You can assess your company’s financial health using a number of SaaS metrics, depending on the type of business you are in. Among the most useful is the SaaS Magic Number. So, why is it called the SaaS Magic Number, and how do you calculate it? And why is it so important to track your SaaS Magic Number regularly?

This jargon-free post will answer these questions and more, including:

What Is The SaaS Magic Number?

The SaaS Magic Number measures a SaaS business’s sales efficiency by evaluating the return on investment on sales and marketing spend versus annualized revenue growth.

Essentially, the Magic Number seeks to answer the crucial question: “How much revenue does our company generate for every dollar we spend on acquiring new customers?”

The SaaS Magic Number helps measure the ratio between the current quarter’s recurring revenue and the last quarter’s marketing costs. It is calculated quarterly because accounting reports sales and marketing expenses quarterly.

Why Is The SaaS Magic Number Important?

The SaaS Magic Number compares your annual recurring revenue with sales and marketing spending to determine whether you are making enough money (profit margin) to continue investing in sales and marketing.

If your company’s magic number is 1, it indicates your ratio of dollars spent to dollars earned is 1 to 1, meaning your sales and marketing processes are efficient.

A Magic Number below 1 indicates that you should evaluate your SaaS business and see what needs to be improved, including your:

- Product-market fit

- Customer retention strategy

- Conversion rate optimization and

- SaaS pricing (or setting more ideal pricing tiers, plans, etc.)

Other benefits of the SaaS Magic Number include:

- Tracks sales and marketing ROI: Helps tell if you are earning a healthy ROI on your sales and marketing dollars

- Measuring scaling efficiency: Shows whether your company is ready to boost sales and marketing to accelerate growth

- Sales and marketing redesign: It helps you see what sales and marketing techniques are working and which ones you’ll want to improve or replace

- Cloud cost optimization: By analyzing your Cost of Goods Sold (COGS), you can determine where to invest more to maximize ROI and reduce costs without hurting revenue to increase gross margins.

- Investor insight: Serves as a benchmark for investors to assess how efficiently your company turns investment into growth.

Limitations Of The SaaS Magic Number

While the SaaS Magic Number is a useful indicator of sales efficiency, it’s not a complete measure of profitability. It doesn’t account for operating costs, customer churn, or changes in pricing strategy. It also ignores other revenue growth drivers like product expansion or upselling.

A best practice is to use the Magic Number alongside other important SaaS metrics to get a complete view of your business health.

What next?

How To Calculate Your SaaS Magic Number

To determine your SaaS Magic Number, take the current quarter’s recurring revenue and subtract the previous quarter’s recurring revenue. Then, multiply the result by four (to annualize it) and divide it by your sales and marketing costs in the previous quarter.

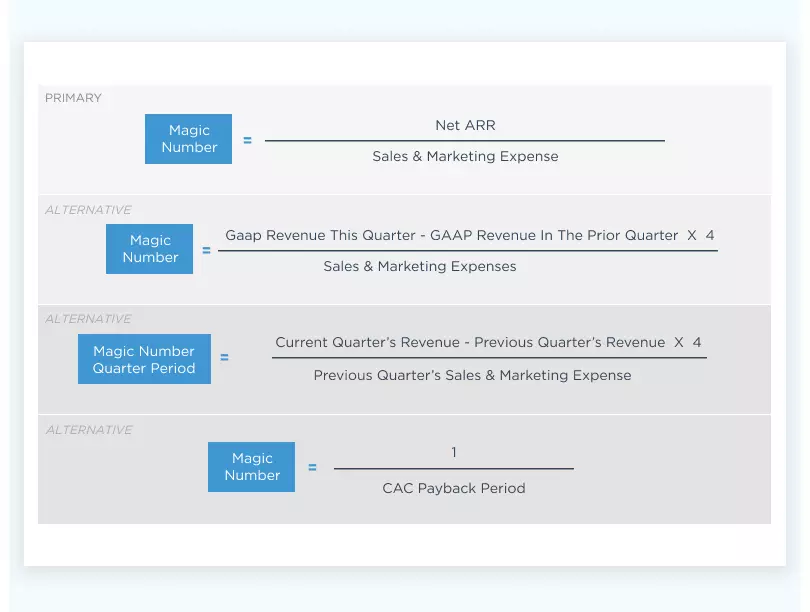

Here’s the formula:

SaaS Magic Number = [(Current Quarter’s GAAP Revenue – Previous Quarter’s GAAP Revenue) X 4] / Previous Quarter’s Cost of Sales and Marketing

Other formulas for calculating your SaaS Magic Number include:

SaaS Magic Number example:

Company A’s recurring revenue in Q3 is $700,500. Its recurring revenue in Q2 was $550,700. It spent $600,200 on Sales & Marketing in Q2.

Using the SaaS Magic Number formula, Q3’s Magic Number is:

SaaS Magic Number = [($700,500 – $550,700) X 4] / $600,200

SaaS Magic Number = 599,200 / 600,200

Company A Q3 Magic Number is 0.998 or just about 1

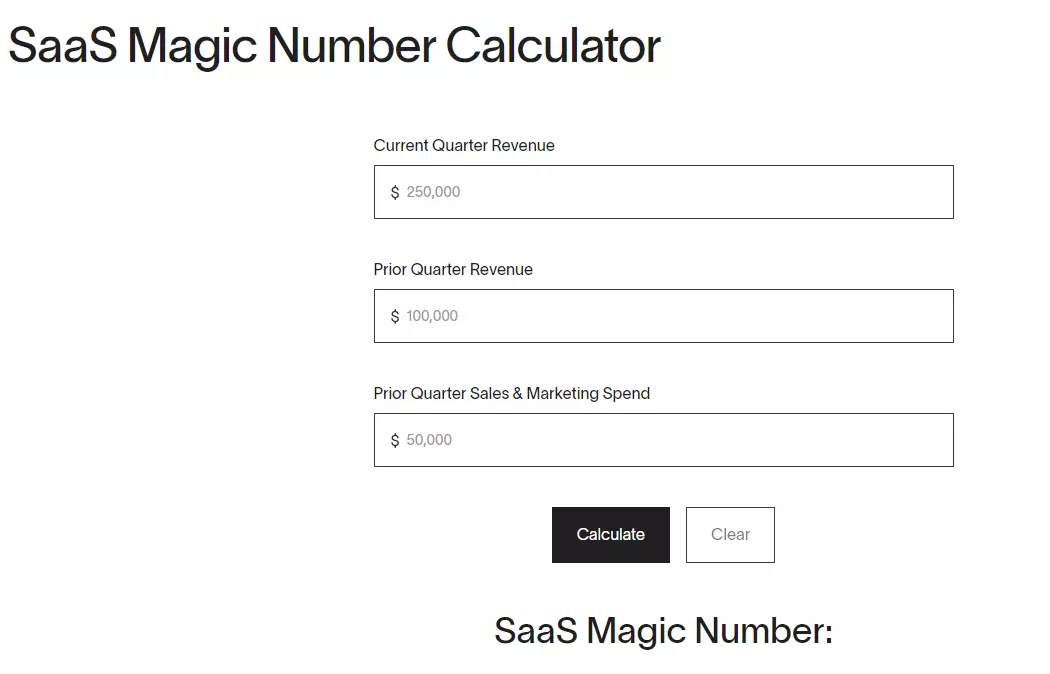

You can calculate this number manually. You can also use one of several SaaS Magic Number calculators available today, including Ramp and Klipfolio.

Credit: Ramp

So, is Company A’s Magic Number healthy, or should it work on making its sales and marketing efforts more efficient? And what is a good SaaS Magic Number anyway?

How To Interpret Your SaaS Magic Number

If your SaaS Magic Number is below 0.75, you should evaluate your sales and marketing strategy as it isn’t working in your favor.

A Magic Number between 0.75 and 1 indicates that the company is on track to streamline its sales and marketing to improve profitability.

If your SaaS Magic Number is greater than 1, your strategies are efficient and sustainable – and you can use similar ones to increase your margins further.

What Metrics Relate To The SaaS Magic Number?

You can better understand your Magic Number with the help of several SaaS metrics. These include:

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the total amount spent to acquire one additional user. Over time, SaaS companies recover this upfront investment through subscription revenues.

CAC Payback Period

The Customer Acquisition Cost (CAC) payback period is when a SaaS company recoups all the sales and marketing costs it used to gain one customer.

Investors are also interested in this metric because it lets them know when to expect a return on their investment.

Monthly Recurring Revenue (MRR)

MRR measures the revenue your existing customers generate monthly, regardless of the number of pricing tiers you have.

Also, MRR is extremely helpful in calculating other SaaS metrics for reporting, such as Gross Margin, Net Monthly Growth Rate, and SaaS Profit and Loss.

Annual Recurring Revenue (ARR)

ARR is the annualized MRR; your MRR X 12.

Churn rate

An organization’s customer churn rate is the percentage of its customers who do not renew their subscriptions during a particular period. Defection, attrition, and turnover rates are all terms used to describe customer churn.

Likewise, the revenue churn rate refers to how much revenue you lose over time compared to the previous period. Revenue retention rate refers to the percentage of income you keep from recurring subscriptions.

Gross profit margin

SaaS Gross Margin refers to the difference between revenue and cost of goods sold (COGS). For SaaS companies, revenue is positive income from sales of goods or services — usually software sales or subscriptions. COGS describes the direct costs associated with producing and distributing the software.

Net profit margin

Net Profit Margin (or Profit Margin Ratio) indicates how much profit a company generates from its total revenue. Specifically, it measures how much profit you make for each dollar of revenue.

The net profit margin is a percentage of total revenue divided by net profit (often referred to as net income).

The Rule of 40

According to the rule of 40, a SaaS business is healthy and profitable when the sum of its growth rate and profit margin is greater than 40%. Here’s a quick guide to the Rule of 40 for SaaS companies.

It’s worthwhile to learn how metrics like growth rate, profit margin, expansion revenue rate, customer retention rate, and others compare and why they matter.

How To Improve Your SaaS Magic Number?

The following are some common tips for improving your Magic Number:

- Shortening your sales cycle

- Encourage upsells

- Facilitate more cross-selling

- Focus on customer retention/subscription renewals

- Make conversion optimization a priority

- Experiment with different marketing channels to discover the ones with the best price-return ratio

- Do more of what returns the highest sales and marketing ROI

Here’s the thing. SaaS is a highly dynamic market where change is the only constant, so regardless of your score, you’ll want to improve your SaaS Magic Number continuously.

When your Magic Number exceeds 1, it is also an ideal time to experiment with different sales and marketing techniques alongside those already producing a good ROI. You can afford it.

Here are several advanced yet relatively simple ways to improve your SaaS business Magic Number:

Optimally manage your COGS

When you know exactly what’s driving your cost of goods sold, you can cut unnecessary costs and pass the savings on to your customers to encourage renewals. Or, you can keep the increased margins to boost your bottom line and fund further growth.

Maximize ROI by evaluating your unit costs

By understanding where your money is going, such as the people, products, and processes driving your cloud costs, you can pinpoint where to cut costs and increase investment to improve margins.

Set profitable SaaS pricing

When you know how much you are spending to support each cost center, a specific customer, or a project, you can tell how much you need to charge for each to protect your margin.

Encourage renewals with timely, personalized discounts

Knowing how much you spend to support a specific customer helps you determine how much discount you can give them without hurting your margins or losing them.

Understand your gross margins

The total gross margin does not tell the whole story. Knowing how much gross margin you earn per customer, project, team, software feature, product, etc., is more effective. Taking this approach helps you build a profitable business from day one.

If you are wondering where and how to collect, analyze, and act on this level of SaaS intelligence, CloudZero can help you automate it.

With CloudZero’s Cloud Cost Intelligence approach for SaaS organizations, you can:

- Accurately track and collect the costs of tagged, untagged, and untaggable cloud resources, along with those in shared environments – even if you have imperfect cost allocation tags.

- Simplify your total cloud costs using granular, immediately actionable cost insights, such as your cost per individual customer, project, environment, product, team, product feature, etc.

- Help finance understand your cost per customer to ensure your margins aren’t eroded during pricing negotiations.

- Empower your engineers to track the impact of their activities on costs to make your product more competitive in your market and cost-effective.

- Ensure your FinOps team can better budget, forecast, and allocate costs (showbacks and chargebacks), among other things.

- Take advantage of real-time cost anomaly detection and prevent overspending with timely alerts via Slack, email, etc.

Yet, reading about CloudZero’s capabilities is nothing like seeing them in action.  to increase your SaaS Magic Number in days — not years. Companies like Drift, Remitly, and Malwarebytes are already saving up to $2.4 million annually with CloudZero.

to increase your SaaS Magic Number in days — not years. Companies like Drift, Remitly, and Malwarebytes are already saving up to $2.4 million annually with CloudZero.