SaaS is a competitive sector, so finding ways to win on gross margin is increasingly crucial. By finding sustainable strategies that either increase your revenue or minimize your cost of goods sold (COGS), your SaaS company can gain a competitive advantage.

Every SaaS brand wants to be profitable, but the definition of profitability varies greatly. The gross margin measures the difference between the revenue generated from a product (the software) and the costs associated with its production and delivery.

The gross margin provides a focused approach to evaluating the profitability of a product. In this article, we’ll share what you need to know about SaaS gross margin and how you can improve yours.

What Is SaaS Gross Margin?

SaaS Gross Margin represents the difference between revenue and the cost of goods sold (COGS). For SaaS companies, revenue — which is defined as positive income from the sales of goods or services — is usually generated from the sale of software or software subscriptions.

COGS is a term used to describe the direct costs associated with producing and distributing the corresponding product(s).

Usually, the term “gross margin” refers to all revenues and direct production and distribution expenses accrued by a company over a specific period. However, gross margin can also be itemized by different sectors, different products, and other variables, thus allowing for direct comparisons.

SaaS Gross Margin is different from the commonly used “profit margin” because while profit margin simply compares revenues and expenses, gross margin only accounts for the expenses accrued from selling an additional unit of a good or service. Fixed costs, such as office space and (some) salaries, are excluded from the gross margin calculation.

Essentially, looking at the gross margin can help answer the question, “If we were to produce and sell one additional unit, how much revenue would we generate and how much more money would we need to spend?”

There are two ways to calculate gross margin. A unit margin tells you how much you can make in dollars by selling one more unit, while a margin percentage tells you how much you can make per dollar by selling one more unit (margin as a ratio).

Why Is SaaS Gross Margin Important to Monitor?

Paying close attention to gross margins is especially important in the SaaS industry, where many businesses have a lifecycle and profit structure that are notably different from their more traditional counterparts. Some reasons it is crucial to track your SaaS gross margin include:

The net profit margin isn’t always ideal for SaaS

For example, in SaaS, the costs of delivering a product from conception to the end-user are usually heavily concentrated up-front (particularly, Research and Development). That means, only looking at the net profit margin might not accurately illustrate the company’s true earning potential.

The digital, pseudo-physical nature of the “product” (software subscription) also yields a situation in which it makes more sense to separate fixed costs and costs categorized in the actual selling of goods (COGS).

It can help you to accurately calculate your cost of goods sold

Many SaaS companies report weaker margins because they overreport their COGS. As we’ll see in the next section about how to calculate your SaaS gross margin, you have to accurately consider what to include as your COGS and what to exclude, if you are to find your true SaaS gross margin figure.

If you are wondering what really counts as COGS for SaaS, check out our What To Consider In Your Cost Of Goods Sold Calculation here.

It helps assess a company’s scalability potential

Once you are forced to understand your COGS, you’ll know metrics such as your per-unit costs. Modern cloud cost optimization platforms, such as CloudZero, can help you view cloud costs in granular SaaS dimensions such as Cost per Customer.

Using this example, you can use your Cost per Customer metric to answer questions such as:

- If we onboard 10 more customers tomorrow, how will our costs change?

- How should we set our pricing to protect our margins?

- What kind of discounts can we afford to give our customers to encourage signups and renewals without eating into our margins?

Check out our guide to the common cloud cost questions to expect from finance to see more of the questions understanding your COGS and SaaS gross margin can help you answer.

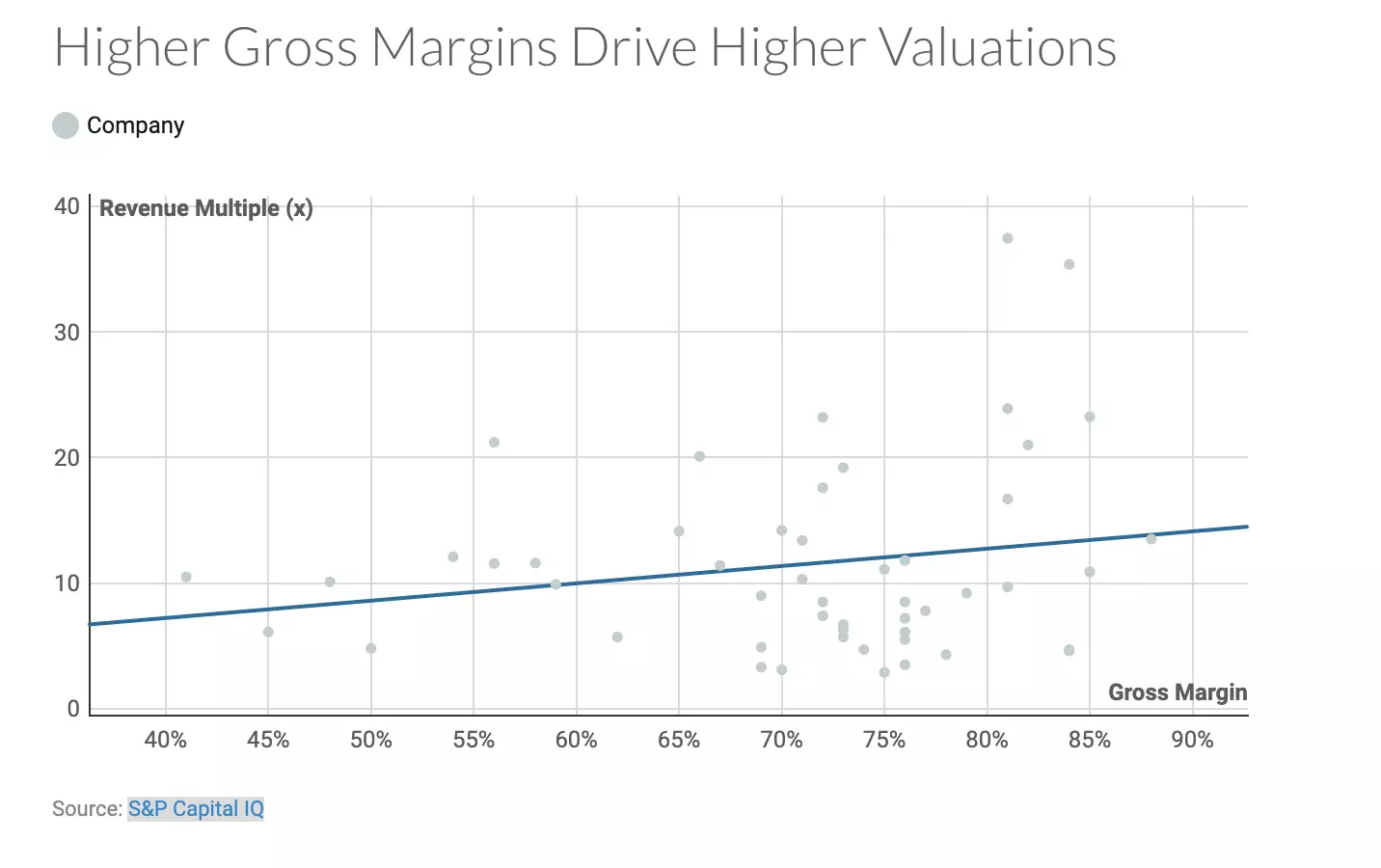

Your SaaS gross margin impacts your valuation and investor attractiveness

It is important to note that even a few percentage points of margin can have a tremendous impact on a company’s valuation. In turn, an undervaluation can impact your ability to attract investors to finance your growth. And this can hurt your overall growth and success.

An interesting chart we got from Villie Itche of Two Sigma Ventures shows how gross margins correlate with valuation.

It more accurately illustrates a company’s sustainability potential

Furthermore, many SaaS companies begin operating with deep losses, hoping to overcome these losses in the future. The question that leadership needs to ask themselves is, “if we were to keep expanding and selling more of our product, could we sustain our business model?”

This is not a question that can always be answered by the net profit margin, especially in a SaaS company’s earlier years. The SaaS Gross Margin, on the other hand, can help illustrate the organization’s sustainability potential.

Here’s an example.

If gross margins are low (or even negative), this means that even in the “best-case scenario”, the business will continue facing financial challenges.

On the flip side, the more a business can do to widen the gap between marginal revenue and marginal COGS, the better positioned that business will be.

Investors use the SaaS gross margin to gauge suitability to finance

Additionally, Gross Margin is one of the first metrics that banks, venture capitalists, angel investors, and other individuals will look at when they are making important funding decisions.

It is a measure of a SaaS company’s profitability potential and hence its ability to make a good return on investment.

On the margin, excelling in this component of your income statement can help your company distinguish itself from possible alternatives or competitors.

How To Calculate SaaS Gross Margin

Calculating the SaaS Gross Margin (Gross Margin Percentage) is relatively simple:

Gross Margin Percentage = (Revenue – COGS)/(Revenue) x 100 percent

It is very similar to many other common ratios, including the formula for calculating net profit margin. But let’s break down its components real quick:

Revenue

Revenue for a SaaS company refers to the total income generated from its subscription-based software services. This income typically arises from monthly or annual subscription fees that its subscribers/users pay.

In the context of SaaS gross margin calculation, this revenue is crucial as it’s compared against the direct costs of delivering the service (like hosting, support, and license fees) to determine the efficiency and profitability of the company’s SaaS business model.

COGS

Cost of Goods Sold represents the direct costs associated with delivering digital services to customers. These costs include server costs, software licensing fees, and direct support and customer service costs.

When calculating your SaaS gross margin, deduct COGS from revenue to assess your gross profit. This is an indicator of how efficiently the company produces its software product or services.

Examples of costs included in COGS are hosting expenses and customer support salaries. Costs not included are marketing, sales, and research and development expenses. Learn more about what to account for as COGS and what not to report in our guide here.

So, what does the SaaS gross margin say?

SaaS gross margin can be positive or negative (though it is usually positive). When the margin is negative, it means that the cost of creating and delivering a product is greater than the revenue it is generating from sales.

As suggested, some managers also like to look at the unit margin in addition to the gross margin. The formula for calculating the unit margin is:

Unit Margin = Selling Price – Cost Per Unit

Once again, this is a metric that could yield a negative number; likewise, a negative value indicates there is probably something wrong with the company.

Knowing how to calculate and interpret the gross margin makes it easier for leadership to make informed, profitable decisions.

When the difference between revenue and COGS is high, this suggests that the company is currently operating a high markup. The combination of higher markups and higher sales volume can maximize profit.

Example SaaS gross margin calculation

Let’s use a Company X’s financials for a given period (and no, we aren’t referring to Musk’s new acquisition here):

- 1. Revenue: Company X earns $500,000 from its subscription-based software services.

- 2. Cost of Goods Sold (COGS):

- Hosting Costs: $50,000

- Software Licensing Fees: $20,000

- Customer Support Salaries: $30,000

- Total COGS: $50,000 (Hosting) + $20,000 (Licensing) + $30,000 (Support) = $100,000

Calculating X’s SaaS Gross Margin:

- 1. Gross Profit: Revenue – COGS = $500,000 – $100,000 = $400,000

- 2. Gross Margin Percentage: Gross Profit/Revenue ×100 = ($400,000/$500,000) X 100 = 80%

From this example, we can see that Company X’s SaaS gross margin is 80%. This indicates that after subtracting the direct costs of delivering its service, Company X retains 80% of its revenue as gross profit, which is a healthy margin in the SaaS industry.

What Is the Ideal SaaS Gross Margin To Aim For?

Companies in the SaaS (Software as a Service) industry typically have a higher gross margin than other industries. Most SaaS companies have a gross margin between 70% and 85%, with best-in-class companies having at least 80%.

Compare that to the auto and truck sectors (9.04%), restaurants and dining sectors (27.60%), and household products (50.87%), and you’ll notice the SaaS sector has significantly higher gross margins.

Early-stage SaaS startups often have lower SaaS gross margins, typically around 50% (or lower), due to not yet benefiting from the economies of scale that later-stage SaaS businesses enjoy.

Also, as we mentioned earlier, SaaS companies often invest a lot upfront in research, development, and market penetration.

5 Ways To Improve Gross Margin

Now that you know how to calculate gross margin, you can have a better understanding of your company’s current financial and operational situation.

However, understanding how to calculate gross margins is one thing, knowing how to improve gross margins is another.

The best ways to improve gross margins will depend on your company’s stage in the business cycle, its size and structure, its target market, and numerous other factors. However, even keeping these nuances in mind, there are still a few things that virtually all SaaS organizations can do to increase gross margins:

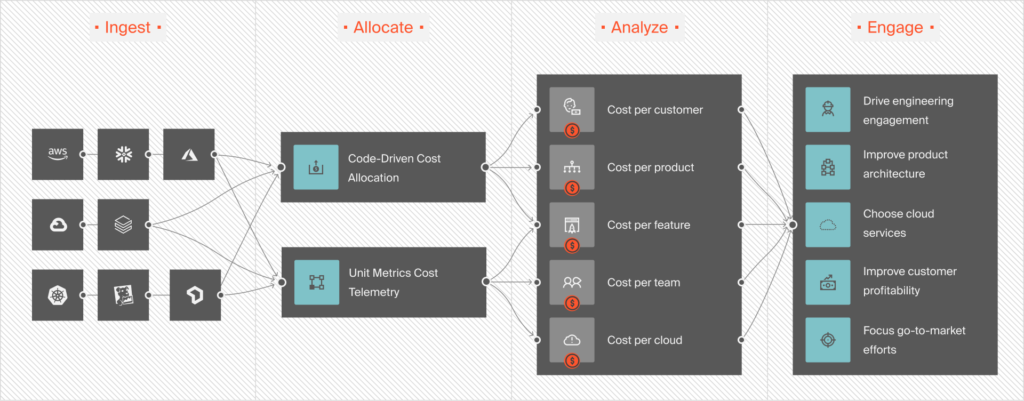

1. Measure and monitor cloud costs

As a SaaS enterprise, your access to and implementation of cloud technology and data can help you establish a competitive edge.

In addition to gross margin, many other broader metrics will need to be monitored including cost per transaction, lifetime customer value, and many others.

Using platforms like CloudZero makes it easier to take a deep dive into your cloud usage, map costs to products and features, and develop a sustainable, high-yielding business model.

2. Restructure payment

When all else is equal, your business would obviously much rather be paid today than a year from now.

Finding ways to encourage upfront payment (such as discounts or “bonus” features), rather than defaulting to monthly payment will accelerate your cash flow cycles and give you the capital you need to advance gross margins.

Additionally, decreasing the “trial period” will also help your margins. The difference between a 15-day and 30-day trial may not affect subscription rates, but it can affect your cash flow cycle.

3. Itemize cost of goods sold (COGS)

The term “cost of goods sold” includes many different expenses. On any given income statement, there are potentially many different expenses that can be bundled, decreased, or outright eliminated.

Itemizing the broader categories makes it easier to spot potential opportunities. If you have not taken a deep dive into your financials this year, it might be time to take a look.

4. Expand markets

Because your company relies on a subscription model, it can be difficult to sell already existing clients. Rather than working your current network, it might be helpful to look outward in search of new opportunities.

Implementing an international, digital, and multifaceted marketing campaign can help increase exposure and lead to more conversions.

Offering specialized versions of your already existing product (enterprise, platinum, office, student, etc.) can also help increase your reach.

5. Use creative marketing techniques

The more your business can do to increase revenue without significantly increasing COGS, the better your gross margin will be. Many short-term marketing techniques have proven to be effective.

Creating a referral program, expanding your social media presence, implementing a content marketing campaign, and investing in better branding can all deliver real results.

Optimize COGS and Improve Your SaaS Gross Margin the Smarter Way

While there is no way to “automatically” improve your SaaS gross margins, there are certainly several steps you could take to put your enterprise in a much better position.

Your gross margin calculation, after all, is simply a derivative of revenues and the costs of goods sold. Anything you can do to drive revenues up or drive your costs of goods sold down will cause an improvement.

For SaaS companies, cloud costs are a large component of COGS.

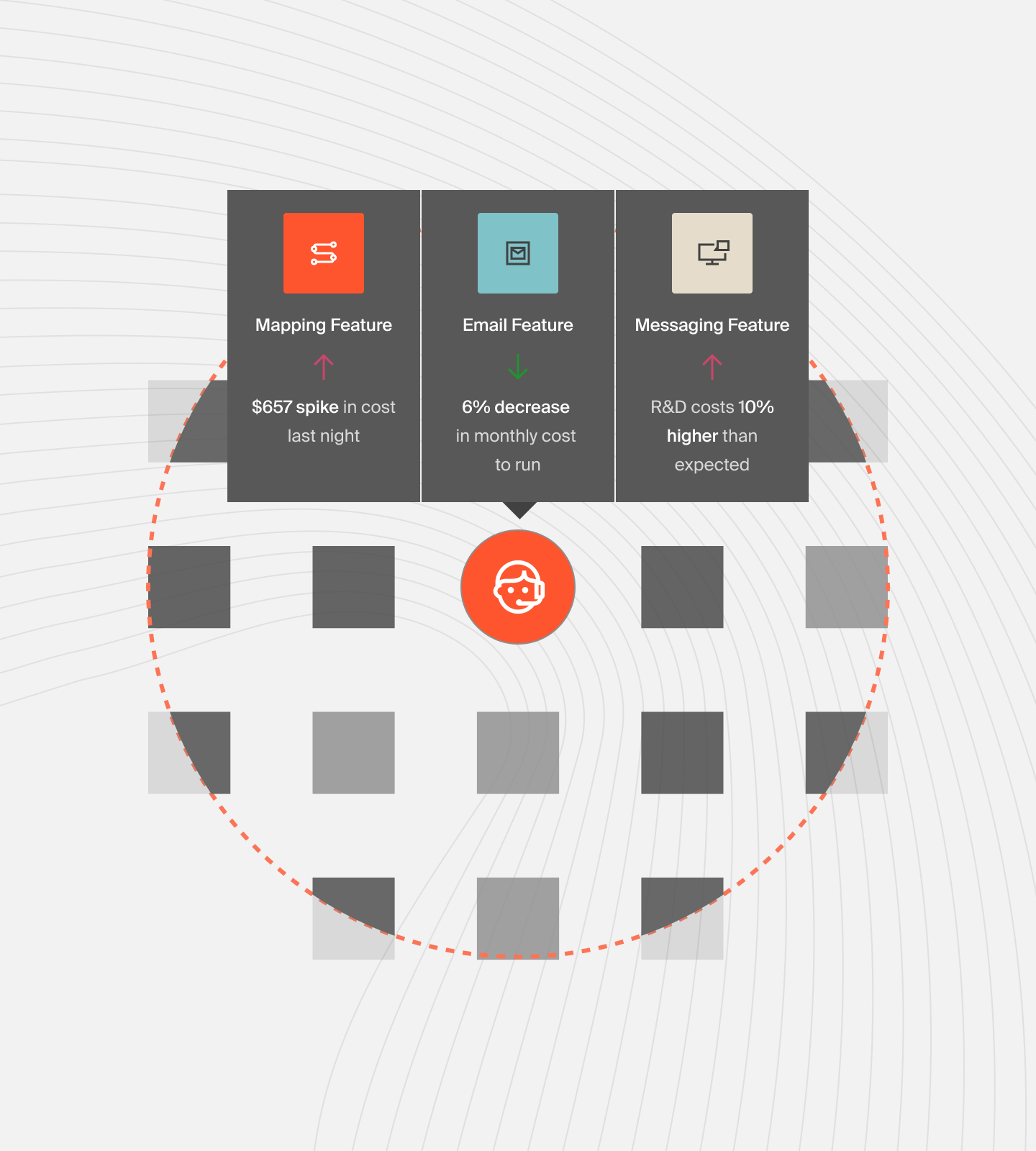

To design architectures that maximize profitability, you will need a strong understanding of how much you spend on specific cloud services and how those costs translate to your business (e.g., how much your features or products drive your cloud costs or how much it costs you to serve specific customers).

Contemporary cloud cost management tools focus on total and average costs, they don’t help you understand your per-unit costs. This is where a robust cloud cost optimization platform like CloudZero can be helpful.

CloudZero’s Cloud Cost Intelligence approach empowers you to:

Get hourly, granular, and immediately actionable insights into your cloud costs, such as Cost per Customer, Cost per Team, Cost per Software Feature, and Cost per Environment.

Having a clear understanding of who, what, and why your cloud costs are changing allows you to optimize usage and avoid overspending (which reduces your SaaS gross margin).

Allocate 100% of your cloud spend in minutes or a few hours no matter how complex your cloud environment is.

By doing this, you can immediately start understanding your cost drivers (COGS) and how they impact revenue generation. Understanding your Cost per Feature, for instance, can help you tell if a feature is profitable or if you should repurpose, refactor, or decommission it to prevent it from eating into your margins.

Use the cost per customer metric to pinpoint your most profitable and most expensive customers.

To maximize your margins, you can then focus more on profitable segments and less on expensive ones. Or, at renewal, you can revise the contracts of your most expensive customers to better reflect the value you deliver (improving your gross margin).

Companies like Remitly, Wise, and MalwareBytes use CloudZero to understand their unit economics, such as Cost per Customer. You can, too.  to see how CloudZero helps you make sense of and improve your SaaS gross margin.

to see how CloudZero helps you make sense of and improve your SaaS gross margin.