Getting the right information at the right time can dramatically change the direction of your business. Yet, you may not have enough time to keep up with everything.

We get it. So, our team pulled a few all-nighters (so you don’t have to), and we bring you the key SaaS statistics every SaaS leader, team, and engineer should see right now.

You can dig even deeper by checking out the sources we included.

What Is Software-As-A-Service (SaaS)?

SaaS is a cloud computing model for accessing a complete, cloud-hosted application via a web browser, a mobile app, or an API over the internet. You then pay for using the service on a monthly or annual subscription basis.

Another company, the SaaS provider, manages all the hardware, software, storage, and other infrastructure components for that application, including security patches and upgrades.

This approach limits your control over the underlying infrastructure. Yet it also frees your team to focus on maximizing the application’s benefits rather than building and managing its infrastructure.

The most common companies that use this approach are those that build and sell consumer-facing software, such as office productivity tools, customer relationship management (CRM) systems, project management tools, and financial management tools.

Want to implement a SaaS platform yourself vs the on-premises approach? Learn more about how SaaS architecture works here.

That said, here are essential SaaS statistics you should know now to keep up with the industry.

Top Picks: 10 Must-Know SaaS Stats For SaaS Executives And Teams

- The cloud bill of 60% of organizations is slightly over or way above their expectations. (Source: CloudZero)

- 91% of organizations believe SaaS will help them adopt new technologies and boost their revenues. (Finances Online)

- SaaS (cloud application services) contributes nearly 30% of worldwide public cloud end-user spending. (Gartner)

- ChatGPT, Canva, LinkedIn, Udemy, Grammarly, and Adobe Acrobat are among the most renewed SaaS products today. (Vainu)

- Over 50 SaaS companies were funded in Nov–Dec 2024, with 11 more in Jan 2025 — signaling strong investor confidence. (Software Suggest)

- Companies now use 275 SaaS apps on average, but 53% of licenses go unused within 30 days — driving major waste. (Zylo)

- SaaS vendors can save $349 million from negotiating contracts. (Vendr)

- 50% of organizations using multiple SaaS applications are expected to centralize their management through SaaS Management Platforms (SMPs). (Gartner)

- A recent study revealed that 31% of companies have experienced former employees accessing assets stored in SaaS applications after departure. (Security Magazine)

- 72% of IT experts believe zero-touch SaaS automation will impact the use of SaaS applications in the coming years. (G2)

Dive right in for the full story.

SaaS Market Size: What Does The SaaS Industry Look Like Today?

SaaS is by far the most popular type of cloud computing today — and will be for the foreseeable future. Here’s what that means.

1. SaaS spending will grow to $300 billion in 2025 (source: Gartner)

According to Gartner, businesses worldwide will spend nearly $300 billion on SaaS products in 2025 — up from $250.8 billion in 2024. That makes SaaS the largest segment of cloud spending, making up around 41% of total public cloud investment this year. With more companies leaning into digital-first operations, SaaS remains the top choice for flexible, scalable, and cost-effective software delivery.

2. SaaS solutions will make up 85% of all business software in 2025 (source: BetterCloud)

Companies said they use an average of 80 external SaaS apps compared to 21 custom SaaS applications. The majority of their business apps will be cloud-based by 2025, according to BetterClouds’ State of SaaSOps survey.

3. Productivity and collaboration solutions dominate the SaaS market (source: Vainu)

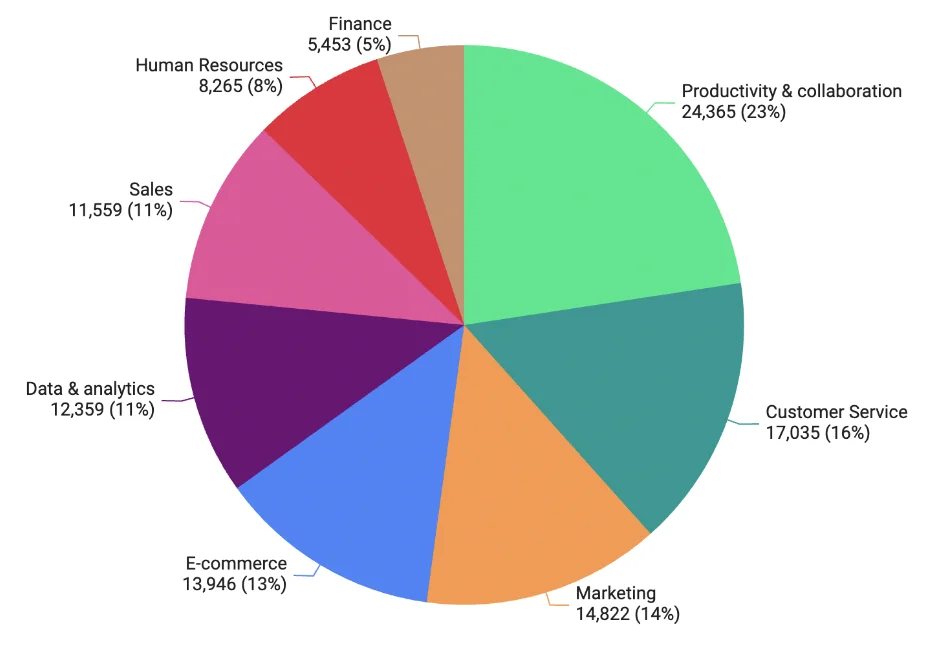

Vainu estimates there are over 24,365 SaaS solutions in 2023. Customer service (17,000+), marketing (14,800+), and e-commerce SaaS tools lock in the top four slots.

Credit: Vainu

4. What are the top SaaS markets today?

- China’s SaaS market is expected to hit $17.4 billion in 2025 and grow to $37.98 billion by 2029. (Statista)

- India’s SaaS industry is on track to grow from $20B to $100B by 2035. (Business Standard)

- Brazil’s SaaS market was valued at $3.9 billion in 2022. While exact 2025 figures aren’t available, Latin America’s SaaS industry hit $21.4 billion in 2024, with Brazil leading the region. The market is projected to grow at a 12.5% CAGR through 2030. (PayPro Global)

- Germany is still one of Europe’s fastest-growing markets, expected to grow from €6.85B in 2020 to €16.3B by 2025. (Statista)

Oh, one more thing.

5. Public SaaS companies now trade at 7.3x forward revenue

In 2025, the median valuation for public SaaS companies sits at 7.3x forward revenue, down from peaks of 17x in 2021. Private SaaS firms also average around 7x revenue, reflecting a market correction and more emphasis on profitability.

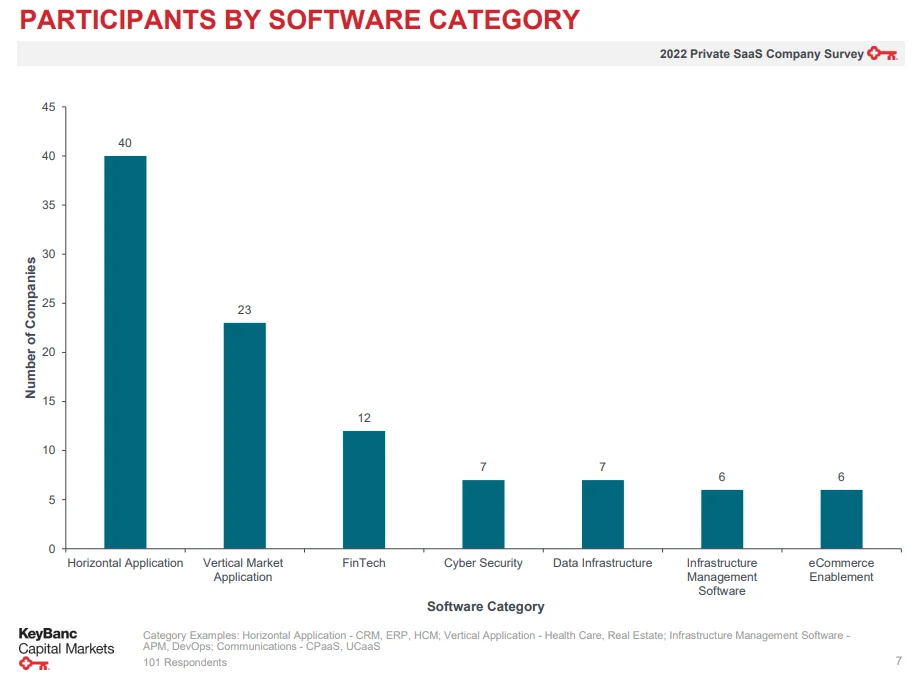

6. Many SaaS companies are in the horizontal category (source: KeyBanc Capital Markets)

The 2023 Private SaaS Company Survey shows 40 out of 100 medium-sized SaaS providers serve in the Horizontal category compared to just 6 in the infrastructure management service or e-commerce enablement categories.

Credit: KeyBanc

Statistics On The Benefits Of SaaS Platforms

Here are some statistics demonstrating the potential and proven benefits of SaaS solutions.

7. With SaaS, companies can introduce new capabilities to the market faster (source: McKinsey)

Companies said in a McKinsey study that adopting cloud platforms helps them get to market 20% to 40% faster. They said that by leveraging a SaaS model on platforms like AWS, they can build, test, and release new products faster to respond to market demands.

8. 91% of organizations expect SaaS to help them adopt new technologies and boost revenue (source: Finances Online)

Respondents said they expect SaaS to become the key enabler of emerging technologies, including Augmented Reality (AR), Machine Learning (ML), and Artificial Intelligence (AI). More benefits of SaaS include:

- 71% of businesses use cloud-based SaaS to speed up IT service delivery

- 71% want to speed up IT service delivery

- 63% want more flexibility

- 58% want to promote business continuity

Ultimately, businesses choose SaaS solutions because they are complete, cloud-native solutions that require little maintenance.

Statistics On SaaS Providers

Salesforce led the enterprise SaaS market for years until Microsoft surpassed it not too long ago. Here’s more.

9. Salesforce is now the leading SaaS vendor, followed by Microsoft (source: Synergy Research)

As of 2025, Salesforce leads the global SaaS market with 9.3% share, followed by Microsoft at 8.7%. SAP, Oracle, and Google round out the top five.

10. Google is the fastest-growing SaaS vendor (source: CloudZero)

Alphabet has been coming up fast since 2019. The company is the parent company to Google’s collection of companies, including Google Workspace (Gmail, Docs, Drive, Meet, etc) and Google Cloud Platform (GCP).

Want to migrate to one or more of the top cloud service providers today? Check our guide to the biggest cloud providers right now.

Top SaaS Companies Today

Want to know about the largest, most influential, and most profitable SaaS providers? Check out this list of the best of the best 99 SaaS companies here. In this section, we share some mind-blowing stats on the most influential SaaS companies today.

11. Over 150 SaaS companies now valued at $1B+ (source: AscendixTech)

As of 2025, 150+ B2B SaaS companies have crossed the $1 billion valuation mark, with major players like SAP and Databricks reaching record highs.

The top 10 publicly traded SaaS companies by market capitalization (in USD billions).

12. There may be over 72,000 SaaS companies worldwide (source: Vainu)

Well, that depends on who you ask. Vainu reports over 72,000, Statista concludes the number is more than 31,000, Capterra features over 50,000 solutions, and SaaSHub lists more than 168,000 products.

According to Statista, over 17,000 SaaS Companies are in the US alone.

13. Stripe no longer leads as the top private cloud company (Crunchbase, Reuters, The Australian)

While Stripe once held the top spot at $95B, ByteDance now leads with a $220B valuation, followed by rising stars like CoreWeave ($35B+) and AirTrunk ($24B).

14. The most purchased SaaS apps today (source: Cledara)

According to a 2024 report by Cledara, the most popular SaaS tools include Slack, ChatGPT, and Canva. This is based on data from over 1.1 million software purchases across 4,000 vendors.

15. What are the most renewed SaaS applications? (source: Zylo)

Based on 2024 expense data, the most frequently renewed SaaS tools include ChatGPT, Canva, LinkedIn, Udemy, Grammarly, and Adobe Acrobat. These apps continue to dominate due to their daily utility across teams.

SaaS Funding And IPO Statistics

Despite the effects of the pandemic on fundraising and exits, SaaS companies continue to attract record-breaking funding.

16. SaaS funding slowed heading into 2025 (source: CTOL.digital, Crunchbase, EY, VentureBeat)

Global VC funding reached $371B in 2024, but SaaS deals declined as investors shifted toward late-stage giants like Databricks and OpenAI.

17. SaaS funding is alive and well in 2025 (source: Software Suggest)

SaaS companies continue to raise capital consistently. In late 2024 alone, firms like Armis Security ($200M) and TRACTIAN ($120M) secured major rounds. The funding pace shows no signs of slowing in 2025.

SaaS Statistics By Industry

18. FinTech still leads, but AI and vertical SaaS are rising fast (source: Zylo)

FinTech remains the top SaaS subsector. But, AI-powered tools and industry-specific SaaS (like healthcare and education) are now among the fastest-growing segments.

19. HR tech spending is rising again in 2025 (source: Hacket Group)

After a dip, HR software investment is bouncing back. In 2025, 41% of organizations plan to increase HR tech spending, while only 7% expect cuts — signaling renewed focus on digital HR tools.

20. SaaS is booming across key industries (Source: Fortune Business Insights)

The global SaaS market is worth $315.7B in 2025 and is set to hit $1.13T by 2032 (CAGR 20%). Cloud-based supply chain tools alone will grow from $10.8B in 2023 to $37.6B by 2030.

SaaS Adoption And Usage Stats: How Many Companies Use SaaS Solutions?

In this section, we highlight how organizations use SaaS solutions and other related concerns, such as shadow IT and subscription waste.

21. 85% of business apps are now SaaS-based (source: Cloudwards)

By 2025, 85% of business applications run on SaaS, confirming that cloud-based tools are now the standard for most organizations.

22. Companies now use 112 SaaS apps on average (source: Productiv)

In 2024, the average company used 112 SaaS apps, down from 130 in 2022. 49% of licenses go unused, and SaaS spend per employee hit $5,607 — highlighting the waste and inefficiency that are increasingly tied to SaaS usage.

23. Shadow IT still accounts for 42% of SaaS apps

In 2024, 42% of SaaS apps companies use are shadow IT, meaning they operate outside IT’s control. 65% of apps remain unapproved, creating major security and visibility risks.

24. Orphaned and duplicate SaaS apps drive waste

In 2025, companies average 4.3 orphaned apps and 7.6 duplicate subscriptions, leading to wasted spend and security risks. Better SaaS oversight is critical. Learn more about SaaS cloud waste.

25.SaaS consolidation is rising, but shadow IT persists

By 2024, companies cut average SaaS app use to 342, down from 374 in 2022. Still, 65% of apps remain unsanctioned, with ChatGPT the top shadow IT app.

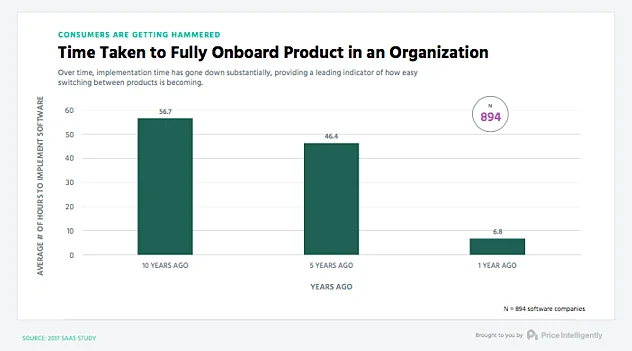

26. Implementing new software now takes about 7 hours (source: Price Intelligently)

It’s easier than ever to deploy SaaS solutions. A decade ago, implementing a new software product took 57 hours, but now it takes just seven hours. This supports faster time to market and value.

Credit: Price Intelligently

Views On SaaS: What Do People Think Of SaaS Solutions?

Here are some quotes from different stakeholders in the SaaS industry that are worth considering.

27. The fastest growth came from companies with ARRs of $5 million to $10 million and over $100 million

“Responses from larger companies are more indicative of the overall trends in the sector,” explained Peterson, “The median ARR this year is 40% higher than it was last year, this data is more indicative of mature SaaS companies.”

- Scott Peterson, Managing Director, KeyBanc Capital Markets Technology Group in October 2022

28. Forward multiples retreated to 6x levels, on par with the 10-year average prior to the pandemic

“Investors have been stress-testing their forward models for recession scenarios,” said Celino. “Companies with a combined growth rate and profit exceeding 40% and those that can at least maintain margin leverage in a downturn have relatively outperformed. High growth companies with worsening margin profiles have obviously underperformed.”

- Jason Celino, Director, Equity Research Analyst at KBCM

29. Indispensable Saas solutions aren’t going anywhere

“Companies don’t cut mission-critical SaaS. Yes, it’s a harder sales environment. Yes, prospects expect a deal. Yes, budget compression is real. But, companies still need world-class SaaS to operate their businesses.”

- Ryan Neu, Vendr CEO

30. SaaS buyers can save $349 million by negotiating contracts

“We found these insights by analyzing our customers’ SaaS spending. With over 20,000 deals, 2,500 suppliers, and over $2.3 billion in processed spend, we’ve seen the following trends:

- Total savings achieved by customers through negotiations was $349 million

- The average savings percentage for completed deals was 16.49 percent

- The average ROI for complete retainers was 7.6x, with a total ROI of 8.4x”

-Ariel Diaz, Co-founder and Chief Strategy Officer, Vendr

31. Cloud providers’ revenue will be flat or down overall, and that’s a cause for celebration

“The reduction in cloud spend we’ve seen in the last six months is one of its greatest success stories: That’s money that would have otherwise fed the always-on data center, which, despite all the grumbling about “cloud waste” every year, has never approached the efficiency of the cloud.”

- Erik Petersen, CEO, CloudZero

32. SaaS Suites are the way of the future

“It isn’t good enough to have a best-of-breed application. You have to have a suite. The front office, the eCommerce system, has to talk to the supply chain system.”

- Mark Hurd, Oracle CEO

He also noted that the largest SaaS companies may consolidate the market, presenting a serious entrance barrier.

33. SaaS quotes on priorities and CAC Payback time

- Nearly half of 1,920 business professionals said customer experience (CX) will be their highest priority for the next five years, surpassing SaaS pricing and product. (SuperOffice)

- 13% of customers leave brands they love after just one bad experience. Several more negative interactions, and that figure jumps to 92%. (PwC)

- 89% of SaaS businesses say new customer acquisition is their top growth activity. (Totango)

- In the first year, 92% of startup revenue is spent on acquiring customers. It takes 11 months to recoup the Customer Acquisition Cost, but it can be up to 18 months or as low as five months. (David Skok, General Partner, Matrix Partners)

- SaaS businesses with annual revenues of less than $10 million experience a 20% churn rate. (SaaS Capital)

- 85% of customers are willing to spend more on a SaaS product if the user experience is good.

SaaS pricing is also a big deal, as you’ll see in the next section.

SaaS Pricing Methodologies

So, how do SaaS companies purchase SaaS applications and services? And how do they set prices for their own SaaS products? You can check out our guide to SaaS pricing plans here to explore how to set pricing options.

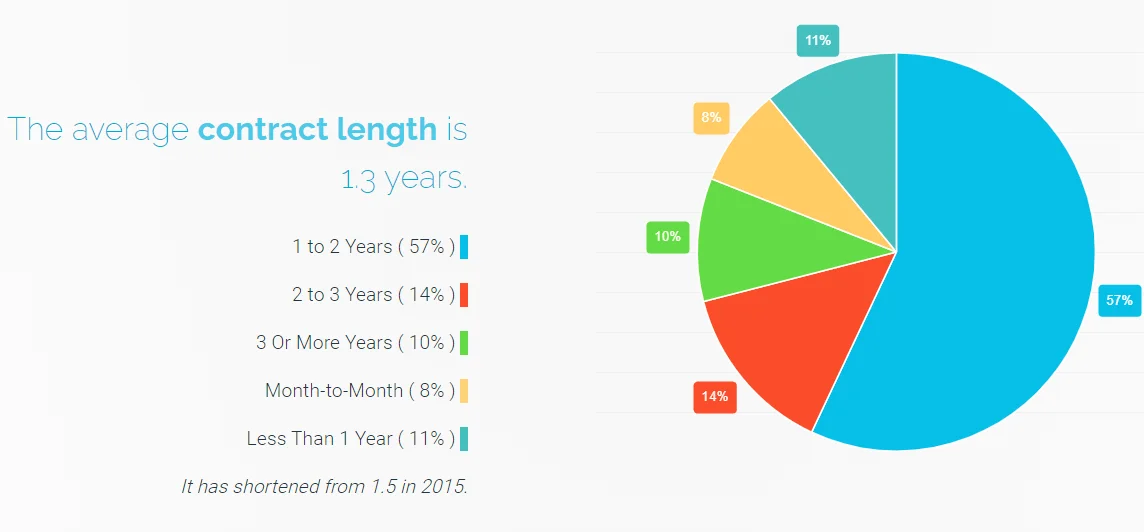

34. Annual subscriptions are the most popular (solutions: Insivia)

The most popular SaaS billing periods are annual plans (42%), monthly (36%), quarterly (11%), under one year (9%), and 1-2 years (3%). However, the average contract length is 1.3 years as shown here:

Credit: Insivia

35. Month-to-month contracts have a 14% churn rate (source: Reply)

In 2019, Reply reported several interesting findings on churn (which 69% of respondents measured by the number of customers and 62% by revenue):

- The churn rate for SaaS companies on month-to-month contracts is 14 percent, compared to 15 percent for those with one to 1.5-year contracts.

- 89% said their executive’s highest priority was new customer acquisitions, 59% prioritized existing customer renewals, and 46% said upsells and add-on sales.

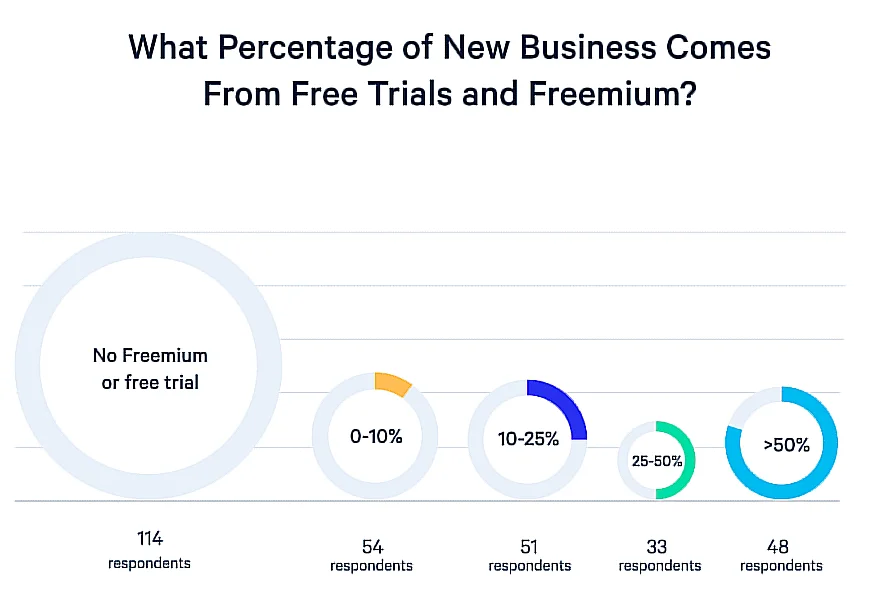

- Offering freemium plans or free trials to attract customers can be hit or miss

- 192 out of 300 respondents said their annualized revenue churn was 0-10%, 51 said 10-15%, and 57 reported higher than 15%.

Credit: Do freemium plans and free trials increase conversions for SaaS companies – Reply survey

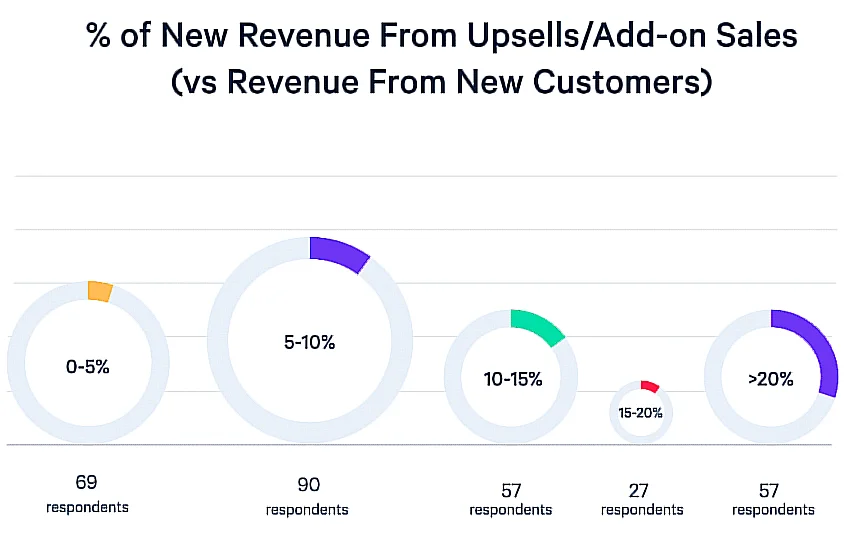

In comparison, revenue from upsells and cross-selling can also be hit and miss, depending on who you ask:

Credit: Does upselling and cross-selling increase revenue?

36. The profit boost from a 1% price increase could be as high as 12.7% (source: Price Intelligently)

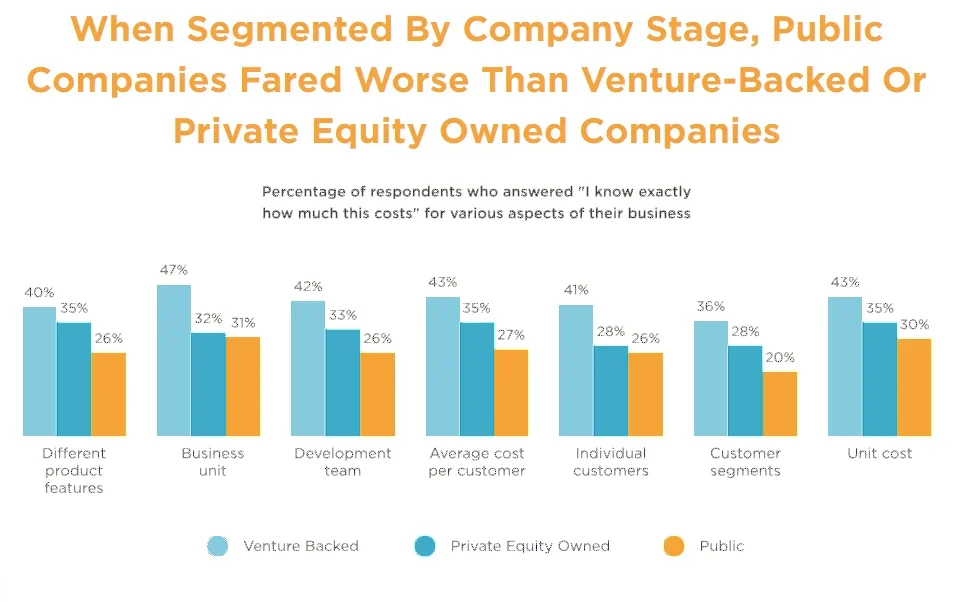

You don’t want to ignore pricing – or use guesswork when setting it up. You can instead use real-world data to figure out how to set profitable pricing for your SaaS product using your own cost of goods sold, cost per customer, and other unit cost insights.

With CloudZero, you can collect, understand, and act on granular, immediately actionable cost data. That includes cost per individual customer, per project, per service, per environment, per product, per software feature, and more — down to the hour. No cost allocation tags are required.

This empowers you to tell exactly how much you can price your service to protect your margins and grow your income to fund growth.

to see how it works for yourself.

to see how it works for yourself.

SaaS Cloud Cost Statistics

It’s no secret that sales and marketing eat up over 50% of SaaS company revenues (McKinsey). Cloud costs are a growing concern as some SaaS companies report weaker margins.

37. 60% say their cloud bill is a little higher than it should be or way too high (source: CloudZero)

CloudZero’s State of Cloud Cost Intelligence report is a must-read for any SaaS team that needs to treat cost as a first-class metric.

- A whopping 73% of respondents said that cloud cost is either a C-suite or board-level issue.

- It can take a week or more to discover a cost variance (cost anomaly such as a spike) leading to surprise costs.

- Only 13% said they have 75% of their cloud costs allocated. So, 87% are unsure what to do about chargebacks and showbacks, making it tough to tell who or what is affecting their cloud costs and why.

Another thing. Only 3 out of 10 can tell where their cloud spend goes, such as to a specific product, business unit, or customer. It’s worse for larger SaaS companies:

38. Nearly half of SaaS companies want to optimize costs (source: Flexera)

Over the next year, 48% of businesses plan to improve how they manage their SaaS products. The majority (54%) want to maximize savings and optimize software spend.

How Many Companies Achieve the SaaS Magic Number?

The SaaS Magic Number indicates the sales efficiency of a SaaS business. It does that by evaluating the return on investment on sales and marketing spend compared to annualized revenue growth. Here are insights on it:

39. Typically, the SaaS Magic Number at $15 million Annual Recurring Revenue is 1.2 (source: SaaStr)

A good 25% of SaaS companies reach 2.1 or reach profitability on a customer within 6 months, while 10% achieve “profitable” on a customer within just three months, or less.

Also noteworthy is that sales efficiency is fairly constant across the entire SaaS industry. (Mendoza Line for SaaS Growth)

40. Grow fast or die slow (source: McKinsey)

Other companies can afford to grow at 20% annually. But a software company growing at this rate has a 92% chance of going out of business in a few years. Software companies only stand a chance of becoming billion-dollar giants if their growth rate exceeds 60 percent.

How Many SaaS Companies Meet The Rule Of 40?

According to The Rule of 40 SaaS principle, a software company’s combined revenue growth rate and profit margin should equal or exceed 40%. At above 40%, the SaaS company is often generating sustainable profit, but companies below 40% may have cash flow or liquidity problems.

41. Only 11% of SaaS companies met the Rule of 40 in 2024

According to the 2024 KBCM SaaS Survey, just 11% of private SaaS companies hit the Rule of 40, though EBITDA improvements are helping more get closer.

Statistics on SaaS Challenges

The following stats show the challenges other SaaS companies are struggling with right about now.

42. SaaS sprawl still challenges IT teams (source: Vena FP & A)

- In 2024, 53% of organizations consolidated redundant SaaS apps, up from 40% the previous year. Despite this, 59% of IT professionals report that managing SaaS proliferation is still difficult. Looking ahead, Gartner predicts that by 2027, 40% of organizations using multiple SaaS applications will centralize management via SaaS Management Platforms (SMPs), up from less than 25% in 2022.

43. 50% of companies that use multiple SaaS applications plan to centralize them in the next five years (source: Gartner)

In fact, the Gartner Market Guide for SaaS Management Platforms has a warning. It asserts that organizations without centrally managed SaaS lifecycles will be 5X more vulnerable to data loss or a cyber incident related to misconfiguration.

44. 30% of employees use SaaS apps not approved by IT (source: IBM)

A recent study by IBM found that one out of every three employees at Fortune 1000 companies use cloud-based SaaS apps without their IT department’s approval. And that increases data security risk.

45. 94% of IT executives think managing SaaS manually leads to poor decision-making about SaaS spending (source: Productiv)

In addition, 25% of IT teams said they spent most of their time managing external vendors and solutions — and 31% of their time involved overseeing security and compliance.

Statistics On SaaS Employees And Team Management

Now, picture this:

46. Proper onboarding can reduce employee turnover by 82% and boost their commitment to your company 18X over (source: Brandon Hall Group and BambooHR)

There’s more. 89% who had an all-around onboarding felt fully integrated into the company culture versus the 59% who got an effective onboarding.

47. Offboarding is more tedious than it should be (source: BetterCloud)

Offboarding can take up to seven hours per user, which is tedious. Engineers are the hardest to offboard, followed by operations, sales, and finance professionals. Something else:

Speaking of data loss and risks, the following SaaS security stats will concern you.

SaaS Security Statistics

Take a look at these findings.

48. SaaS security is a major issue across the board (source: Logic Monitor)

The greatest challenges businesses face when using public clouds are:

- Security (66%)

- Compliance (60%)

- Lacking training or experience (58%)

- Privacy (57%)

- Vendor lock-in (47%), and

- Cost (40%)

That’s not all.

Misconfigurations in SaaS are difficult to detect and remediate manually, leaving organizations at risk. Almost half (46%) only check monthly or less frequently, while 5% never do.

The lack of visibility into the security settings of SaaS applications is the top concern for 56% of respondents. Concerns over a lack of visibility into the entire SaaS security settings follows.

49. 56% of enterprise apps aren’t managed (source: Productiv)

Unfortunately, that also means there isn’t much attention paid to security and compliance alongside renewal dates, licenses, and app usage.

Also, 56% of respondents to a G2 study admitted using software that their respective IT or InfoSec teams hadn’t vetted or approved.

50. Former employees cause up to 22% of incidents (source: Security Boulevard and OneLog)

Insider threats, counting ex-employees with access to a company’s SaaS apps, account for 22% of security breaches.

According to OneLog, 48% of organizations were unaware that a former employee could still access their corporate network.

- More than half of IT leaders admit that ex-employee accounts aren’t deactivated within a day after the employee departs.

- An alarming 32% reported it took a week, while 20% reported a month or more. A further 25% are unsure how long accounts remain active after employees leave.

SaaS Industry Trends, Growth, And Predictions: What Are The Top SaaS Initiatives For 2025?

Here are some trends set to transform SaaS into the future that you’ll want to pay attention to.

- AI-driven SaaS: Predictive analytics, personalization, and AI copilots are standard

- Vertical SaaS: Industry-specific tools for sectors like healthcare and finance are growing fast

- Low-code/No-code: Simplified app development is speeding up deployment

- Cybersecurity: Zero-trust and compliance automation are now must-haves

- White-label & Micro-SaaS: Demand is rising for niche, rebrandable tools

- Sustainable SaaS: Energy efficiency and green hosting are gaining focus

How To Understand, Control, And Optimize Your SaaS Costs With Confidence

These SaaS statistics can help you develop new strategies to lead your company in the right direction. If you are one of the SaaS leaders keen to understand, control, and optimize your cloud costs this year, CloudZero can help you.

With CloudZero, you can:

- Identify, analyze, and share cloud cost metrics automatically in the context of engineering, finance, or FinOps.

- View costs of tagged, untagged, and untaggable resources. No endless, manual tagging is required here.

- Engineers receive insights related to their technical role, including cost per feature, per environment, per development team, per project, per deployment, and more. This enables them to determine how their architectural choices impact the bottom line so they can design cost-effective solutions.

- Finance and FinOps get immediate insights into cost per customer, project, team, and more. In turn, you can set profitable pricing for your services, know how much discount to give a specific client based on their usage, etc.

- Visualize, understand, and share your COGS, gross margin, and other investor-oriented insights with the board anytime.

- Take advantage of real-time cost anomaly detection. Get timely alerts straight to your Slack to prevent overspending.

Yet, reading about CloudZero is nothing like experiencing it for yourself. Drift tried CloudZero and saved over $2.4 million in annual AWS spend.  and see what you can achieve.

and see what you can achieve.