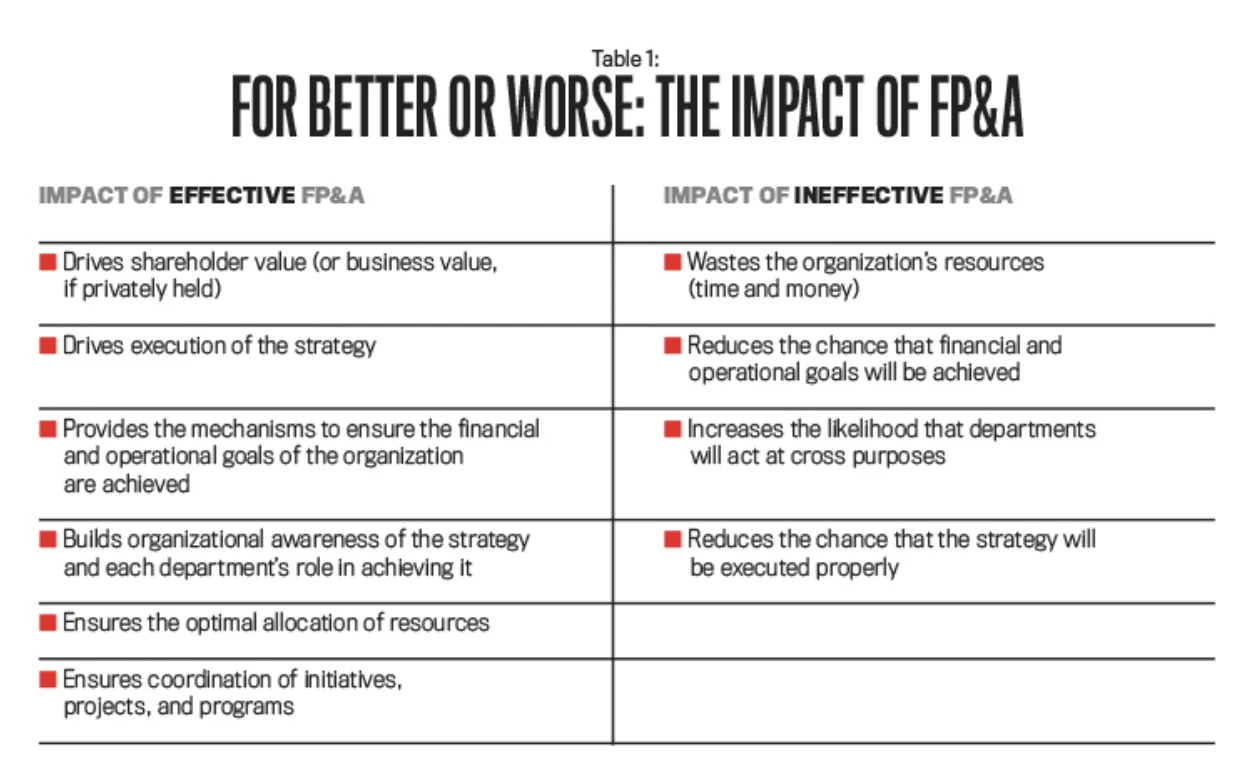

FP&A is a strategic part of the finance organization and has the potential to drive important business outcomes. When done right, it can have a major positive impact on the future of the business. When done poorly, it can slow a company down.

The role of FP&A has evolved. Today it isn’t just about taking inputs and crunching numbers — it’s about being a strategic advisor to the organization. An effective FP&A team should strive to understand the goals of the business, and help drive better decision making across the company, shaping strategy to ensure goals are met.

When done poorly, the FP&A process is put on autopilot, simply “keeping track” of numbers and producing budgets, often for process’ sake.

Strategic Finance Magazine neatly summarizes the differences in outcome in this chart:

Credit: 12 PRINCIPLES OF BEST PRACTICE FP&A, Strategic Finance Magazine

Credit: 12 PRINCIPLES OF BEST PRACTICE FP&A, Strategic Finance Magazine

So how can you make sure you’re driving outcomes for your organization, and not holding it back? Follow the three FP&A best practices outlined below and you’ll know your team is on the right path — the one that can truly have a transformative effect on your company.

A New Era Of Financial Planning And Analysis

In essence, financial planning is about predicting and driving accurate results for your organization. Historically, the FP&A process involves getting your budget, cash flow, P&L, and balance sheet set up, and using them to predict your future performance.

Today, modern finance acts more like an extension of the teams they work with. Instead of retroactively analyzing performance, they work to understand the goals, strategies, and tactics of the team.

Finance needs to be part of the conversation, not just the referee.

What does this concept actually look like? For example, if finance partners with marketing, they should understand everything from the ROI of advertising campaigns to the cost and outcome of trade shows. Similarly, if finance is partnering with engineering, they should understand the ROI of their cloud investment, how headcount can drive innovation, or even how much it costs to patch a bug.

That change in thinking requires a shift in both the mindset of finance, as well as practices and processes.

Shifting To Strategic FP&A: Top Process Improvement Tips

If your organization wants to make financial planning and analysis useful, it is vital that you step back and look at the whole business — and build a FP&A process flow that makes sense for your organization.

There’s no right or wrong. However, there are some ways you can shift finance to be more strategic.

Start with these three tips:

1. Act like the board meeting is always a few days away.

At many companies, a couple weeks out from the board meeting, the FP&A team can be found locked in a room with the CEO crunching numbers and sending Slack messages to stakeholders in different departments to get up-to-date metrics. Then, they weave those metrics into a story they want to tell.

The process is time-consuming and frustrating for everyone involved — not to mention disruptive to day-to day-operations as team members are pulled away from their regular work.

However, what’s even more concerning is the tendency for surprises to occur. A team may report metrics that don’t match what the presenting executives had believed and they’re caught off guard, forced to revisit their story altogether.

How can you avoid this scenario? Pretend the board meeting is always a few days away.

Instead of scrambling to pull together key metrics and information on a monthly or quarterly basis, figure out how to gain a continuous understanding of your business partners’ financials and KPIs. Consider this information a living, breathing asset that changes as your organization evolves.

Start by ensuring you have access to any relevant dashboards and reports that your business partners use to track metrics. For example, if you work with engineering, you’ll want to get access to tools like Jira. Similarly, for go-to-market teams, you’ll want to keep an eye on certain dashboards in tools like Salesforce.

Then, set up regular check-ins to meet with your business partners and understand their spend, along with their business strategy and results. Ask questions about why they are investing time and spend in certain areas, along with what they hope to get out of it.

When it comes time for a board meeting, not only will you be prepared to quickly pull together the required data but you’ll also be able to arm your executives with a compelling, accurate story to explain the numbers.

This mentality also has benefits far beyond the board room. A continuous understanding of the metrics and the “why” behind them helps FP&A professionals make better decisions with business context, which ultimately helps them better serve their business partners.

2. Serve as a trusted advisor to your business partners.

Many finance professionals feel like they’re constantly taking inputs, buried in work that requires calculations and reporting. But the most strategic finance people spend equally as much time (if not more time) providing recommendations back to their business partners.

To start acting as a strategic business partner, the first step is to stop thinking only about what everything costs and instead focus on how to drive value.

For example, instead of simply tracking the cost of a trade show for your marketing team, take the time to understand the KPIs they hope to impact with that spend. Is the goal to impact the existing pipeline? Drive new leads? Or just build brand awareness? Depending on the answer, you could drive revenue generated, average cost per lead, cost per impression, or something else.

Once you understand the metrics you’re hoping to impact, you can spend time analyzing the different events that marketing runs and how different amounts of spend drove different results. When it comes time to choose next year’s trade shows, you can arm your marketing team with essential data that informs decisions about which shows to sponsor, how they can set realistic goals, and whether or not their budget is appropriate to hit revenue targets.

Ultimately, you’ll be working with your business partners to work toward a single goal: driving business value and profit.

If you’re succeeding, you might notice your business partners will proactively seek you out for advice. Instead of just chasing them down for metrics, you’ll have meaningful conversations about how to make better decisions for your business.

3. Create a shared language and set of metrics to expedite FP&A processes.

Standardizing data across an entire organization is difficult to accomplish — and a lack of standardized data can create confusion and inefficiency. However, finance can help all departments create a standardized approach, which saves time for everyone.

Technology can be a great asset to your organization when used correctly, and there are many finance tools available to help automate manual processes and improve accuracy. However, standardizing reporting goes far beyond how you report, and should also focus on what you’re reporting.

It’s important to create a shared language and set of metrics to communicate with finance and business stakeholders.

For instance, if you’re partnering with engineering, they likely spend their day thinking about the best way to build products and solve problems, rather than business ROI.

You may need to work with your engineering team to help them understand how they can translate their work into terms that make sense for the rest of the business. For example, instead of “production environment costs” they should think in terms of “cost of goods sold.”

Similarly, they are likely tracking engineering velocity using a tool like JIRA. You can help them understand how to track unit economics and answer questions like “How much are we investing per story point?” or “How does our cloud cost change per customer onboarded?”

By putting cost metrics into a business context, you can better translate finance information from your partners back to the business.

Gain Continuous Insight Into Cloud Cost With CloudZero

Financial planning and analysis is a critical part of your cloud organization’s success. However, if you don’t have the story behind the numbers, your financial planning may not be driving the growth you need.

When it comes to having more visibility specifically into your cloud costs, you can not only gain more insight into the financials, but also get insight into relevant SaaS metrics that matter to the different departments in your organization with CloudZero.  to see it in action.

to see it in action.