By now FinOps has proven its value — so much so that the web is full of helpful in-depth guides, broad overviews, bite-sized articles, and resource lists on the subject.

But if you’re preparing to pitch a FinOps program at your company, you need to convey only the most important points in a way that’s both impactful and succinct. That’s when it’s time to call in the visuals.

To help you prepare a thorough presentation, we’ve rounded up ten visuals you can use to convey the value of FinOps — and describe how it could change your organization for the better.

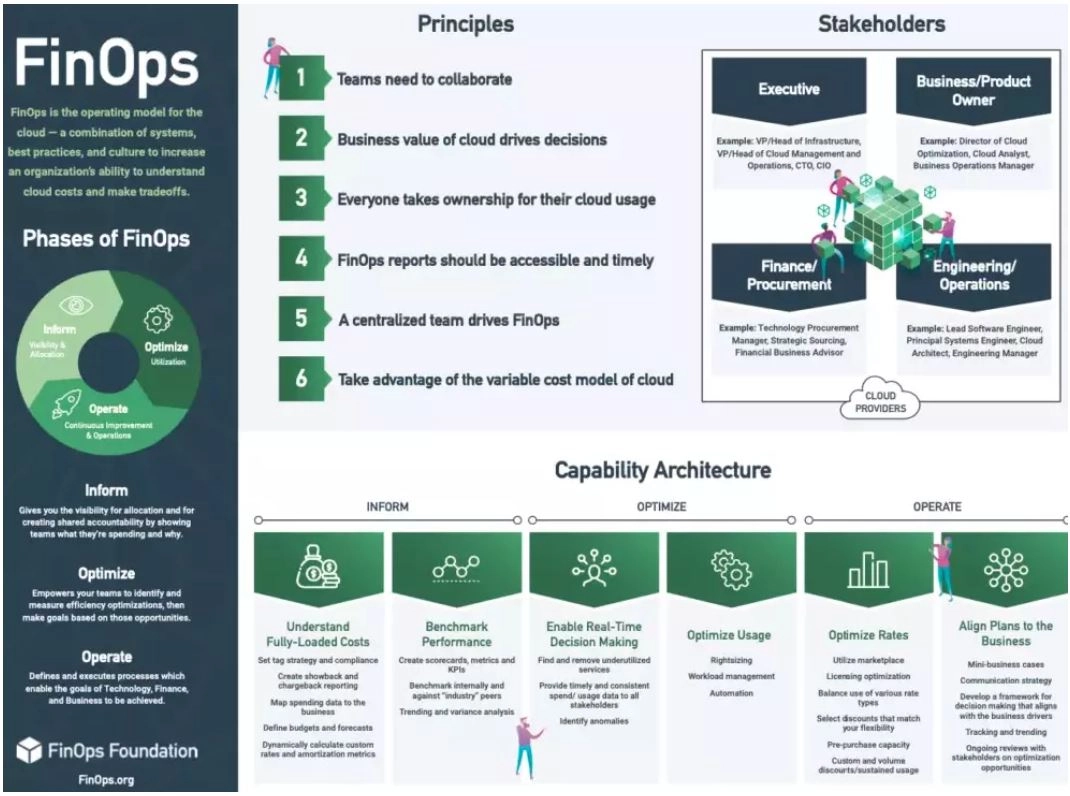

1. What Is FinOps?

Credit: The FinOps Foundation

Credit: The FinOps Foundation

Cloud Financial Operations — FinOps for short — is the practice of bringing finance and operations together to achieve better control and accountability over cloud costs.

Depending on the organization, you may sometimes hear FinOps referred to as Cloud Cost Management or Cloud Financial Management.

Achieving better control might mean spending less on cloud expenses overall, but more important than slashing costs is the idea of maximizing your ROI on the cloud investments you do make.

You can do this by making cloud costs transparent to your whole team and by holding each team member accountable for their contributions to the total cost. Proper FinOps implementation gives everyone within your organization a common goal, a means of understanding cloud costs, and a way to quickly see the effects of their decisions.

Within FinOps, there are various phases, principles, and maturity stages, pictured above. These frameworks serve both as a road map that can guide you from point A to point B and as a way to gauge where your company currently is in the FinOps journey. We’ll explain each in detail below.

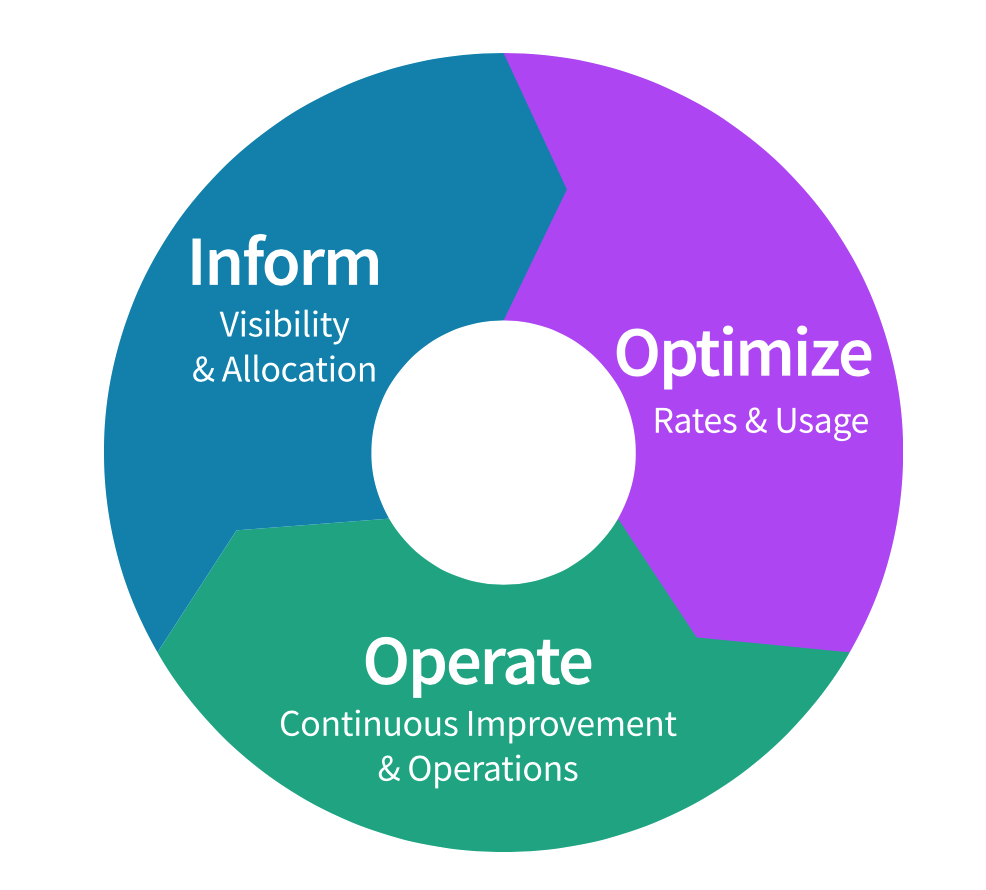

2. What Are The Three Phases Of FinOps?

Credit: FinOps Framework by FinOps Foundation

Credit: FinOps Framework by FinOps Foundation

The phases of FinOps are best shown as a constantly spinning flywheel:

- Inform: In the beginning, you’ll focus on gathering data through cost allocation and making that information visible to all stakeholders.

- Optimize: Once you have visibility into your cloud costs and understand how your cloud spend is being used, you can take strategic measures to optimize efficiency.

- Operate: From there, your optimizations guide future decisions on how best to operate with your business objectives in mind. Then the cycle begins again as you gather more information from the optimized operations you’ve put in place.

You’ll almost never be able to start from nothing and achieve FinOps maturity immediately; it will take a few revolutions of this cycle before you can consider your organization truly mature. With that said, it is something you can get started with immediately.

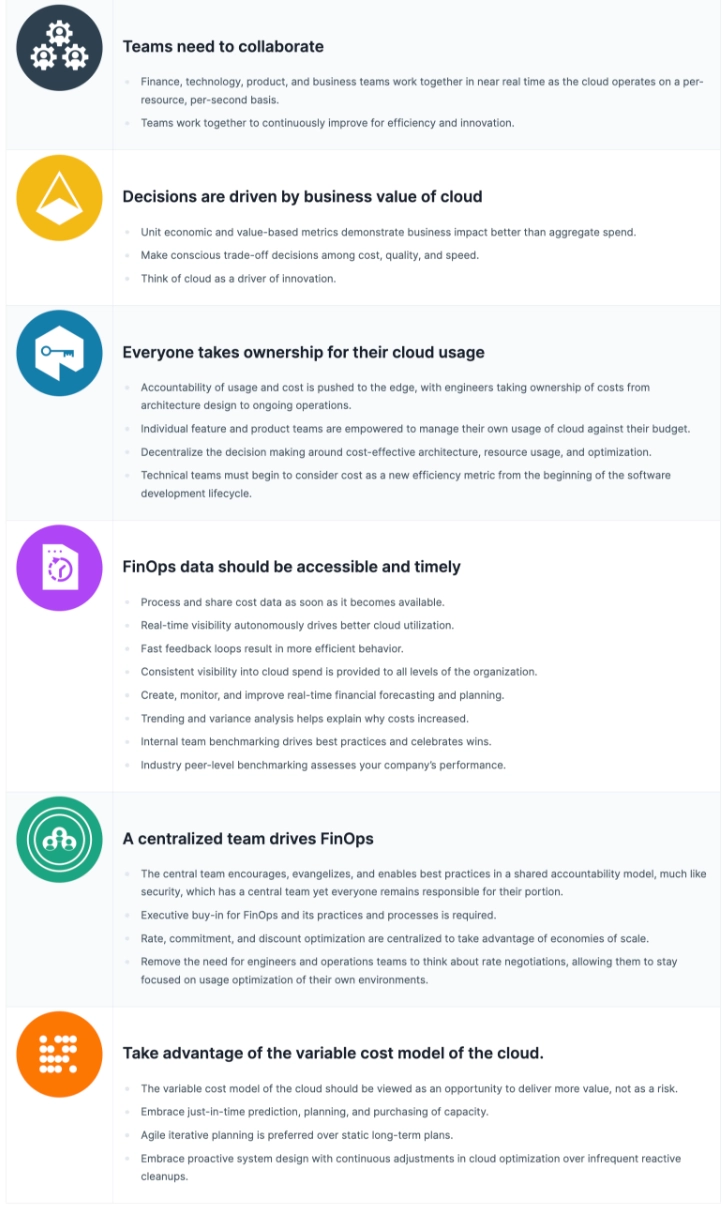

3. The 6 FinOps Principles

Credit: The FinOps Foundation

Credit: The FinOps Foundation

The FinOps Foundation lists six key principles that are crucial to the success of a company’s FinOps strategy.

It’s imperative to communicate these principles to your audience because if any one of these areas isn’t properly addressed, it could hinder the organization’s ability to gather information, build a company culture around cost efficiency, make informed decisions based on unit economics, and provide valuable feedback to stakeholders. In other words, your FinOps strategy would be less effective than it should be.

On the other hand, if you do address each of these areas, you’ll find that they work together to inform and enhance each other.

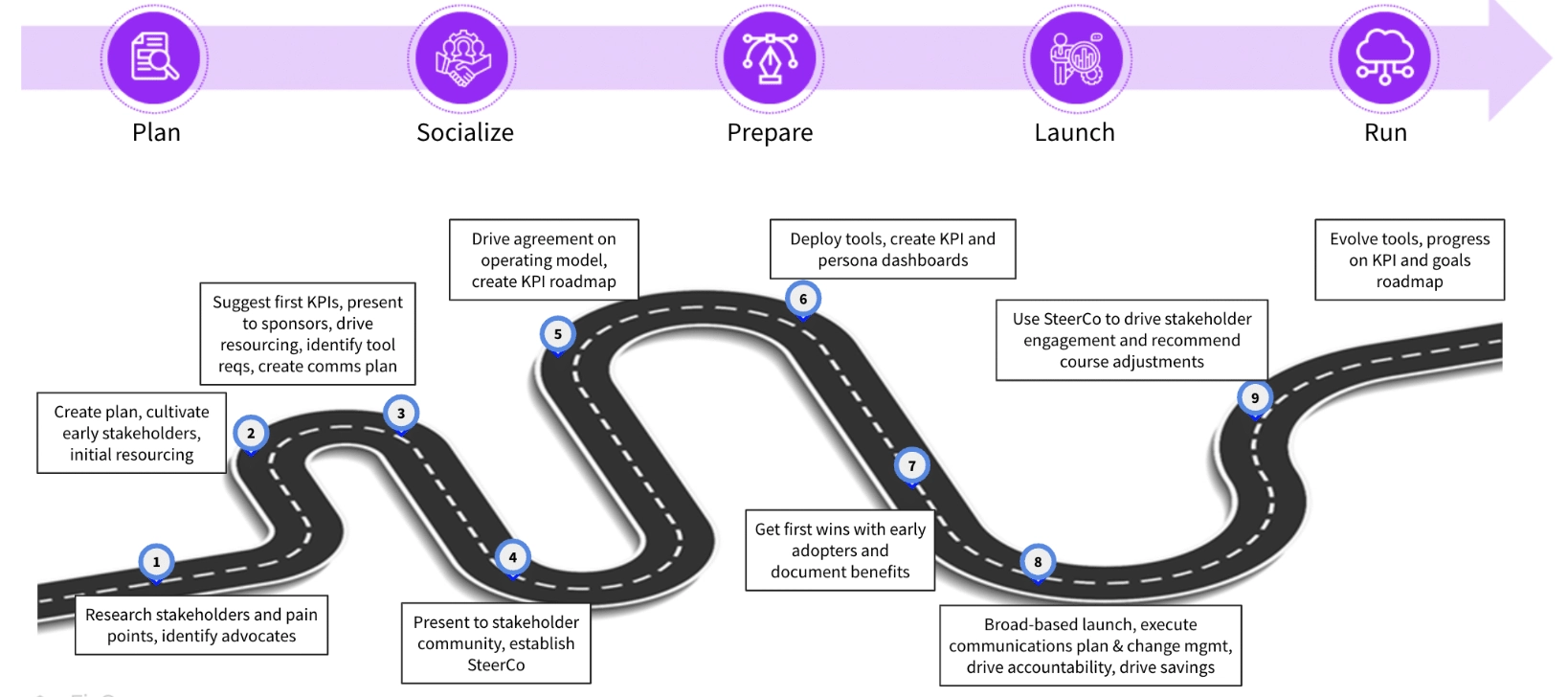

4. How FinOps Works

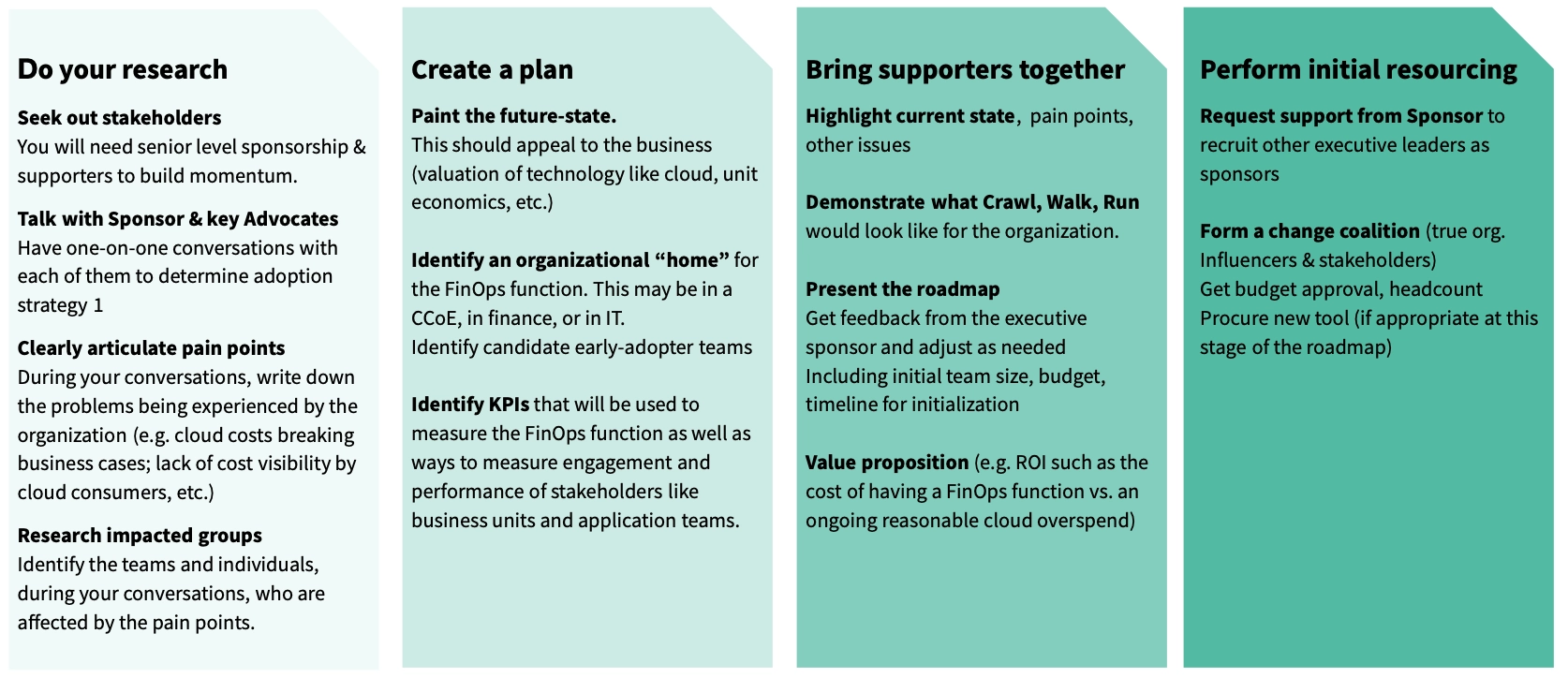

Credit: Dean Oliver & Mike Eisenstein (Accenture, LLP); Adopting FinOps by The FinOps Foundation

Credit: Dean Oliver & Mike Eisenstein (Accenture, LLP); Adopting FinOps by The FinOps Foundation

There are five steps to planning and implementing a FinOps program within your business: Plan, Socialize, Prepare, Launch, and Run.

It’s important to complete these steps in order to have a well-formed strategy before you begin operations. This road map shows how to work your way through each step before moving onto the next.

Having a thorough understanding of what it takes to complete each stage is a huge benefit when you must present your strategy to other stakeholders.

5. The Planning Stage

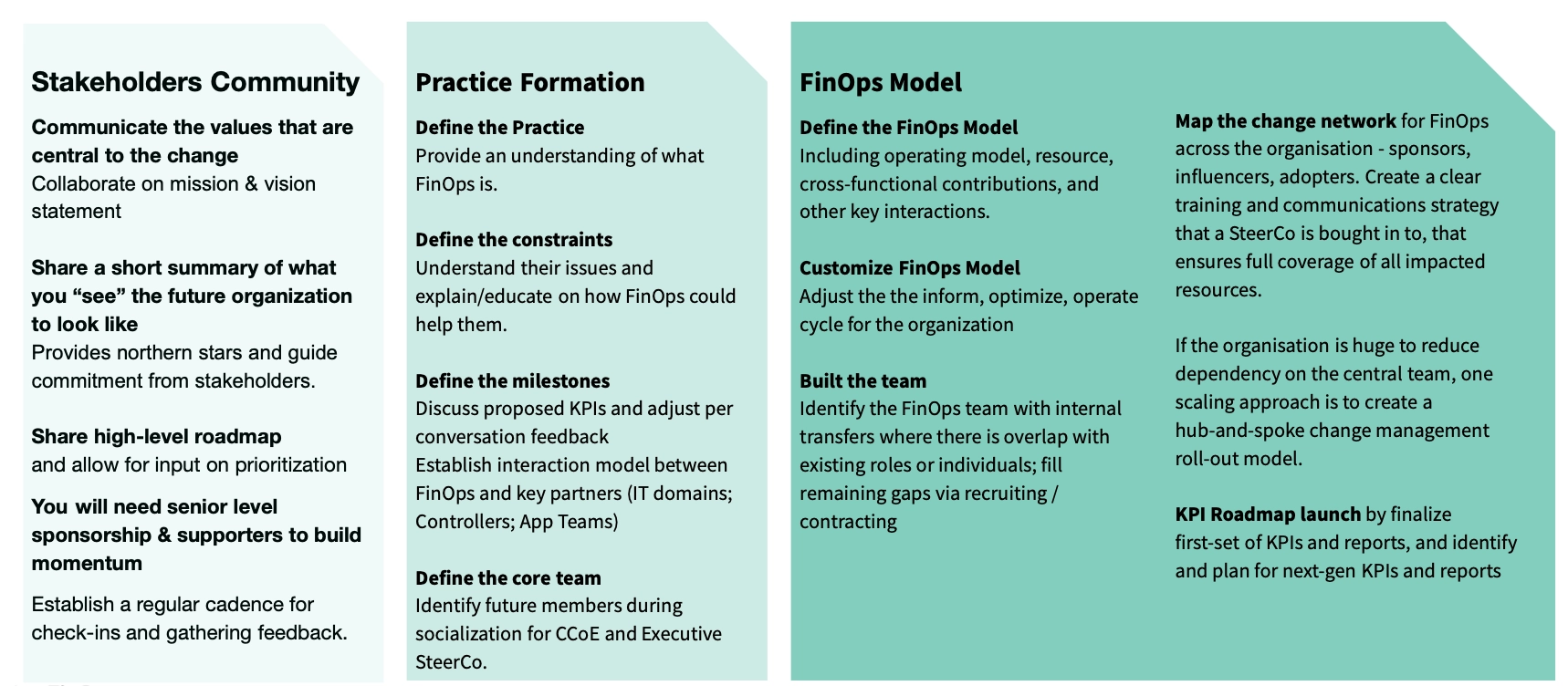

Credit: Adopting FinOps by The FinOps Foundation

Credit: Adopting FinOps by The FinOps Foundation

The Plan stage is all about conducting research and getting stakeholders involved. If your FinOps plan is to be successful, you’ll need the help and support of your colleagues and at least a few people in upper-level management.

It’s best to have clear explanations of goals, pain points, KPIs, and solutions you can bring to these individuals to help get them on board.

6. The Socialize Stage

Credit: Adopting FinOps by The FinOps Foundation

Credit: Adopting FinOps by The FinOps Foundation

The first stakeholders you involve can help you bring your message to the rest of the organization. These conversations can help all parties understand why a FinOps program is important and how you plan to implement one.

At the very least, it will be important to get engineering and finance leadership involved in the discussions at this point. Together, you can begin to map out the roles certain team members will need to take to bring the FinOps plan to fruition.

It’s a good idea to think of your new FinOps team as a central hub of individuals with the shared goal of cost efficiency and optimization.

That hub should have “spokes” that include leaders from each major department within the organization. If you pay attention to the placement of these spokes, the ultimate launch of your FinOps program will go much more smoothly.

7. The Preparation Stage

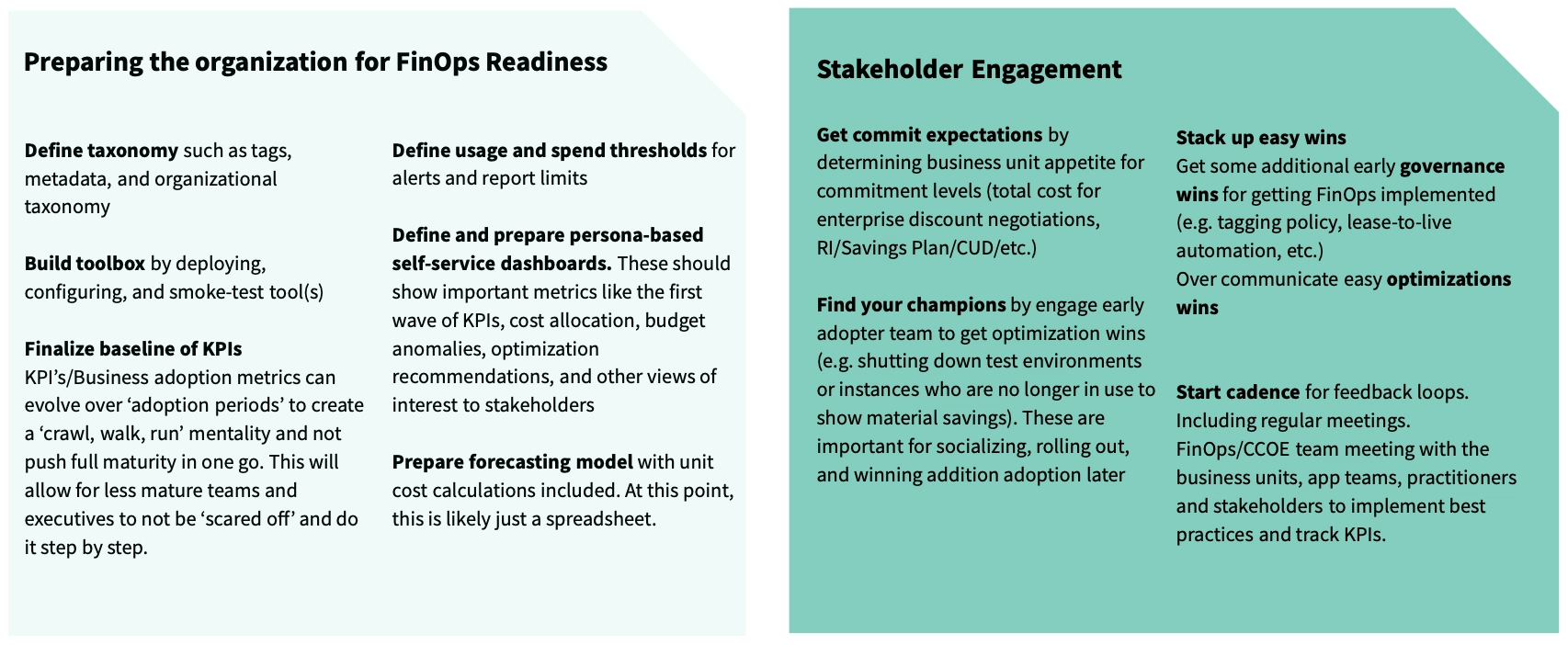

Credit: Adopting FinOps by The FinOps Foundation

Credit: Adopting FinOps by The FinOps Foundation

By this point, you’ve moved past the early days of broad planning and you’re ready to get started on the finer details.

It may take considerable effort to come up with some practical aspects of the plan, such as deciding on a naming scheme for resource tagging, determining KPIs that make sense for your goals, and setting your first threshold alerts for spending and usage.

8. The Launch Stage

Credit: Adopting FinOps by The FinOps Foundation

Credit: Adopting FinOps by The FinOps Foundation

By the time you launch your FinOps program, you should have all the practical tools and protocols in place. You can iterate and improve upon these at any time, so don’t feel like they have to be written in stone.

Upon launch, you’ll begin to see which aspects work well and which could use some refinement. You can also begin to customize certain aspects of your program, educate the rest of your organization on why you’re prioritizing FinOps, and begin your first optimization efforts.

After the Launch stage, you’ll begin to see cloud cost insights rolling in. You can use this valuable information to devise future plans of action and make informed decisions about the directions your company could take. This is also the perfect time to conduct more in-depth optimizations and come up with ways to improve upon your current formula.

9. What Are The Benefits Of FinOps?

When you thoroughly understand your costs and can find individual unit economics for all your resources, you’ll have the power to steer your company in any direction you want without taking on undue risk. You’ll be able to tell when one course of action isn’t working well and how you can take steps to fix the problem immediately before it snowballs into a high monthly cloud bill.

For instance, the chart above is an example of what you might see on your CloudZero dashboard if you were trying to find your most expensive customers.

Once you find the customers that are costing you the most, some possible solutions could include redesigning your pricing tiers to gain more revenue from heavy-cost customers or focusing your efforts on attracting new prospects similar to your lowest-cost customers.

In truth, there are so many benefits to a well-implemented FinOps program that you’ll probably discover new ones on a regular basis.

Just a handful of examples include:

- Deciding where to cut spending without sacrificing functionality, speed, or security

- Identifying the opportunities most likely to result in higher revenue or diversified streams of revenue

- Optimizing pricing and service tiers to balance margins and eliminate or fix areas that regularly underperform

- Strategically switching resources on and off to save costs during periods of inactivity

- Finding savings opportunities and discounts from cloud providers

- Planning new product and feature releases based on winning formulas

- Focusing on the customer demographics or regions that generate the highest revenue

- Pinpointing infrastructure or code that runs inefficiently and rebuilding them to be better

- Identifying whether costly products are popular enough to bother with maintaining as a loss-leader

- Shutting down costly products that aren’t popular enough to keep supporting

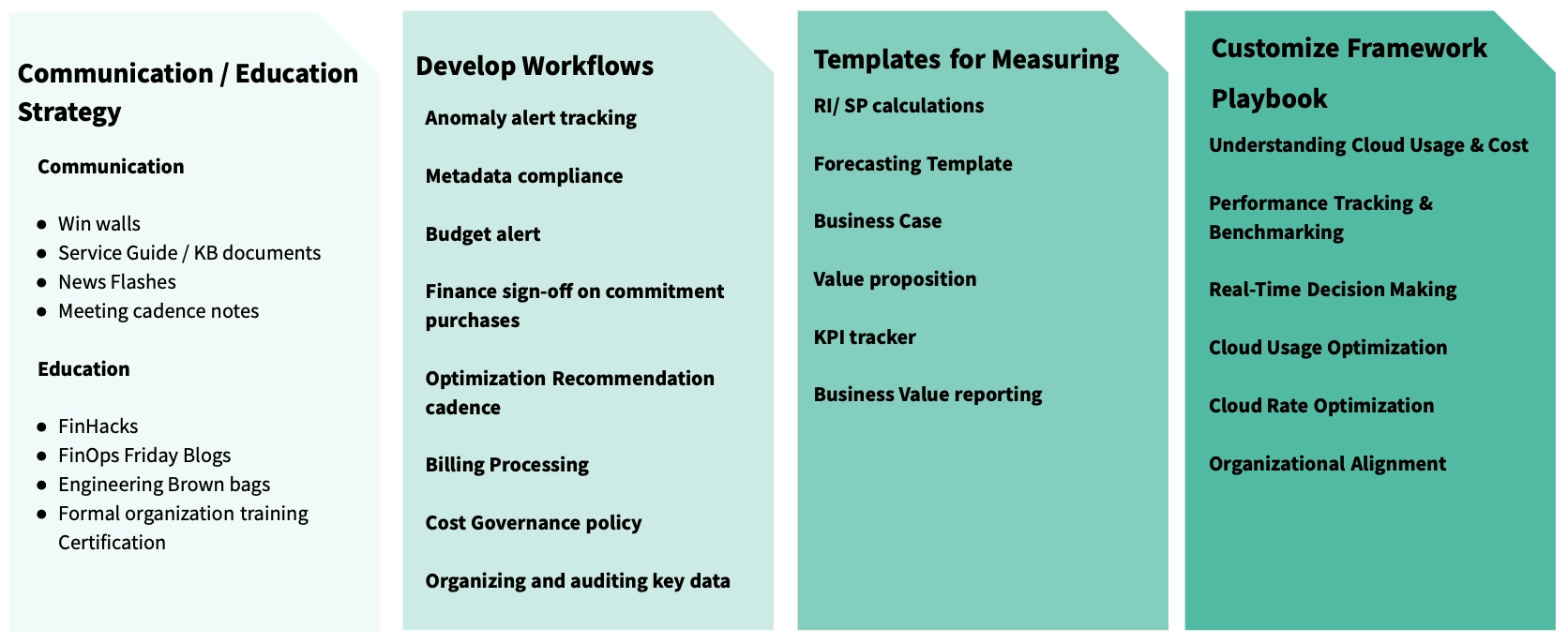

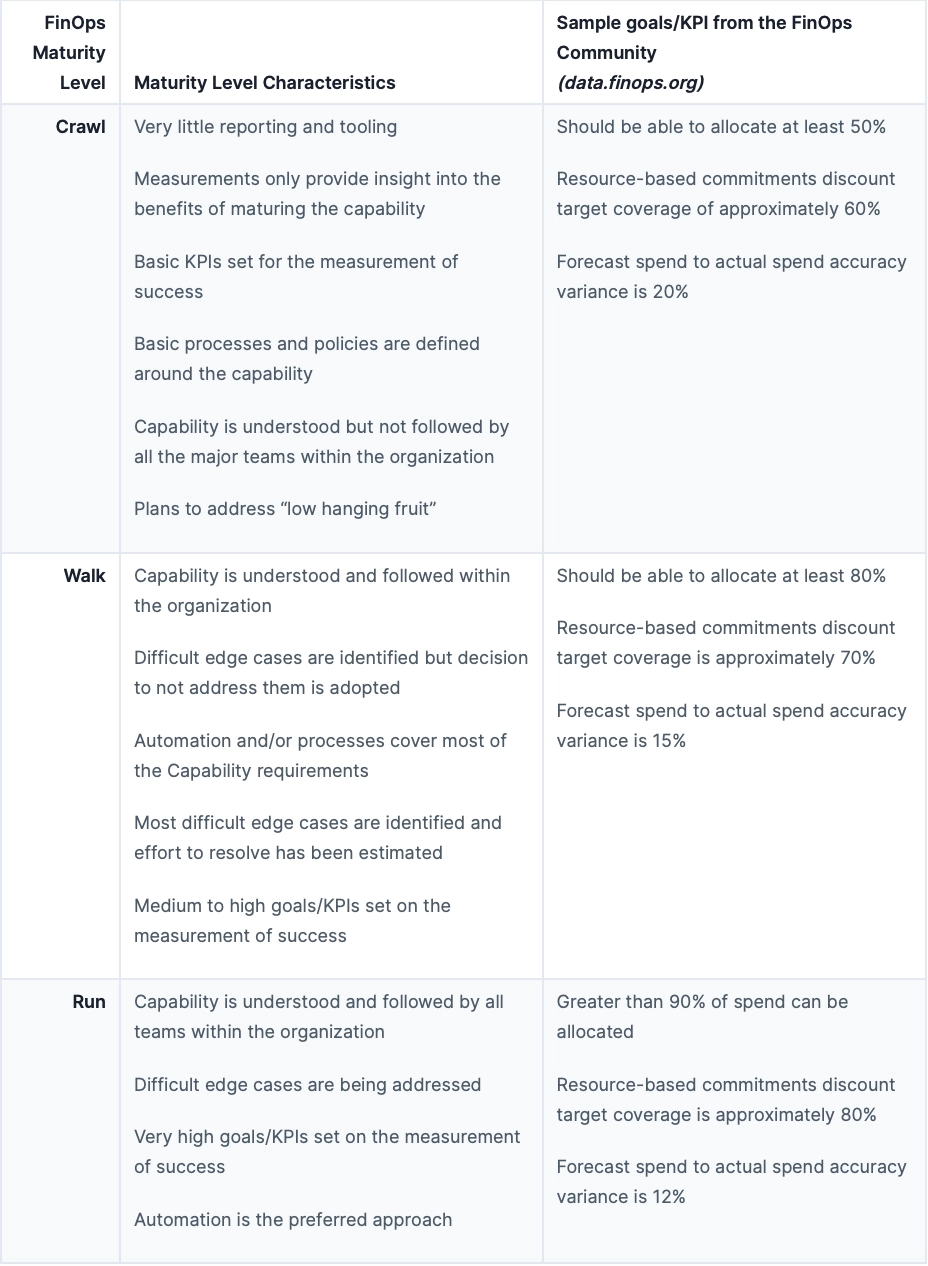

10. FinOps Maturity Stages: Crawl, Walk, Run

Credit: The FinOps Foundation

Credit: The FinOps Foundation

Just as a child learns to crawl before they can walk and to walk before they can run, your organization may spend significant time in the early learning stages. That’s perfectly fine!

As long as you’re constantly working toward improvement and gauging your progress with carefully devised KPIs and other measures of success, you’ll be able to move through the maturity stages at your own pace.

The FinOps Foundation suggests the above guidelines to determine your company’s progression through the stages of maturity. This is also what we use at CloudZero when our experts guide you toward more mature practices over time.

Even with a wealth of FinOps resources to choose from, it’s always easier to get started with the help of a knowledgeable guide.

Despite the overwhelming value of FinOps programs, many companies still delay implementation because of the work involved or the complexity of getting all the moving pieces into place.

CloudZero understands how overwhelming it can be for companies to begin their FinOps journeys when they have little to no prior experience in the area.

Our FinOps experts are happy to help guide you through each implementation step, flywheel phase, and maturity level at a pace that feels comfortable to you.

And, with the added benefit of our advanced cost tracking platform that allows you to break down your unit costs with ease, you might find moving through each of those stages of progression isn’t so hard after all.