Typically, startup founders and executives must meet with their board of directors each quarter to review the progress of the company. They may talk about broad topics such as total costs and total revenue, and use these numbers as a guide to determine which moves the company should make in the near future.

Often missing from the conversation, however, is a clear and detailed discussion of SaaS metrics. SaaS metrics reveal a lot about the health of the company, because they give each party a clearer understanding of how cloud spending affects overall profitability.

In non-SaaS companies, costs and revenue may operate fairly independently of one another. If costs soar, the margin narrows, and the company must increase prices or slash costs to make up the difference.

In a SaaS company, however, your costs are often tied directly to your revenue. Sometimes an increase in costs doesn’t point to a problem; it may be a sign that more customers have signed up for your services and your monthly revenue is likely to grow in proportion.

It may still be necessary to slash costs, or it could be a huge mistake that leads to a buggier user experience and a loss of customers. Unfortunately, there’s no good way to know this for sure without tracking SaaS metrics in detail and calculating how each change affects profitability.

That’s why it’s so important to incorporate cloud cost analysis as part of your strategy. Only when SaaS executives understand how cloud spending affects revenue, customer retention, and overall profitability can they make informed decisions about how to streamline operations, look for new opportunities, and make other crucial choices about the company’s future.

While your exact calculations and chosen metrics will vary based on your company, industry, and unique situation, the following guidelines should get you started — and track the health of your startup.

Running The Numbers

As a software business owner, you may be familiar with metrics such as:

- Lifetime Value (LTV)

- Customer Acquisition Costs (CAC)

- Monthly Recurring Revenue churn (MRR churn)

- Software margins

But how do you actually calculate these business metrics to find out if they are where you want them to be? To do so requires knowledge of your company’s unit economics at a fairly granular level.

In order to calculate software margins, for example, first you must know your cost of goods sold (COGS), or the unit costs associated with delivering your product to the customer, and the revenue the product brings in.

If your company is in the startup stage, with costs and customer reach both growing quickly, you’d have to have a pretty tight grasp on how both are changing to accurately calculate your unit profitability. Without knowing your costs and revenue in detail, there isn’t a great way to find your margin.

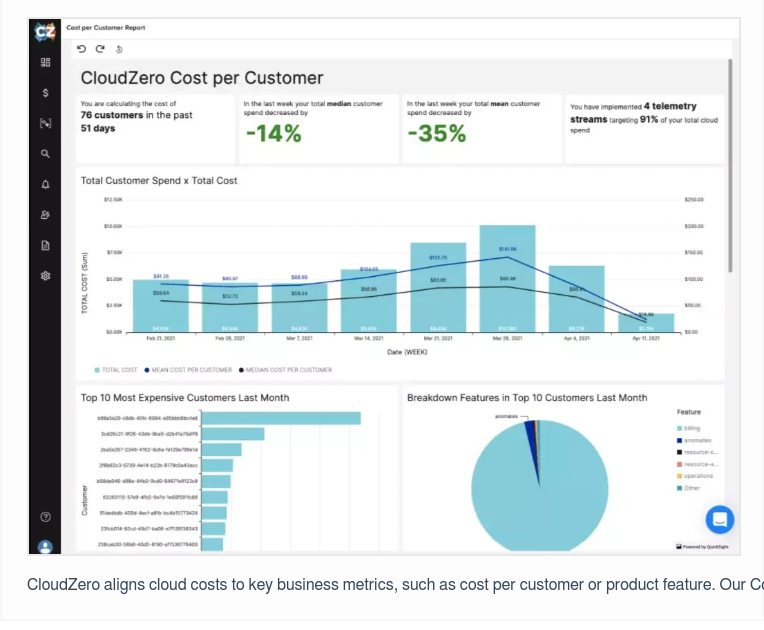

It can be very tough to track these metrics without an in-depth cost intelligence strategy, but the platform and services offered by CloudZero offer an easy place to start. CloudZero gives you access to visible, easily understandable measures of unit economics you can use as the basis for all your cost-related calculations and decisions.

Once you have a system in place to track your unit economics, you can compare and contrast important metrics.

Primarily, you’ll be focusing on two areas:

- The revenue you can expect from a service in comparison to the costs required to provide that service

- The time it will take to break even on your R&D investments

Because SaaS companies often offer multiple products and features and may contract with multiple cloud service providers, you’ll likely be running these comparison calculations for a variety of different items.

You may find, for example, that although setting up an account tier with unlimited messaging would cost more per month than you’re currently paying for capped messages, the revenue gained by allowing high-dollar customers to send and receive as many messages as they want far outweighs the monthly payments.

While the most obvious metrics to compare are costs and revenue for each cloud service you use, don’t forget about other measures of success as well. Customer happiness and retention, for example, may be dramatically affected if your company switches from one cloud service to another, even if the math on cost versus expected revenue checks out.

Similarly, it may appear at first that switching to another service would save money per transaction, but if you’ve built an established relationship with your current provider, you may be able to negotiate discounted rates that more than make up for the difference in transaction costs.

Showing Your Results To The Board

Board members aren’t going to care so much about the detailed ins and outs of where each dollar goes within your cloud bill.

Most of the time, they just want to make sure those dollars are going toward worthwhile things that bring more revenue to the company and improve the user experience. They also want to keep track of the margin between total costs and profits to make sure the margin stays healthy and strong.

Therefore, it’s always a good idea to have that detailed breakdown of costs on hand. Remember, startup board members have to make critical decisions regarding the future direction of the company, so it’s important they have all the information they need at their fingertips.

Do a thorough analysis of each feature you’re paying for and the revenue you can expect in return. Make sure to put it all down on paper for easy review.

Include each metric you’ve tracked, as well as your analysis of how each metric relates to the others. This will allow the board to see at a glance how changing one area might affect the others.

As an example, let’s say your analysis determined that, although your company charges per customer account, your costs vary most heavily based on the amount of storage each customer uses. Therefore, you might have much larger margins for low-storage customers, while your customers that utilize lots of storage leave you with razor-thin margins.

Is it better to restructure your entire pricing strategy or leave things as-is with the understanding that, on average, the numbers fall within an acceptable range? Another option might be to charge extra for users who exceed a certain storage threshold.

This may be a scenario where there is no right or wrong answer, but the point is, the board and other decision-makers should have all the data they need to make an educated decision and determine a course of action.

Another example: Let’s say you have a great idea for a new feature. It will take a rather large up-front budget to develop this new feature, but you anticipate that it will pay for itself within the first year. It’ll be much easier to sell that idea to the board if you have hard numbers to back up your projections.

Bundle each section of your analysis into a clearly documented, organized report, and include data visualizations that make each section quick and easy to read.

Importantly, be prepared to answer questions about how you chose the metrics, gathered the data, ran the numbers, and arrived at your conclusions.

Still Not Sure Where To Start?

If your company doesn’t have a solid cost intelligence strategy already in place, you might be facing more of a challenge than you’re prepared for. After all, it’s hard to calculate important metrics when you have no visibility into your costs, revenue, and the unit economics of each cloud service.

Instead of trying to create something out of nothing, let CloudZero open a window into the previously opaque black box of your SaaS company’s finances. Helping SaaS companies achieve cost visibility is what we do.

When in doubt, you can even partner with a FinOps specialist who will coach you through devising a cost intelligence strategy that works for your business.