Finding trained financial planning and analysis (FP&A) professionals isn’t too much trouble for most companies. The tricky part is finding a candidate with the right technical and soft skills for your organization’s needs.

The following interview questions will help you find a qualified FP&A professional for your company. Listen to their responses to gauge their reasoning, expertise, situational awareness, ambition, and individual attitude toward various aspects of the FP&A profession.

As a candidate looking for solid FP&A questions and answers, this guide will increase your understanding of the questions you’re likely to be asked, the reasoning behind the questions, and how to position yourself as a competent FP&A expert.

Introductory FP&A Interview Questions

This type of question helps candidates and interviewers break the ice and ease them into the interaction. Begin by asking the candidate why they chose financial planning and analysis as a career, and then move on to these more revealing inquiries.

1. In your experience, what makes an exemplary FP&A professional for a company like ours?

You want to hear the candidate’s perception of how a financial planner or analyst should contribute to the team or organization.

Exceptional candidates will briefly describe their technical and soft skills that align with your company’s FP&A needs. Depending on their responses, you’ll know if they’ve done their homework on your company and what they could offer if you onboard them.

2. Would you describe a typical day for an FP&A specialist in a financial planning and analysis team?

As with any job, the actual duties vary from one organization to another, as does the role they will play within your FP&A team. This question seeks a description of their perceived day-to-day contribution to their team.

Their answer will demonstrate their knowledge of the job. Exceptional candidates will also ask questions about the current role so they can offer specific examples.

3. Can you share what you’ve learned about the defining characteristics of a reliable FP&A financial model?

This question is a great way to listen for technical details and how well the candidate can communicate their thoughts.

Something else.

Interview candidates for lower-level positions will describe operational elements, including how they create robust financial projections, perform regression analysis, and present these projections. Senior hires will go deeper with their reports, compiling a more thorough analysis.

4. Walk us through the possibility of a company having a positive cash flow while still in serious financial trouble. How can this happen?

In this case, the answer is yes, it can happen. Yet, good candidates will discuss the importance of analyzing where the cash is coming from and where it is going — rather than just reiterating cash flow statements.

Exceptional candidates will give examples, such as how a company that sells off inventory but delays payables generates positive cash flow even when struggling.

Technical Interview Questions To Ask FP&A Candidates

This section includes questions intended to test a candidate’s technical ability in FP&A. You are welcome to ask for examples. It would also be helpful if you clarified or provided example scenarios to candidates so they could offer more practical answers.

5. Can you talk briefly about cloud economics as they relate to a company like ours?

Cloud financial management differs from traditional finance in several ways. SaaS brands typically use cloud economics to purchase, manage, and optimize resources in a highly dynamic cloud environment.

Your candidates need to understand how to work with the operating expenditure (OPEX) vs capital expenditure (CAPEX) models, cost allocation, and forecasting in the cloud, as well as accurately calculating Total Cost of Ownership (TCO) in the cloud to help maximize your return on investment.

6. Can you explain ratio analysis to me?

Financial analysts often use the Ratio Analysis approach when analyzing financial statements to gain greater insight into a company’s holistic equity analysis.

Analyzing different ratios helps them measure liquidity, profitability, solvency status, and operational efficiency. A good answer will also explain how combining these ratio findings with other financial statements gives a reliable picture of the organization’s financial health.

7. How is Cash Flow different from Free Cash Flow (FCF)?

The Free Cash Flow (FCF) metric measures a business’s present value to investors by calculating the cash left over after paying operating expenses and capital expenditures. Cash flow, on the other hand, refers to the cash coming in and going out of the business.

A good answer here will elaborate briefly on how FCF defines a business’s valuation, its relation to Net Working Capital, and what positive and negative cash flow mean for a company.

8. Budgeting. Forecasting. Cost allocation. Could you please take us through the differences between all three?

While budgeting involves planning the costs and revenues a company aims to achieve within a specific period, financial forecasting involves projecting how the budget will be met.

Cost allocation involves aggregating and assigning costs to the people, products, and processes that generate them (chargebacks and showbacks).

An experienced FP&A professional will explain the relationship these three have and their particularly crucial yet challenging role in cloud financial management (if you run a SaaS or IT organization).

9. How would you rate Excel as an FP&A tool, and what makes for a good Excel model?

Excel macros are a staple of FP&A work. In addition to their go-to FP&A tools, experienced candidates will have an intermediate to advanced proficiency in financial modeling using Excel. More importantly, the best candidates will describe how they can or have used Excel to uncover growth opportunities and explain financial performance.

Better yet, ask each interviewee to compare Excel to other FP&A solutions such as Vena, CloudZero, Cube, and Anaplan.

10. What three things would keep you up at night as our company’s CFO or lead FP&A professional right now?

Step back and listen as your potential hire gives a high-level overview of your company’s financial status. They may also compare your performance to other companies in the same industry.

You may need to provide some data to help them along, or they may have already done the background research in advance (these are the best candidates, depending on the role they are interviewing for).

Pay close attention to what they think about your income statement (margins, profitability, and growth), balance sheet (liquidity, liquidity ratios, credit metrics, capital assets, etc.), and cash flow statement (long and short-term cash flow profile if you need to raise funds or return capital to shareholders).

11. What factors are you constantly analyzing as a financial analyst?

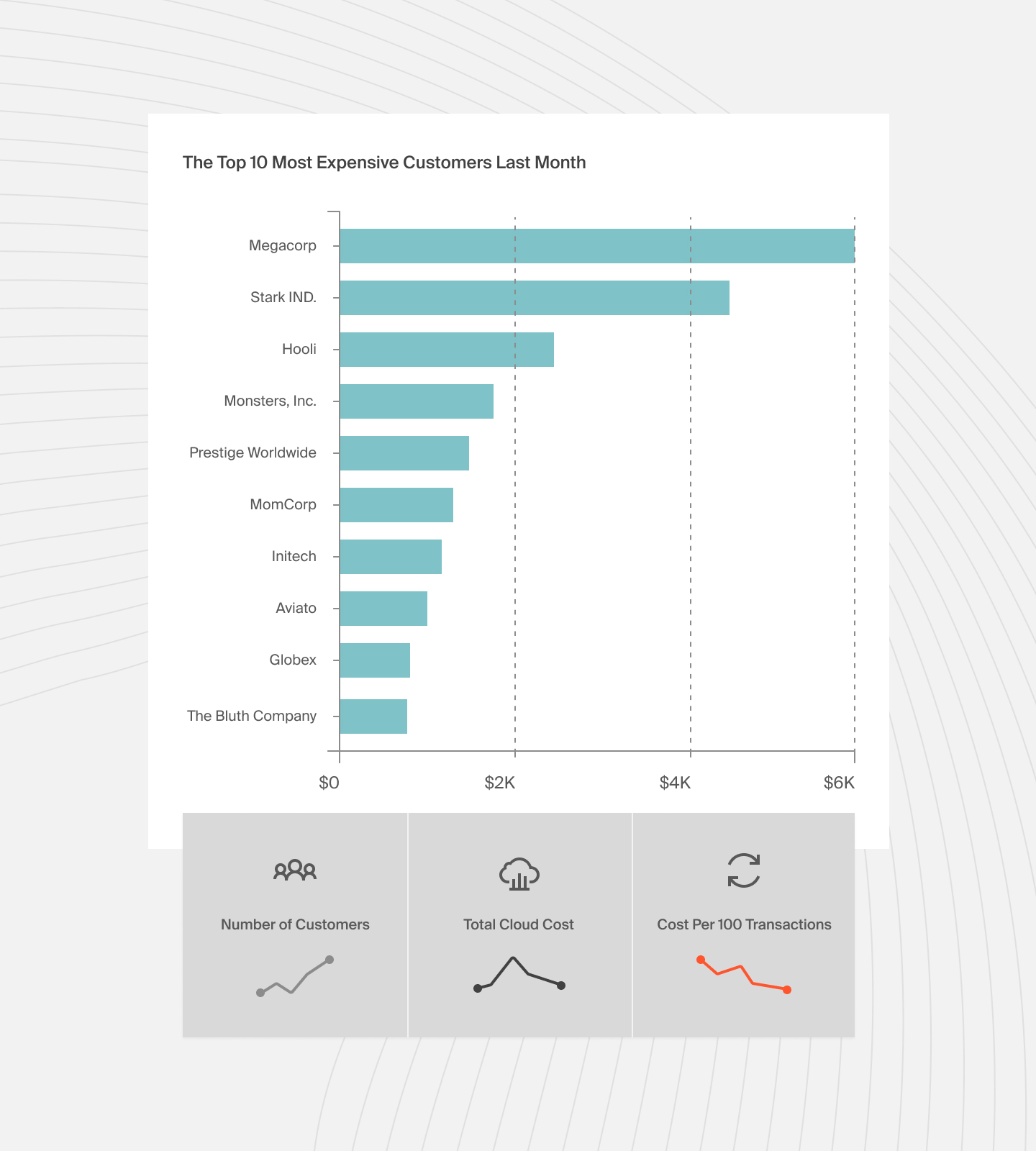

Here, you are probing what FP&A metrics the candidate prioritizes in their day-to-day or previous roles. Their answer can also help you assess their knowledge depth and favorite FP&A best practices.

The metrics will mirror the type of businesses or roles they’ve previously held. Some key ones to pay attention to include risk exposure, working capital impact, and unit costs, such as cost per customer, product, or customer segment in relation to profit margins.

12. Tell us about your favorite Financial Planning and Analysis tools. Can you tell me what makes each unique and why that matters to you?

FP&A tools enable financial analysts to source, analyze, model, and report on data from various sources. You can expect to hear different tools from different applicants — perhaps even different from what you expected.

If they are familiar with several systems, getting up to speed with yours or proposing a different one altogether won’t be too challenging.

13. How do you present complex financial information to non-financial stakeholders?

There is a lot of modeling and presentation involved in FP&A work. You want a professional who can effectively communicate the company’s financial picture to stakeholders – even those with little financial background.

Pay attention to where and how the candidate sources data, which details they prioritize for presentation, and whether or not they clearly communicate their findings.

14. How do you formulate a financial plan for a proposed product or service?

This is one of the most FP&A interview questions out there, and for good reason. A financial analyst’s job is to leverage data to advise your company and suggest feasible investments, complete with revenue and cost projections.

The best answer will elaborate on the process he or she uses to arrive at key insights needed to make relevant and actionable recommendations.

15. What’s your approach to setting the price of a SaaS product or service, including what type of pricing tiers to develop?

Pricing your SaaS product differs slightly from pricing products and services that don’t require ongoing subscriptions. A great response here will explain how to measure various SaaS costs, such as the cost of goods sold (COGS).

Then, the candidate will correlate those figures with designing profitable pricing that protects margins without driving customers to cheaper alternatives.

For example, Drift, MalwareBytes, and Remitly use CloudZero to measure their unit costs, including cost per customer, feature, project, and team, as well as other granular, actionable information.

By knowing how much they spend to support a particular customer, for example, they can dynamically adjust their pricing every billing cycle to protect their margins.  to learn how CloudZero can help you set competitive pricing.

to learn how CloudZero can help you set competitive pricing.

16. Tell us about how you modeled revenue for a company similar to ours.

This question is often asked during FP&A interviews to gauge the candidate’s understanding of revenue projection methods. The three common ways are:

- Bottom-up: It begins with specific products or services, estimates the average price or fee per product or service, and then discusses growth rates.

- Top-down: This method starts by assessing a market’s overall size, determining a company’s market share, and converting that estimate to revenue.

- Year-over-year: This approach involves comparing revenue from the prior year to the current year and comparing the percentage changes.

Solid responses will highlight this and other ways to model financial insights and how the applicants have used them in previous roles.

17. Can you explain the significance of NPV for a SaaS company like ours?

In finance, the Net Present Value (NPV) metric measures the difference between the present value of cash inflows and cash outflows. Finance professionals use NPV in capital budgeting to determine whether an investment or project will be profitable.

Listen as your potential new hire explains how they’d develop and use this KPI in your SaaS environment.

FP&A Interview Questions To Identify Soft Skills And Behavioral Intelligence

You can assess a candidate’s operational and situational skills by asking the following interview questions.

18. Describe a situation when you had to share financial reports with your CFO and the board on short notice. How did you meet the deadline with accurate financial data?

FP&A teams usually have competing deadlines for different financial reports depending on the size and type of company they work for.

Answers from top financial analysts will demonstrate how they proactively organize themselves to ensure they can deliver data-driven financial insights if a board meeting is convened the following day.

19. In your experience, what is the most challenging part of practicing FP&A for a SaaS company?

A competent financial planner has encountered and expects to face various challenges in their work, including inconsistent models.

Best answers should elaborate on several FP&A challenges they’ve faced in their previous roles and explain how they solved them.

Candidates who are well prepared to work with your team will also mention one or more challenges they expect to encounter working for your company in the specific role they are applying for.

20. Can you talk briefly about a time your financial analysis insights saved your company from an ugly situation?

Indispensible professionals know the value they bring to the team. With this question, you want to hear about a real-life situation where a candidate’s contribution directly led to an actual financial gain.

If they can discuss more than one situation, that’s even better because it illustrates consistent high-value contribution. You’ll also want to know if they came up with and implemented the idea on their own or with a team so you can gauge how much they value other people’s input.

21. Tell us about a time you encountered inconsistencies in a company’s finances. How did you find out, and what did you do next?

Inconsistencies in financial planning data can be costly if not caught early. A good answer here will describe the inconsistency they encountered as openly and clearly as possible.

A smart interviewee will also refrain from blaming others and instead highlight their steps to report and resolve the problem.

You want your new hires to be able to go back and countercheck their work and that of colleagues to minimize the risks that come from avoidable mistakes.

22. What would you say is your greatest strength as a Financial Planner and Analyst?

The purpose of this question is to probe self-awareness. Good responses will be humble yet demonstrate how the candidate has contributed significantly in previous roles, including during internships (if they’re just starting their career).

Those strengths include delivering timely reports, collaborating well with others, catching inconsistencies, and resolving conflicts between team members.

The best answers will use examples of times this professional trait has been helpful both to their financial planning career and the organization they were with.

23. What can you say was your most successful project? Walk us through what it was and why.

Listen to what your potential hire thinks success looks like in financial planning and analysis work. Ensure you pay attention to the process, KPIs, and results they measured to determine whether the project was successful.

The best answers will describe a project that used skills relevant to the role they are interviewing for now. This emphasizes they are the best fit for the job.

24. Share with me an instance where you disagreed with your team lead or other leaders. What was the issue, and how did you solve it?

Team members are bound to disagree ideologically, personally, and in other ways. A genuine response will explain the issue and why it became a problem, even if it was their fault.

Did the candidate solve the problem alone or with the rest of the team? Was it a clash of personalities or ideologies? Has the issue been resolved, or has someone had to leave?

You want to hire an FP&A professional who cares enough about your business to resolve team disagreements.

25. How do you explain technical, financial planning, and analysis concepts, models, and reports to clients who aren’t necessarily FP&A specialists?

This is a crucial FP&A interview question because it tests a candidate’s ability to present financial reports in a way that is accessible to all stakeholders, regardless of their background.

A stellar response will demonstrate both technical and communication expertise. It will describe how the candidate plans, analyzes, and presents various levels of detail to multiple stakeholders.

This kind of financial planner has a good understanding of what insights each party needs to make decisions.

26. Have you worked on a failed FP&A project or a flawed financial model or forecast?

Here, the interviewee should explain how they discovered the issue, alerted the rest of the team, and the action they took to resolve it.

Pay close attention to what they learned from the failure and whether they discuss how they could have done things differently from the start to prevent it.

Remember, mistakes will be made from time to time. But a reliable financial analyst should be able to learn from his or her mistakes, or a colleague’s, to avoid repeating them in the future.

27. Tell us about when you had to handle massive amounts of cloud financial data. How did you avoid overwhelm and ensure accuracy?

FP&A work can be overwhelming because it requires aggregating, normalizing, and analyzing massive volumes of data and choosing from or employing several financial modeling methods. You must decide what to measure, when, and how.

Thus, the best candidates will describe their process, prioritization criteria, analysis tools, team structure, and other details they use to deliver accurate, timely, and relevant insights consistently.

28. What do you intend to do within the next 90 days if we hire you right now?

This is an opportunity to hear if a candidate is prepared for the job. Strong responses will talk about the most urgent challenges they see your company facing. The best candidates for the job will have one or more suggestions.

Alternatively, you can suggest some hypothetical challenges you might have and ask potential hires how they would approach them in the coming weeks.

General FP&A Interview Questions To Ask Candidates

Use these questions to conclude the interview and better understand the potential hire’s expectations.

29. Is the stock market something you follow? Which stocks exactly?

This question can help you determine a candidate’s degree of interest in their financial career and knowledge of industry trends.

In addition, a good answer will describe how they evaluate an organization’s value on the stock market, as well as how FP&A work impacts a company’s valuation, its ability to raise funds for growth, and the specific metrics investors look for to determine whether an organization is financially healthy.

30. What are your pay expectations?

The purpose of this straightforward question is to assess a candidate’s perception of the value they bring to the organization, their awareness of the market rate for the specific role, and how much they are happy to accept as compensation for their efforts.

Also, with salary transparency becoming more popular, be open to giving a range so the candidate can decide if they are able and willing to join you.

What Next: Transform Your FP&A Team Into Cloud Cost Optimization Experts

The economics of cloud computing differ from traditional finance, including budgeting, forecasting, and cost allocation.

Cloud resources are available on demand. Costs are driven by the amount of resources your usage consumes. So, a single overzealous engineering session may result in a massive bill at the end of the month. It may take only a few such sessions to wipe out your cloud budget and turn your annual forecast on its head.

To prevent this and protect your margins, you’ll want to dynamically control your cloud costs by:

- Enabling your engineers to understand the financial impact of their technical decisions. This cost awareness will encourage them to balance delivering cost-effective solutions with releasing powerful features.

- Accurately identifying the people, processes, and products contributing to your costs. Think: COGS, cost per customer, cost per product feature, cost per development team, cost per project, and more. Chargebacks and showbacks will be more accurate with this level of detail. You can easily estimate how much it will cost to onboard a certain number of customers. You’ll also be able to calculate how much to charge specific customers or for a particular service or software feature to be profitable.

- Analyzing your AWS, Google Cloud, Kubernetes, and Azure costs together, along with cost data from Databricks, MongoBD, Snowflake, and New Relic. Having a complete view of your costs simplifies analyses and prevents surprises.

With CloudZero, you can achieve all of this and more. Additionally, we’ll notify you whenever we automatically detect abnormal costs or when you’re approaching your pre-set cost limit.

to see how CloudZero can transform your financial planning processes.

to see how CloudZero can transform your financial planning processes.