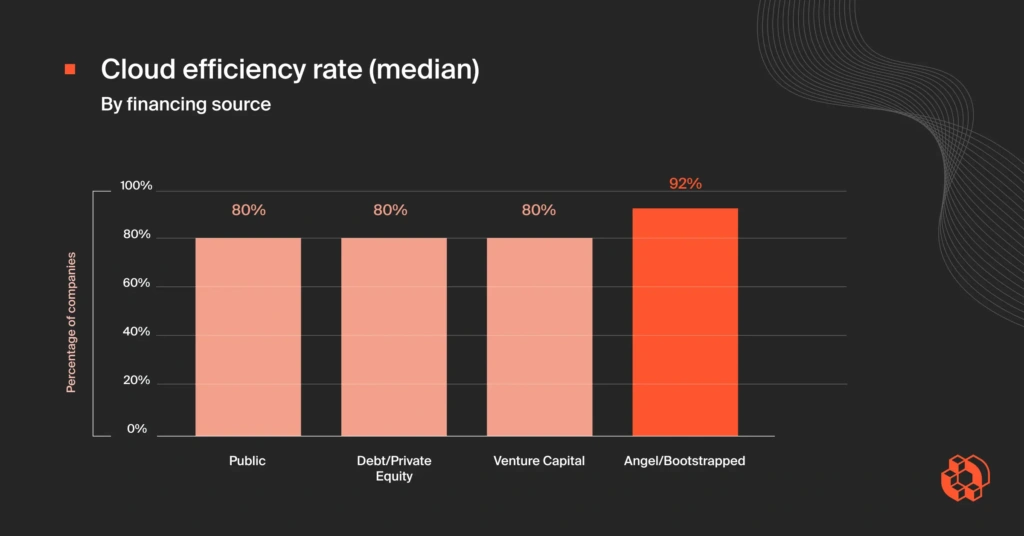

Further data indicates that as companies scale, their CERs tend to worsen. Angel/bootstrapped companies reported the highest median CER (at 92%), with every other company category reporting significantly worse median CERs (80% across public, debt/private equity, and venture capital).

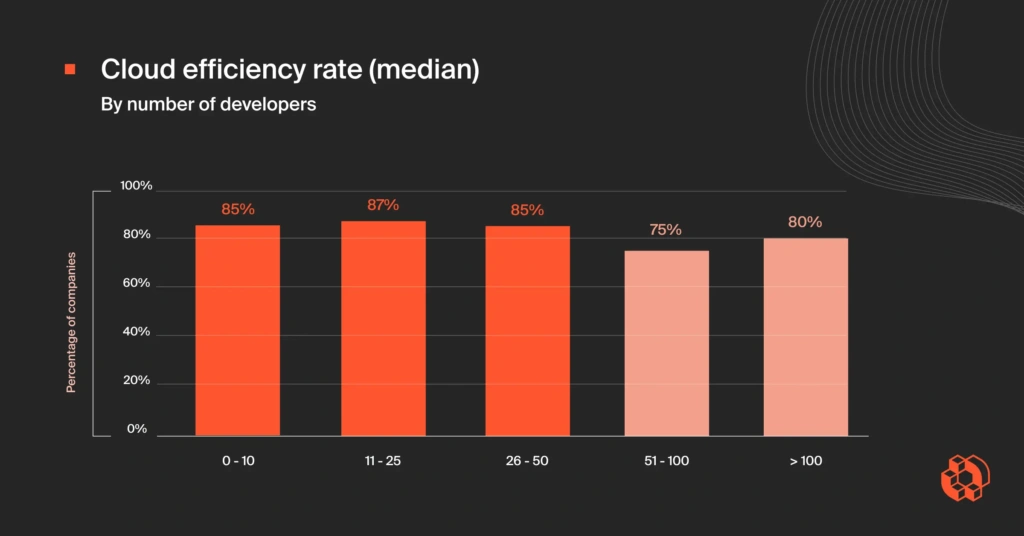

Moreover, as companies add engineers, their CERs tend to worsen: 11–25-engineer companies have the highest median CER (87%), with 51–100 (75%) and 100+ (80%) representing significant CER declines.

Compare the median CER for public companies in this report (80%) to the public companies in CloudZero’s customer base (95%) and you begin to see the CloudZero difference.

Conclusion

The issue isn’t that companies don’t know they have a spending problem. The issue is that most don’t have formalized processes for managing it — which in itself is likely a result of a decade-plus of SaaS investors’ carte blanche spending mentality: It doesn’t matter how much you’re spending, so long as you’re growing quickly enough. That’s not how investors think anymore, and as a result, that’s not how SaaS companies should act anymore.

SaaS companies know they need to refine their cloud spending habits, but they tend not to have the tools to get the results they know they need. With AI a cost hurricane looming on the horizon, the time has never been riper to proactively drive cloud efficiency.

Companies looking to maintain their pace of innovation and drive unprecedented levels of efficiency should at very least start measuring their CER against industry benchmarks. Those concerned with attaining elite CERs can only do so through the most sophisticated CCM approaches: complete allocation, precise budgeting, clear unit economics, and engineering engagement.

Technical personas are the ones who stand to have the most profound impact on cloud efficiency. When they have relevant, real-time efficiency data, they can make informed efficiency decisions.

CloudZero can calculate and optimize the CER of any imaginable business dimension. If you want to break it out by team, CloudZero can easily allocate your costs per team, compare them with revenue data, and give you an accurate CER per team. Likewise for product, feature, customer, microservice, or whatever else is most important to your business. For a fraction of what unoptimized cloud architecture would cost you over the life of your business, CloudZero can launch your organization into the cloud efficiency elite.

Cloud efficiency won’t happen by itself. It requires sophisticated, real-time data, in the hands of the people best equipped to leverage it. That’s what CloudZero was built to do. Schedule a demo with CloudZero here →

Methodology

CloudZero, in partnership with Benchmarkit, conducted research in April and May 2024 to benchmark and assess overall cloud cost efficiency: how an organization’s cloud investments correlate with business value.

More than 700 companies throughout North America participated in the research. Research participants included a wide range of companies based on annual revenue, number of developers, cloud platform expenditures, and software categories. Participants included every level of management responsible for managing and reporting cloud costs, including C-level executives, vice presidents, and directors.

This report is specific to participants in North America. All company profile data was collected in U.S. dollars, and company cohorts were created based on U.S. dollar values.

Financial Control And Predictability In The Cloud

Eliminate wasteful spending, ship efficient code, and innovate profitably — all in one platform.