We’ve covered the fundamentals of FinOps in several guides on this blog, including FinOps 101, the FinOps maturity journey (as outlined by the FinOps Foundation), and more.

But if you need a quick refresher, no worries. We’ve linked key guides on what FinOps is, why it matters, and how to make it work for you in “Related reads” in the next section.

For today’s guide, we’ll dive into FinOps as a Service (FaaS) — not to be confused with Function as a Service (FaaS), the serverless computing model.

What Is Finops As A Service?

FinOps as a Service refers to outsourcing the management of cloud financial operations to specialized providers. These FinOps professionals can help you implement FinOps best practices without waiting years to master them yourself.

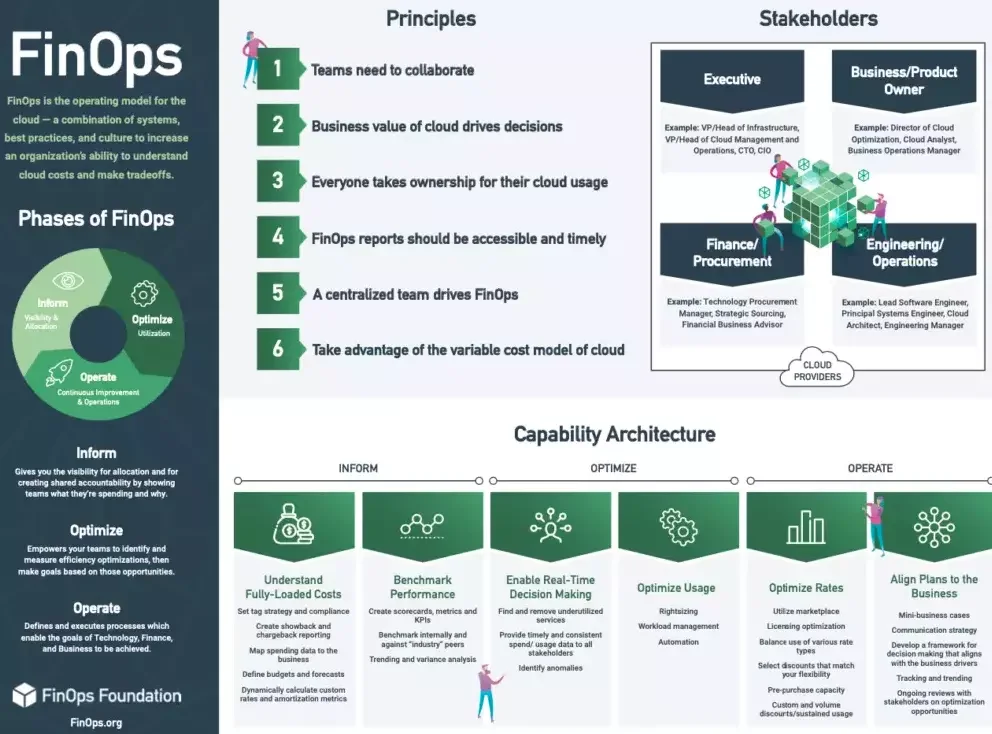

Remember, FinOps, short for Financial Operations, is a framework that promotes collaboration between finance, engineering, and business teams to optimize cloud spending while maximizing value.

It emphasizes financial accountability, cost control, and data-driven decision-making in cloud environments.

The ultimate goal of a good FinOps strategy is not just to reduce unnecessary cloud costs but to increase your cloud ROI without hurting engineering velocity, user experiences, or continuous growth.

Related reads:

FinOps 101: An Intro To The Basics Of FinOps

What Is FinOps And How To Do It Right: A Quick Guide

How Our FinOps Account Management Team Helps You Achieve Your Cloud Savings Goals

But why would you want third-party teams to help drive your FinOps strategy for you? Why not just do it yourself internally?

Understanding The Core Components Of FinOps As A Service

The core components of FinOps as a Service are built around the FinOps principles and lifecycle. Consider this:

Image: FinOps Foundation

These FaaS components include:

- Visibility and reporting. This is about gaining real-time insights into your cloud usage and costs with detailed reporting tools. The goal is to ensure full transparency across teams and tie your spending to business objectives.

- FinOps lifecycle management. FinOps follows a continuous improvement cycle:

- Inform: Gain visibility into cloud costs.

- Optimize: Identify and implement cost-saving strategies.

- Operate: Continuously monitor and refine your cloud spending patterns.

- Accountability and governance. Establish clear ownership of cloud costs by assigning budgets and responsibilities to specific teams.

- Optimization. Here, you identify cost-saving opportunities using techniques like rightsizing resources, leveraging discounts (e.g., Reserved Instances), and automating scaling or shutdown of unused resources.

- Collaboration. Nurture cross-functional teamwork between finance, engineering, and business units to align cloud spending with organizational goals.

- Centralized management. A dedicated team or service provider oversees governance, cost allocation, and purchasing strategies to ensure efficiency and consistency across your organization.

Together, these components can empower your FinOps implementation to get the most value from your cloud investment.

Why Consider A FinOps As A Service Provider?

To understand the benefits of using a FinOps as a Service company, it is essential to understand what a FinOps service provides.

Help you embrace and start implementing your FinOps journey where you are

Picture this:

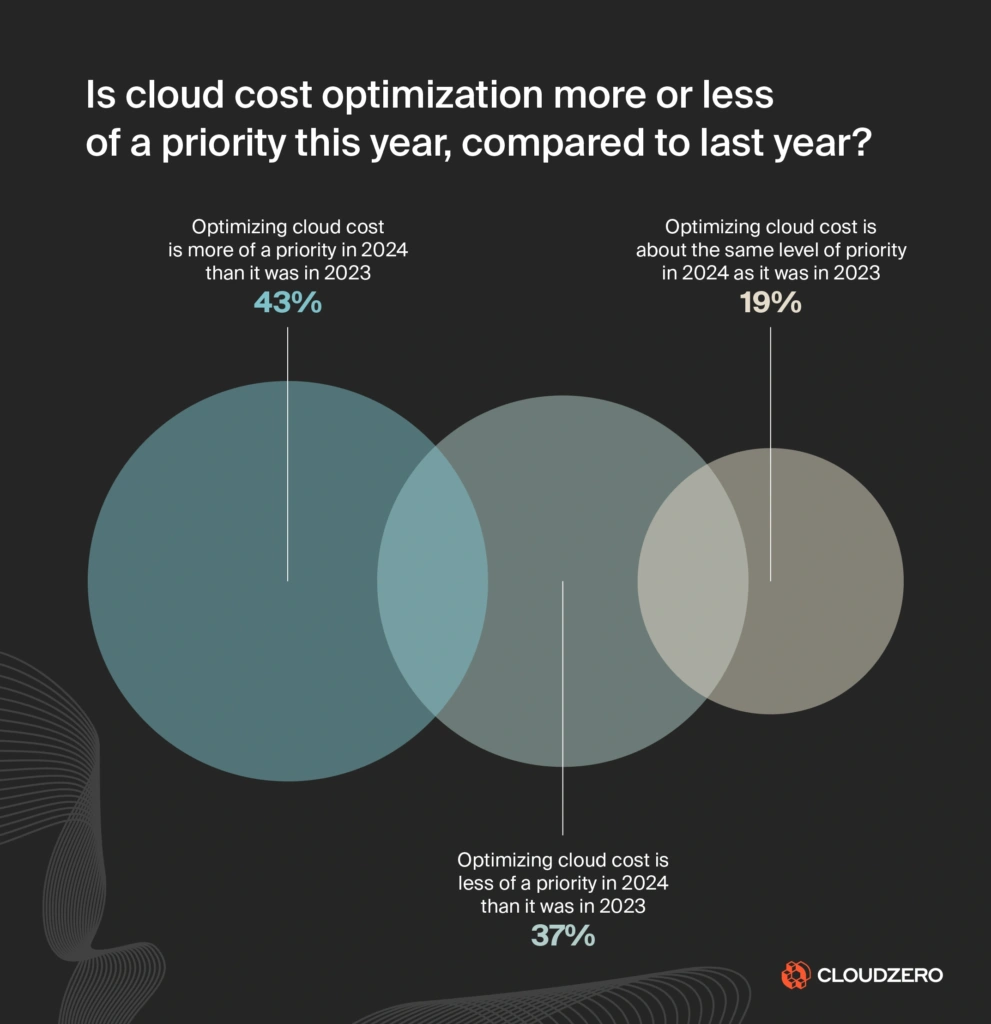

Nearly half of the respondents in our State of Cloud Cost Report said that optimizing cloud costs is now a bigger priority than in previous years.

Here’s the thing. We also know how challenging it can be for organizations to plan, launch, and refine a FinOps strategy. Too often, plans stay just that — plans — for years.

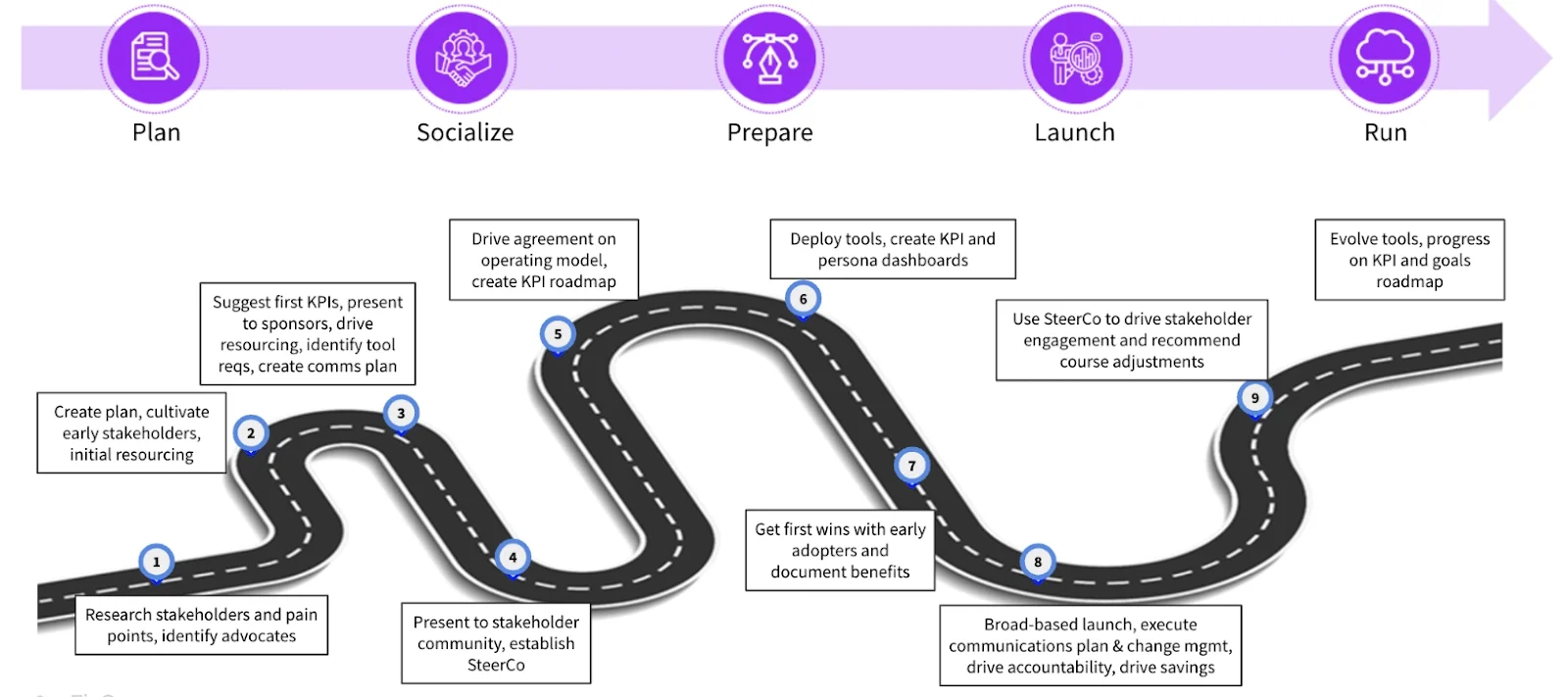

Image: Accenture

That’s where a trusted FinOps as a Service (FaaS) provider makes a difference. With expert guidance, you set timelines, define milestones, and take action, just in time to protect your bottom line, boost profitability, and increase your market valuation.

Of course, these are just a few goals you can work toward with your FinOps consultants. You can further tailor the strategy to include additional unique needs.

Unbiased cloud financial operations expertise

Cutting cloud costs isn’t always straightforward. Some expenses may seem essential when they’re not, or the timing might not be right.

Take overprovisioning, for example. In traditional engineering, teams often allocate extra computing power to safeguard against unexpected traffic spikes or workload surges. But in the cloud, you don’t have to overprovision.

Instead, you can leverage auto-scaling. This function dynamically adjusts resources, scaling up during peak demand and down during off-peak times. This ensures optimal performance while keeping your cloud costs under control.

Create and help manage your cloud FinOps strategy

The FinOps maturity journey follows three key phases: Crawl, Walk, Run. A great FinOps service provider helps determine where you stand in this journey. And, more importantly, how to move forward.

Want instant clarity on where your organization stands in its FinOps maturity journey? Take the FinOps Maturity Assessment Now.

More importantly, they identify roadblocks slowing you down, unique opportunities you can tap into, and strategies to enhance your cloud financial management.

But it doesn’t stop there. A strong FinOps partner ensures you don’t settle too soon. This way, you won’t leave significant savings untapped just because you’ve seen some initial wins.

Take CloudZero, for example. Our team recently uncovered $1.7 million in annualized savings. Instead of stopping there, the success fueled the drive to find even more savings — without compromising innovation, experimentation, or customer experience.

Fast-track collaboration between finance and engineering

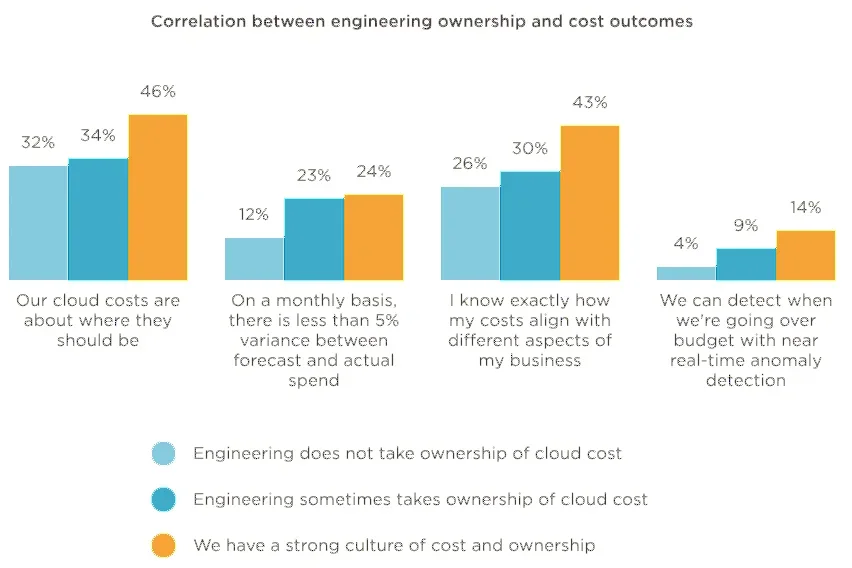

There’s always been tension between engineering and finance, and our previous report on FinOps statistics captured this dynamic perfectly.

Finance teams often feel that engineering isn’t cost-aware or doing enough to optimize spending. Meanwhile, engineers are focused on delivering top-tier features, performance, and innovation — sometimes at a higher cost than planned.

A strong FinOps service helps bridge this gap, bringing the “Fin” and “Ops” sides of your organization together.

Your FinOps provider acts as a liaison, helping you define practical trade-offs based on experience.

They guide your teams in breaking down silos, establishing repeatable workflows, creating best-practice checklists, and fostering a culture of continuous cost optimization — without the usual conflicts.

Related read: How FinOps Can Work With Engineering To Achieve Cost Intelligence Maturity

Foster continuous cost awareness without sacrificing innovation

Like most of us, you’ve probably started something great, only to let previous bad habits creep in over time. The problem? It slows progress, sets you back, and frustrates your team as delayed results chip away at morale.

But with the right FinOps experts guiding you, you can build and sustain a culture of financial accountability and cost-efficiency.

For example, a key focus of the CloudZero FinOps platform is helping customers pinpoint who and what is changing their cloud costs and why.

To support this, CloudZero is the first platform to deliver precise unit cost insights — including cost per customer, cost per feature, and cost per team — with superior accuracy.

Consider this:

Heck, you can zoom into even more granular cost intel, such as cost per deployment, cost per request, and cost per pod for engineers.

Once set up, you’ll have continuous visibility into the people, products, and processes driving your cloud costs.

You’ll also be able to distinguish between cost increases due to growth and unnecessary overspending. Then, you can take action to stop waste and protect your margins.

Overcome FinOps integration challenges

Another FinOps challenge you can overcome with expert guidance is setting up, configuring, and optimizing the right tools, processes, and best practices.

Not just any stack, but the kind tailored to your cloud environment, existing tech stack, and business goals.

With insider expertise, you’ll gain a clear comparison of leading FinOps tools and solutions. You can also get valuable insights on common mistakes to avoid.

This can give you an edge over competitors who are trying to navigate FinOps on their own.

Mitigate the risk of over-reliance

Ongoing consultation can be incredibly valuable, especially when navigating big changes.

Whether you’re refining your cloud strategy, forming a new partnership, acquiring a company, or onboarding new team members, having certified FinOps practitioners guide you can make all the difference.

For example, some of our FinOps as a Service customers opted for ongoing consultation.

And it has paid off.

In just three months, they uncovered enough savings to cover their annual subscription — and within the first year, they averaged 22% in cost savings.

That said, you don’t want to become overly dependent on a FinOps partner.

The key is to work with a provider that empowers your team. The FinOps as a Service company can help you build in-house expertise while remaining available to keep your team on track and drive profitability.

Traditional Cost Management Vs. FinOps As A Service

The biggest difference between traditional cost management and a FinOps partnership is simple but not always easy.

Conventional cost management focuses on average costs rather than precise cost reporting. Also, it typically involves cutting costs at all costs and waiting weeks to analyze your cost drivers.

In contrast, FinOps as a Service takes a proactive, data-driven approach. It helps you:

- Zoom in on your cost drivers to know exactly where your cloud budget is going. Then you can tell what to do next to cut waste and maximize your cloud ROI.

- Focus on smart optimization, not just cutting costs. FinOps best practices pinpoint areas for improvement without compromising innovation, user experience, or growth.

- Get real-time cost allocation to capture, analyze, and understand spending patterns in minutes or hours — not weeks.

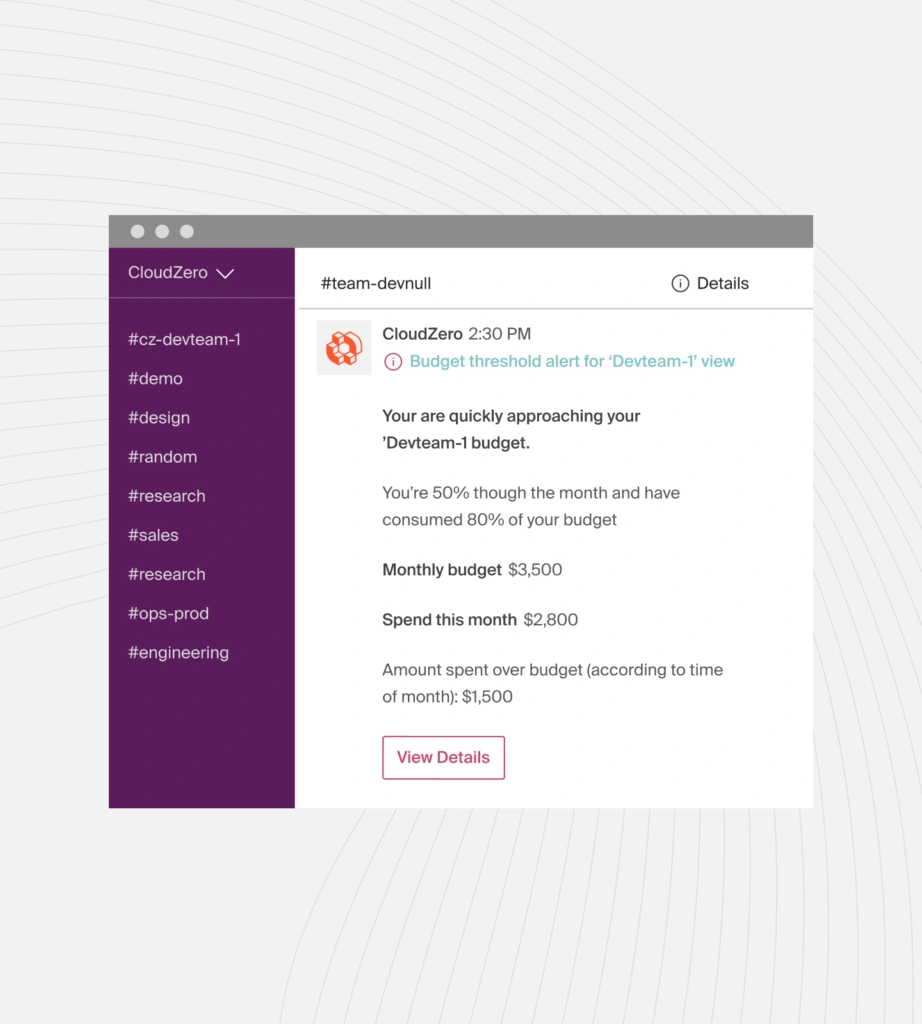

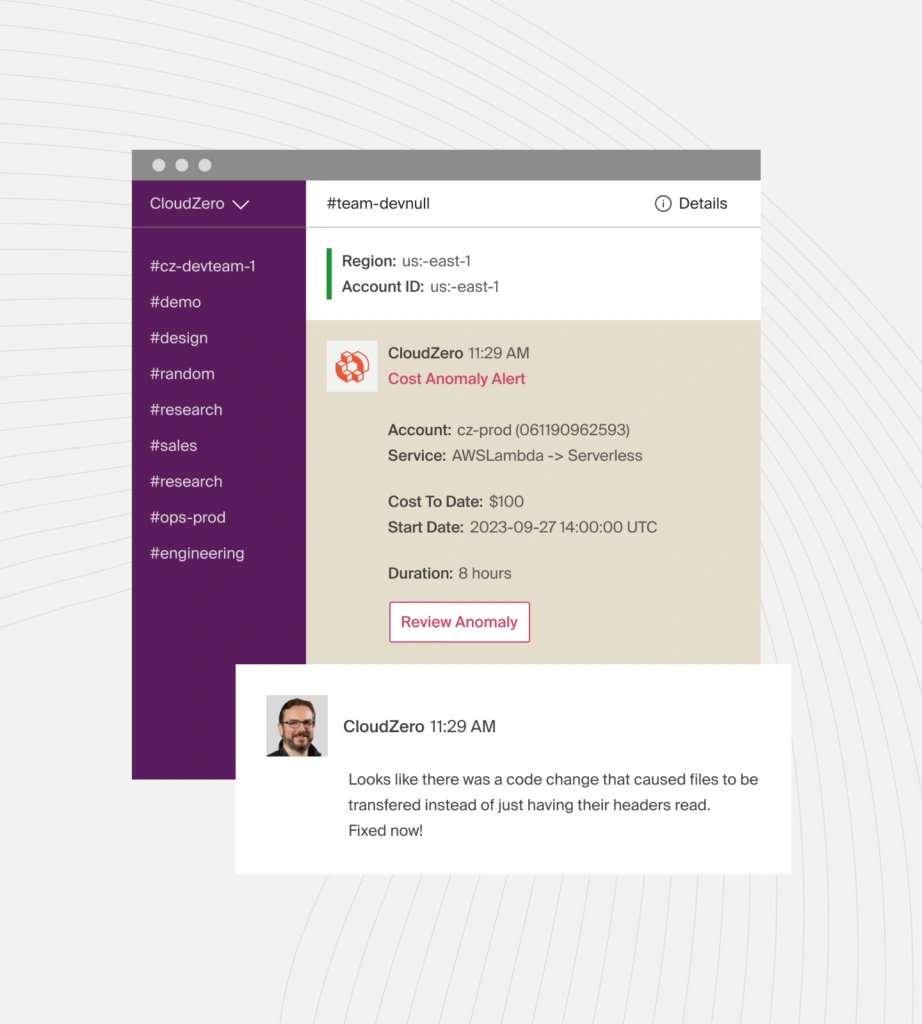

For example, CloudZero’s real-time cost allocation combined with hourly reports helps you detect cost anomalies within an hour or so so that you can protect your margins faster — instead of waiting a month for the several-thousand-page-long Azure or AWS cost and usage report.

And with built-in cost anomaly detection, you can rest easy knowing you’re not silently bleeding money.

Looking for examples of FinOps as a Service providers? Check out our guide here. But if you’re looking for specifics, here’s what you can expect from a CloudZero FinOps as a Service partnership.

CloudZero Simplifies Your FinOps Implementation Without The Usual Endless Hassle

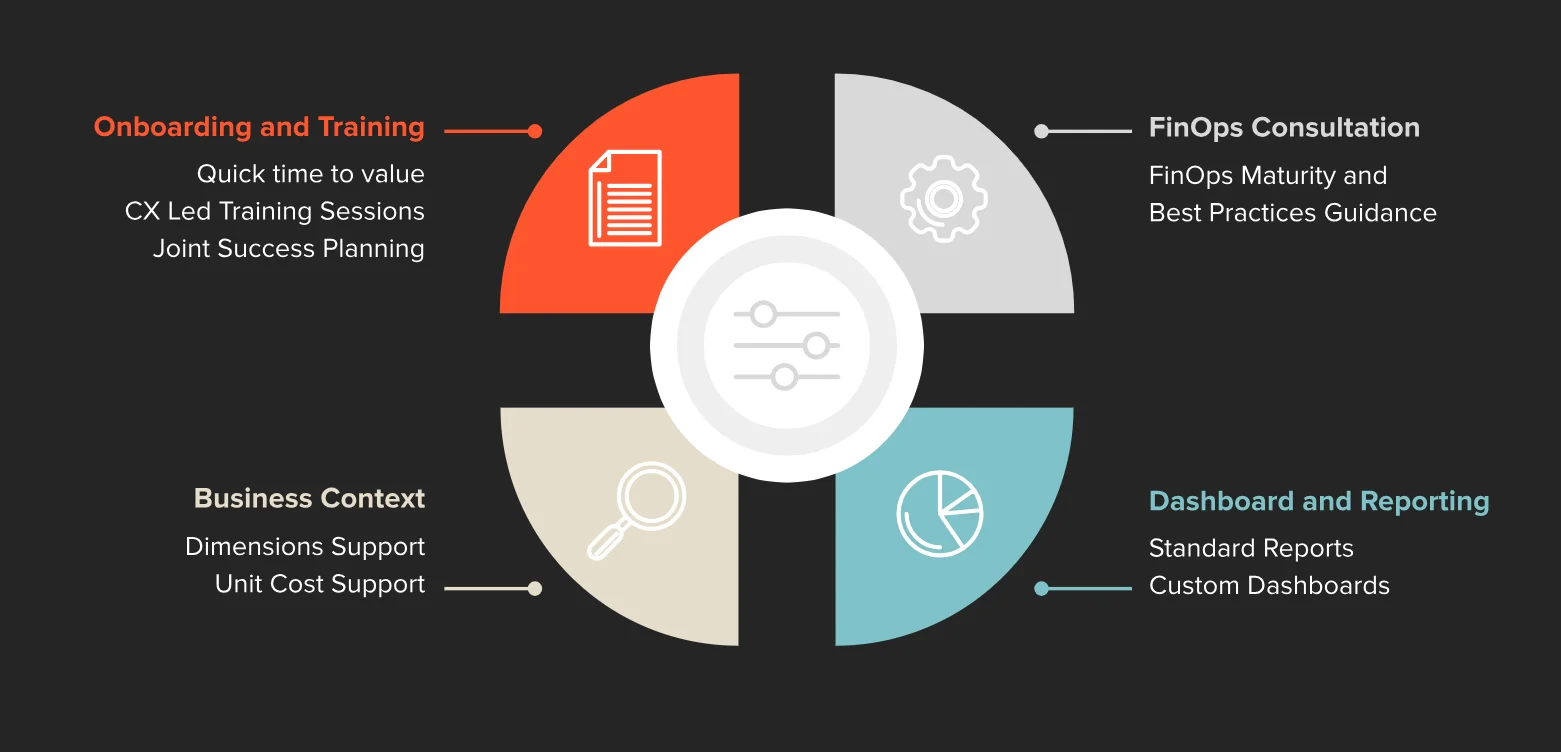

With the CloudZero team of Certified FinOps Practitioners, you’ll never walk alone. Instead, you’ll get:

- Strategy sessions: We’ll kick things off with stakeholder meetings to define your long-term goals and “North Star” and align cost optimization efforts with your business priorities.

- Joint success plan: Together, we’ll develop a customized success plan outlining value metrics and key milestones to confidently track progress.

- In-depth training: Expect hands-on and self-service training during onboarding. This will help you discover and take full advantage of CloudZero tools with confidence.

- Engineering empowerment: We help your technical teams embrace cost-conscious strategies, techniques, and metrics that improve profitability — not undermine it.

- Weekly early-phase check-ins: During the first 4 to 12 weeks, expect regular follow-ups — not just routine meetings, but valuable sessions where our Certified FinOps Practitioners answer questions, provide expert guidance, and ensure measurable progress.

- Ongoing collaboration: We maintain continuous dialogue (Executive Business Review), helping you track achievements, refine strategies, and maintain transparency.

And you’ll be in good company, too. Innovative brands like Cloudera, Shutterstock, Coinbase, and Drift already trust CloudZero to manage over $5 billion in cloud spend. But don’t just take our word for it — see the results yourself. Risk-free.  to run your FinOps plan without the usual migraines.

to run your FinOps plan without the usual migraines.