DevOps. DevSecOps. AIOps. NoOps. RevOps. FinOps. It’s hard to keep up sometimes. No worries, though. CloudZero sits at the intersection of finance and operations — and we recently joined the FinOps Foundation, which brings together FinOps practitioners to collaborate, learn, and network.

In this guide, we’ll discuss FinOps and why it matters to you as a SaaS company that relies on cloud services and OpEx financials.

What Is FinOps In The Cloud?

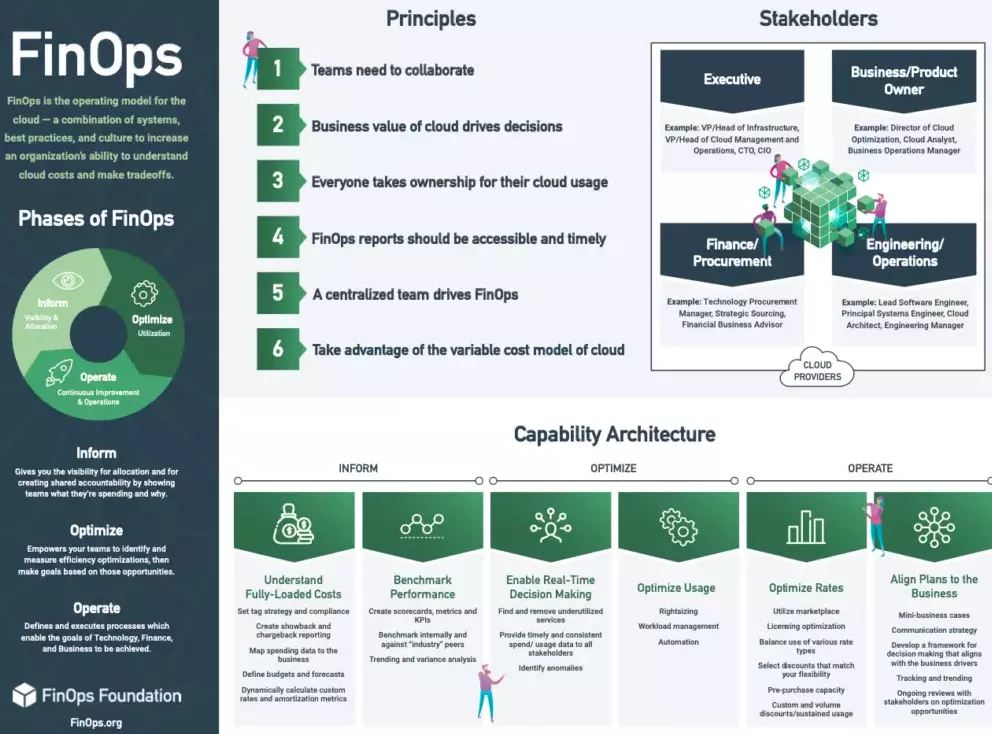

According to Finops.org, “FinOps is shorthand for ‘Cloud Financial Operations.’ This is a relatively new discipline under Cloud Financial Management’ or ‘Cloud Cost Management.’

FinOps is the practice of bringing financial accountability to the variable spend model of the cloud, enabling distributed teams to make business trade-offs between speed, cost, and quality.”

Credit: FinOps Foundation

The FinOps framework goes beyond just reporting spending. It also enables teams to accurately link spending to the people, products, and processes that generate those costs. You can track who gets what, why, and where your cloud budget goes.

The Three Tenets Of Cloud FinOps Explained

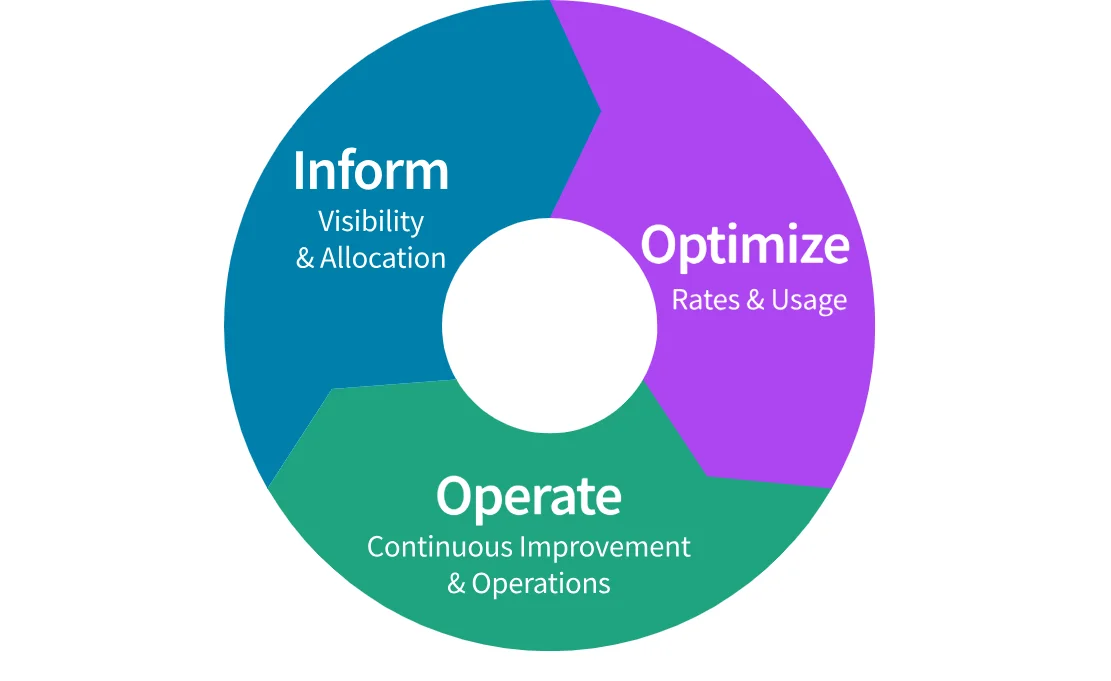

FinOps consists of three phases: Inform, Optimize, and Operate. The three tenets emphasize cloud cost reporting, cloud cost optimization, and continuous improvement.

Credit: FinOps phases by the FinOps Foundation

Below is an overview of each FinOps tenet in the FinOps lifecycle:

Inform

A key focus of this first phase of FinOps is increasing cost visibility. This visibility leads to data-driven decisions about cost allocation, budgeting, and forecasting.

How much visibility you’ll have will depend on your business goals and the cloud cost tools you use. Native cloud cost tools on AWS, Azure, and Google Cloud, for example, provide a single cost report every 24 hours.

Considering cloud billing is done per second and hourly, this 24-hour approach leaves much room for cost surprises.

Meanwhile, a more thorough cloud cost visibility platform like CloudZero surfaces your cloud costs every hour. This enables you to spot anomalies much sooner, minimizing budget overruns.

Additionally, CloudZero offers high-level cost insights, such as total and average costs, as well as more precise insights, such as cost per customer, team, feature, deployment, environment, and more.

This level of cost visibility empowers you to tell exactly who, what, and why your costs are changing so you can actually fix it.

Optimize

Speaking of fixing cost drivers, the Optimize tenet of FinOps focuses on maximizing the return on cloud investment in the most cost-effective way.

Cloud cost optimization is more than just reducing costs. The goal is to maximize ROI without compromising system performance, engineering velocity, or user experience.

This phase involves applying cloud cost optimization best practices such as:

- Rightsizing. This involves matching the type, size, and amount of cloud resources to the type of workload you need to execute. These resources include the type and size of instances or virtual machines (vCPU, memory, storage, and network bandwidth) to reduce overprovisioning (waste) or underprovisioning (performance degradation).

- Minimizing idle resources. Ensure cloud resources are terminated as soon as they finish their tasks. This reduces the amount of money spent on idle or unused resources.

- Using commitment-based discount programs. Take advantage of discounts, such as Reserved Instances (RIs), Savings Plans, and Sustained Use Discounts.

Consider the example we just used about viewing cost per feature.

By knowing which product features cost the most, you can take action. If you offer this feature in a free trial, you could move it to a paid tier and have it pay for itself.

Or, see if it’s popular among your customers. If not, you can decide whether to repurpose or decommission it altogether to protect your margins.

Operate

Operate involves governing cloud costs continuously to ensure you don’t overspend while meeting your cloud computing objectives.

This is where all FinOps stakeholders, including finance, engineering, customers, and management, need to be involved.

A major challenge in implementing FinOps has been the assumption that it is a finance-only function. In reality, it is a joint effort across the organization led by finance.

In particular, you’ll want to improve collaboration between Engineering and Finance. This is because engineering in the cloud tends to spiral out of control more than on-premises.

Additionally, this is why it is so crucial to use cloud cost optimization platforms that incorporate Engineering-Led Optimization (ELO). In this approach, engineers are empowered to make sound cost decisions based on accurate, timely, and actionable cloud cost information in their own language, such as cost per deployment, service, environment, dev team, etc.

What Are The Six Principles Of FinOps?

The following principles serve as North starts for implementing FinOps in your organization. Also, be sure to implement all the principles as a whole and refine them through experience and changing business needs.

- Team collaboration. This emphasizes the shared responsibility model of FinOps, which encourages continuous collaboration between all FinOps stakeholders. More on the specific stakeholders below.

- Ownership. Here, the focus is on improving cloud cost accountability. Using real-time cost allocation, chargebacks, showbacks, and measuring cost per unit can all help you achieve this.

- Business-driven decisions. This principle encourages you to understand your cloud costs in the context of your business. This way, you can map your cloud usage and associated costs to the value you derive as a business. You can do this by understanding your cost drivers to decide whether to invest more in certain areas to maximize value or reduce usage in others to cut costs.

- Timely reporting. The goal here is to surface cost data as soon as it is available. A real-time cost allocation method helps accomplish this by generating quick feedback loops.

- Centralized leadership. You should have a dedicated FinOps team to lead its implementation across teams. Having a defined team makes monitoring progress, delivering business value, and governing responsible cloud usage across the organization easier.

- Take advantage of the variable cost model of the cloud. FinOps, much like DevOps, is a cultural shift. And that means it is about making continuous adjustments to how you consume cloud resources as your business grows and evolves, enabling it to thrive at any stage.

FinOps Benefits: Does FinOps Really Matter?

For a SaaS company, controlling costs isn’t just about cutting spending. Knowing how much it costs to run specific aspects of your business and what levers you can pull to change it can give you a competitive edge.

How?

FinOps can help you answer questions such as:

- Where do we cut spending without negatively impacting performance, security, or engineering velocity?

- Which products do we invest more in to generate more revenue or additional revenue streams?

- Are we pricing all of our product features for strong margins? Are there any with unusually low margins?

- Which aspects of our architecture are “always on” versus which are we only paying for when customers utilize them?

- How would our cost change if we doubled our customers tomorrow or hit our sales plan next quarter?

- Which product features are most expensive to run but are popular with customers?

- Which product or features should we retire in favor of revenue-producing ones?

- Who are our most expensive customers, and are we pricing their services profitably?

- How would our costs change if we onboarded new customers tomorrow, next week, or next month?

- What happens to the cost of goods sold if the unit price of one of our inputs changes?

These are all specific examples of FinOps’s importance to SaaS companies. The FinOps approach takes cost data and breaks it down into granular, actionable insights that tell a story in the context of your business.

FinOps Team And Stakeholders: Who Is Involved In FinOps?

While FinOps is an organization-wide, shared responsibility, there is a select circle of FinOps practitioners with whom you should work together to make it a competitive advantage.

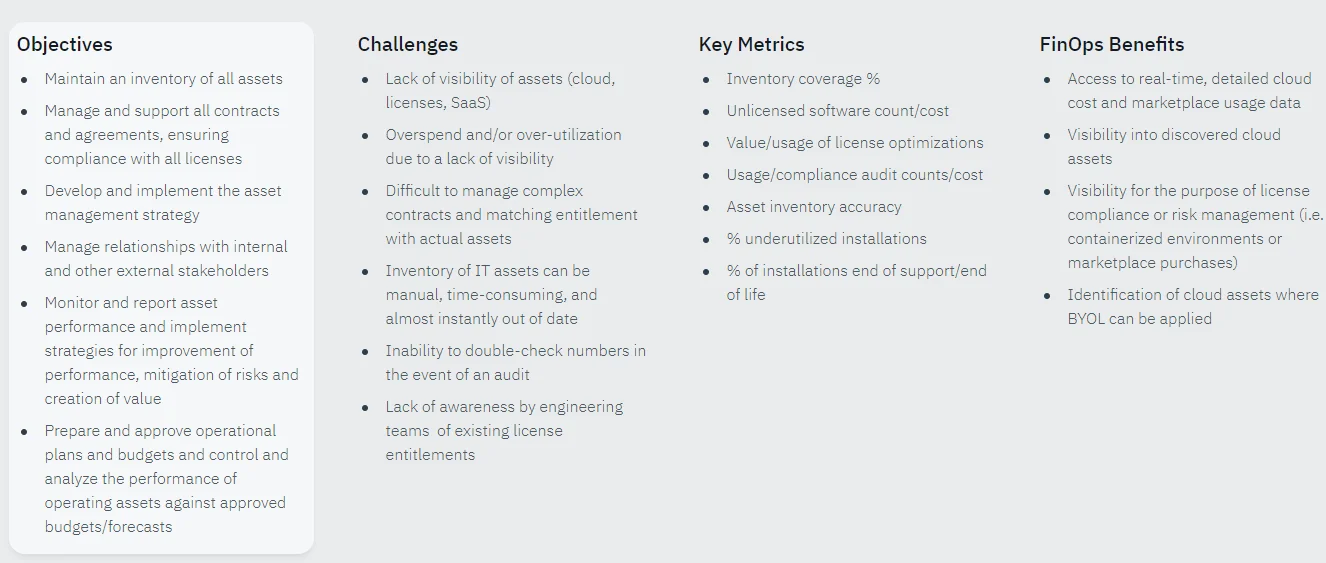

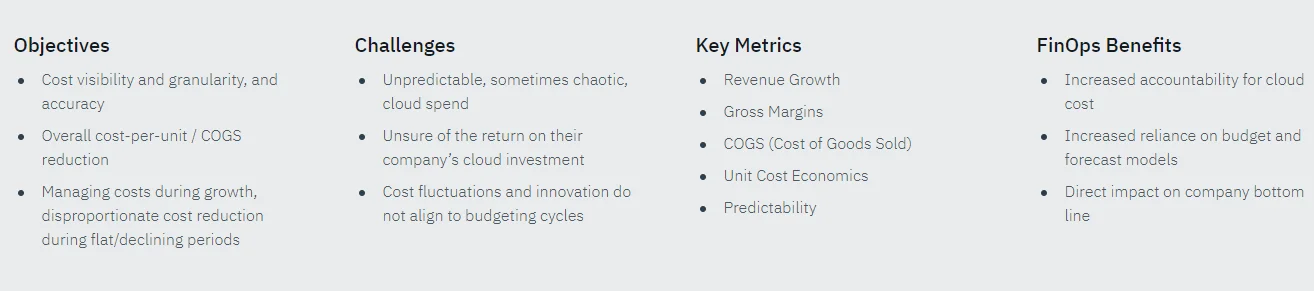

The exact composition of a FinOps team will vary from one organization to the next. A typical FinOps team consists of a representative from the executive, finance/IT procurement, engineering, ITAM, FinOps professional, and the product owner.

Here’s a quick overview of different roles in the FinOps team structure. For each role, we’ve included some metrics and objectives to track, according to the FinOps Foundation.

FinOps practitioner

These professionals help implement best practices for cloud cost optimization in daily operations. They gather unit cost data to drive cost budgeting and forecasting.

Engineering

Cloud engineers must be cost-conscious due to the on-demand nature of cloud resources. When engineering knows how its architectural decisions affect the organization’s bottom line and competitiveness, it can develop cost-effective solutions at the technical level to ensure long-term cost savings — without sacrificing velocity, innovation, and quality.

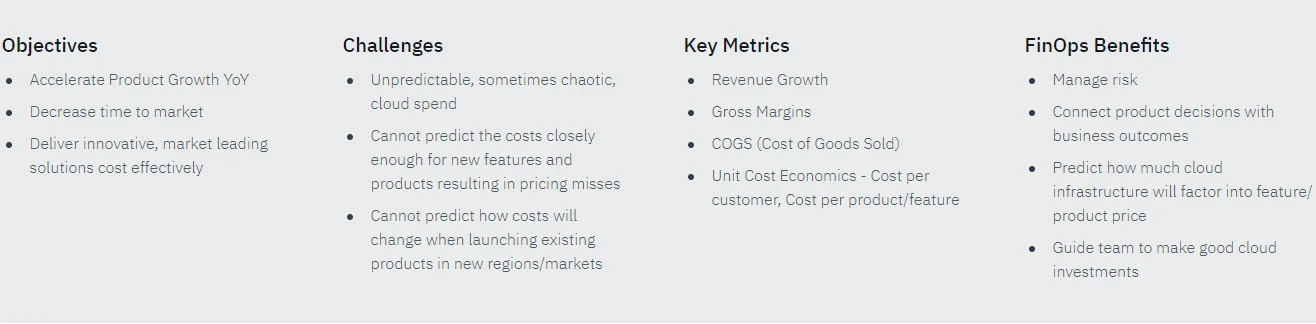

Product owner

This is the stakeholder responsible for delivering value to customers using cloud resources. With accurate, timely, and actionable cloud cost intelligence, the product owner can deliver the product or service at a competitive price (SaaS pricing) at a healthy profit margin.

ITAM practitioner/leader

The IT asset management practitioner is responsible for optimizing resource utilization, minimizing waste, and improving return on investment.

CEO

The Chief Executive Officer wants to know that cloud investments align with the organization’s business goals.

CTO

The CTO’s role in a FinOps team is to ensure that cloud technology delivers value to the business and a competitive advantage among competitors.

CFO

As the organization’s chief accounting officer, the CFO helps everyone understand cloud usage costs (Cloud Total Cost of Ownership (Cloud TCO)).

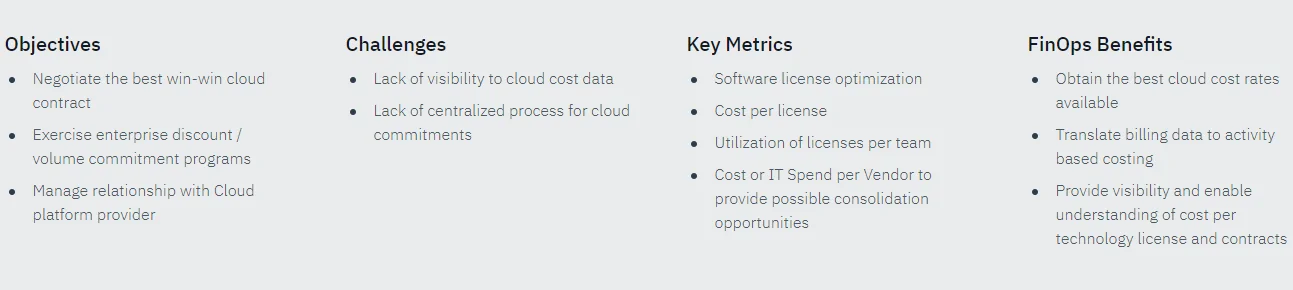

IT Procurement

In this role, the professional negotiates software license agreements, compares cloud providers and vendors, and employs other tactics to ensure the organization receives the best price-performance value.

After determining your FinOps team structure, you can implement best practices in your cloud environment and across the organization. Here is how.

How To Implement A FinOps Program

So, how do you get a better handle on your cloud spend? Here’s a step-by-step guide to applying FinOps in your organization.

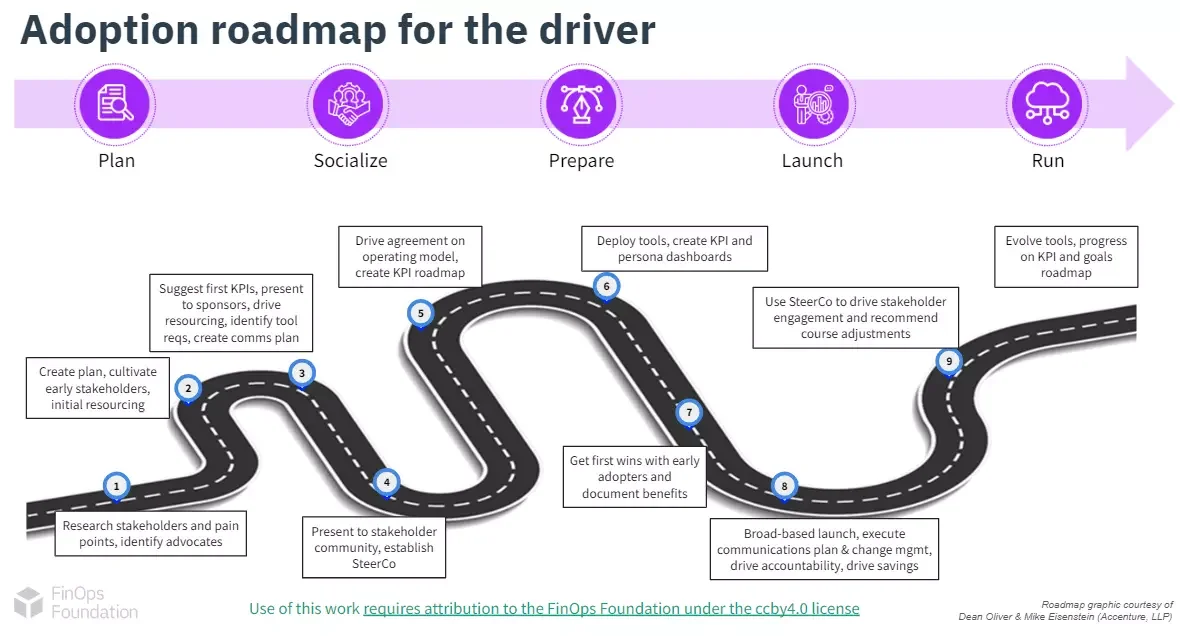

The FinOps Foundation breaks down the process further, as you can see in this image:

Now, let’s break this FinOps implementation plan down real quick.

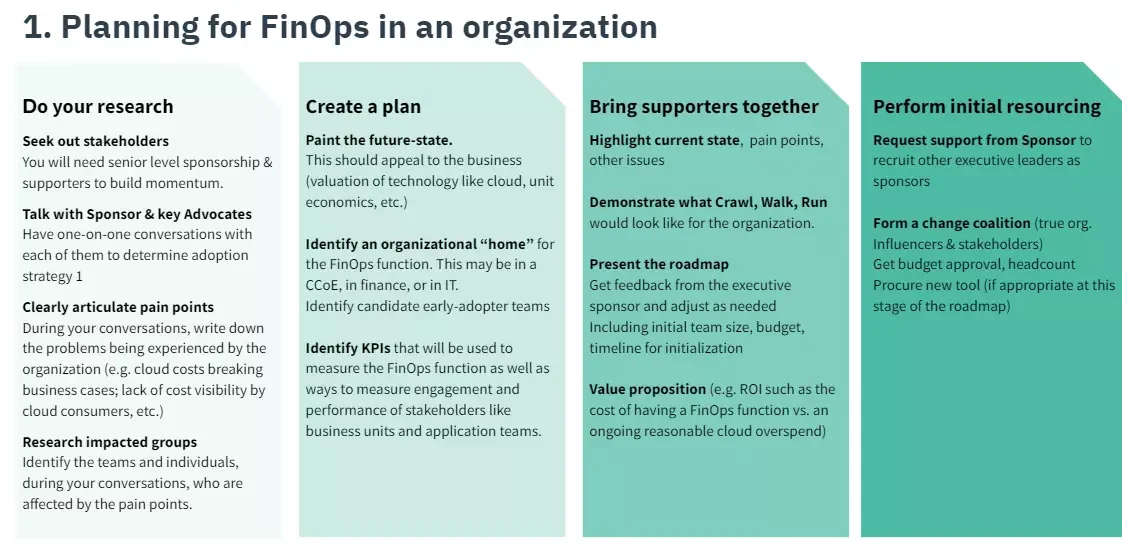

1. Plan for FinOps adoption

Start by researching pain points, operational issues, and other challenges that your organization’s teams and business units face. Encourage teams to articulate issues clearly and concisely, including how they believe other teams affect them.

For instance, finance might complain that engineering provisioned more cloud resources than necessary. Engineering might feel that finance only focuses on money rather than providing redundancy to minimize service disruptions.

Then, assemble a pilot team of engineers, finance, and C-Suite representatives to brainstorm a vision of what you’d like to accomplish. At this point, it is okay to ask an external consultant for guidance.

Credit: How to plan a FinOps adoption – FinOps Foundation

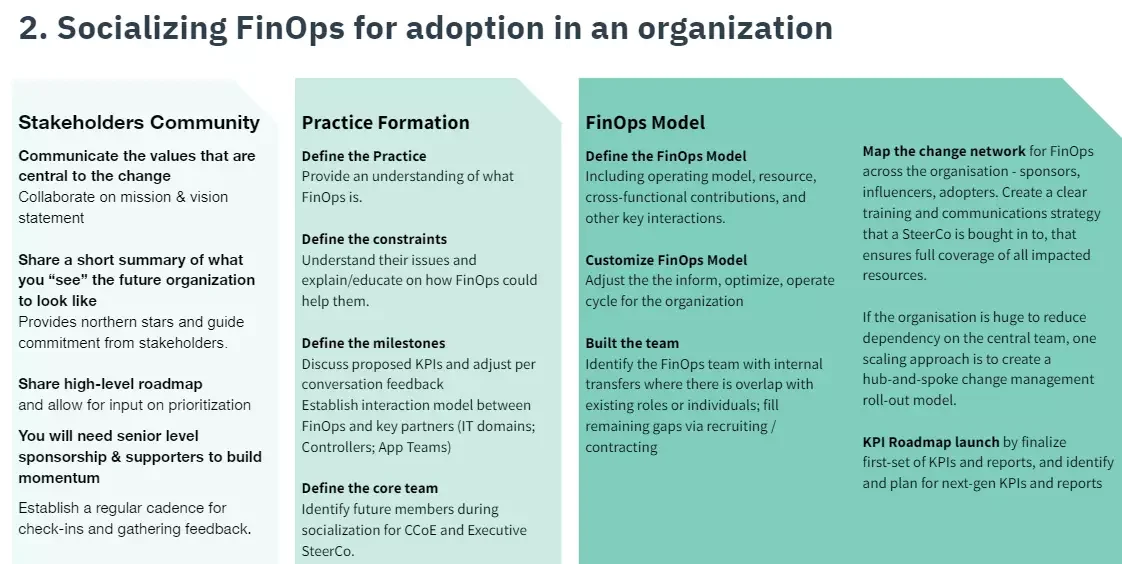

2. Socializing FinOps to the team

The next step is to vividly communicate how adopting a FinOps framework works so you can foster goodwill. You’re also trying to mentally prepare all involved about what they’ll have to improve regarding their values and routines to start seeing progress (a cultural shift).

How to promote a cultural shift to FinOps in your organization

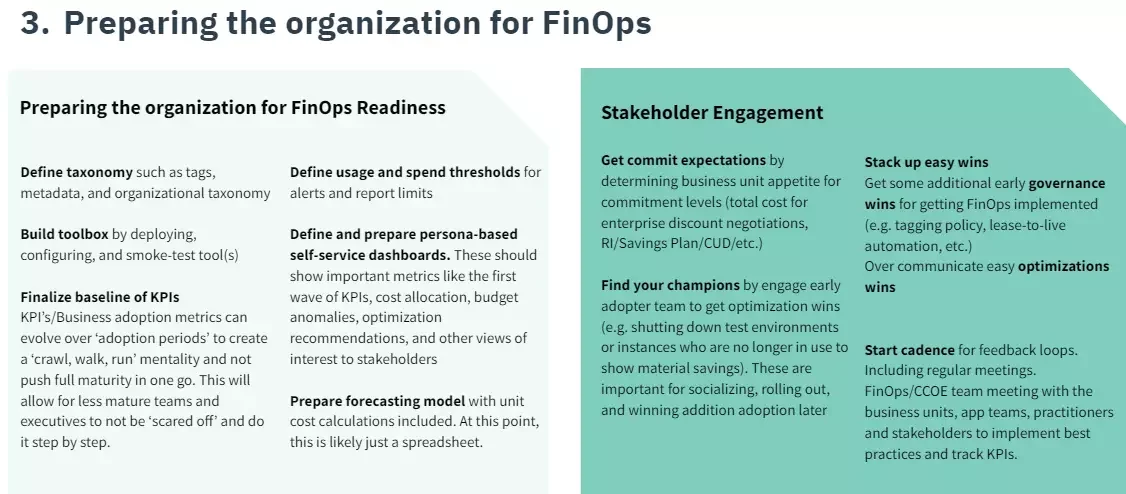

3. FinOps preparation phase

In this phase, you establish key performance indicators (KPIs) to measure your FinOps progress.

You can also create a roadmap defining the progression of your FinOps adoption journey: crawl (starting), Walk (scaling), and Run (mature, full-blown, cost-conscious operations).

Credit: Preparing for FinOps adoption

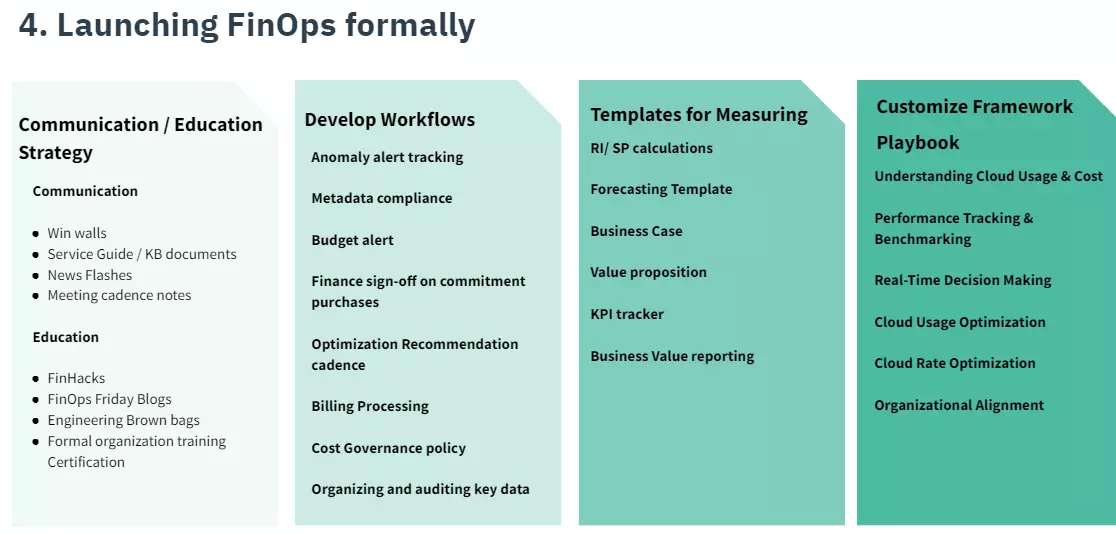

4. Launch FinOps

After laying down the fundamentals theoretically and in terms of infrastructure changes, it is time to implement FinOps best practices sustainably.

Change the basics first. Getting the simple things right will help your team develop the enthusiasm and momentum needed to build more complex workflows.

5. FinOps running phase

In this phase, you’ll actively implement several FinOps principles in production. Be sure to compare actual performance against the KPIs you established earlier to gauge progress.

Continuous monitoring will help you identify which areas need more attention to achieve your FinOps goals.

So, what FinOps best practices will you want to apply right away?

FinOps Best Practices To Make Your FinOps Initiative A Success

Here are some of the critical FinOps principles to apply right away.

- To chart the course for FinOps, a diverse team representing all stakeholders must be brought together.

- Consider inviting external experts to strengthen your team’s expertise at any stage.

- Sell FinOps’s benefits to specific teams or business units to get buy-in. This creates an incentive for your people to overcome resistance to change.

- Align engineering and finance teams by encouraging early and frequent communication so they understand each other’s priorities and problems.

- Agree on which decisions to shift left to engineering to encourage faster responses to architectural issues where delayed answers may lead to overspending.

- Measure unit costs, such as cost per customer, cost per deployment, and cost per team. This will help you identify key levers, trade-offs, compromises, and opportunities that can be used without compromising smooth service delivery.

- Encourage practices that foster a cost-awareness culture, such as right-sizing resources and terminating idle ones.

- Leverage user-friendly and robust FinOps tools to automate continuous monitoring and optimization.

Speaking of FinOps solutions, here are some ways to automate FinOps.

FinOps Tools: Which FinOps Solutions Are Best for Getting Started?

There is a growing number of FinOps tools you can use today. We’ve covered 5 top FinOps platforms you can adopt immediately here. Here are a few you can consider to get started.

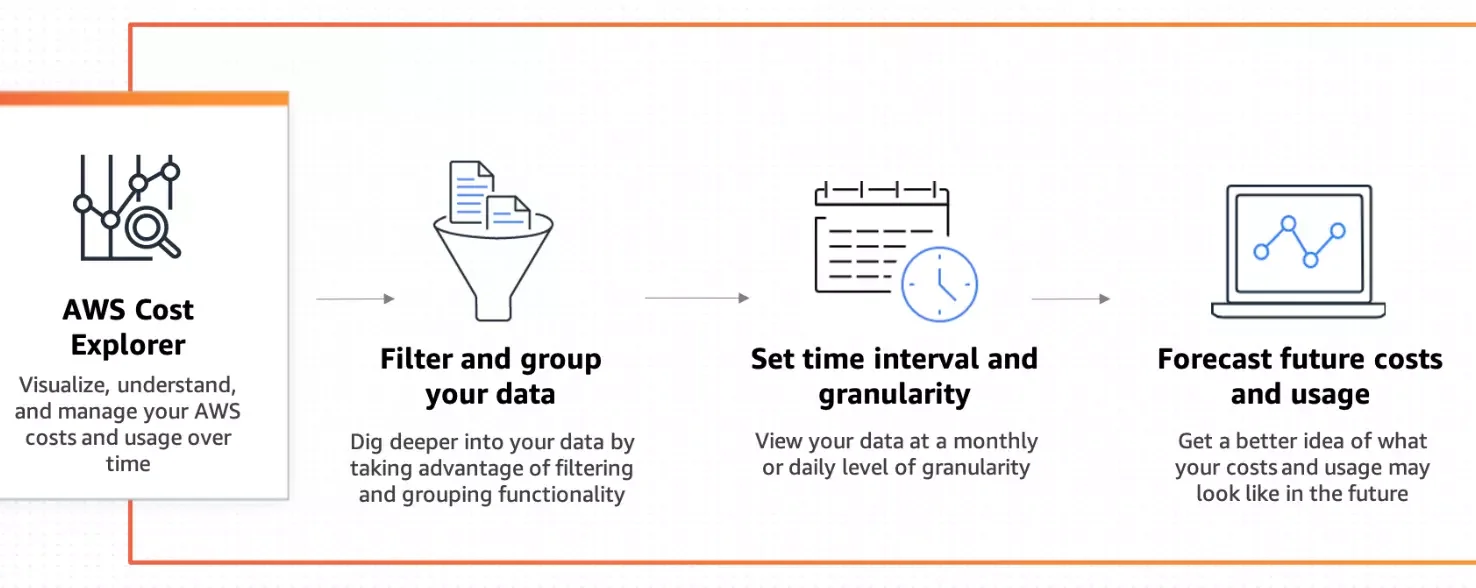

1. AWS Cost Explorer

Cost Explorer is free to all AWS customers. If your requirements are relatively straightforward and you don’t need cost visibility across complex, variable infrastructure, Cost Explorer might be enough for you.

The tool features dashboards, rightsizing, Savings Plans recommendations, and cost anomaly alerts.

Year founded: 2014

Category: AWS Native Tools

Pricing model: Free with AWS

Best for: Businesses that have relatively straightforward billing and spending patterns

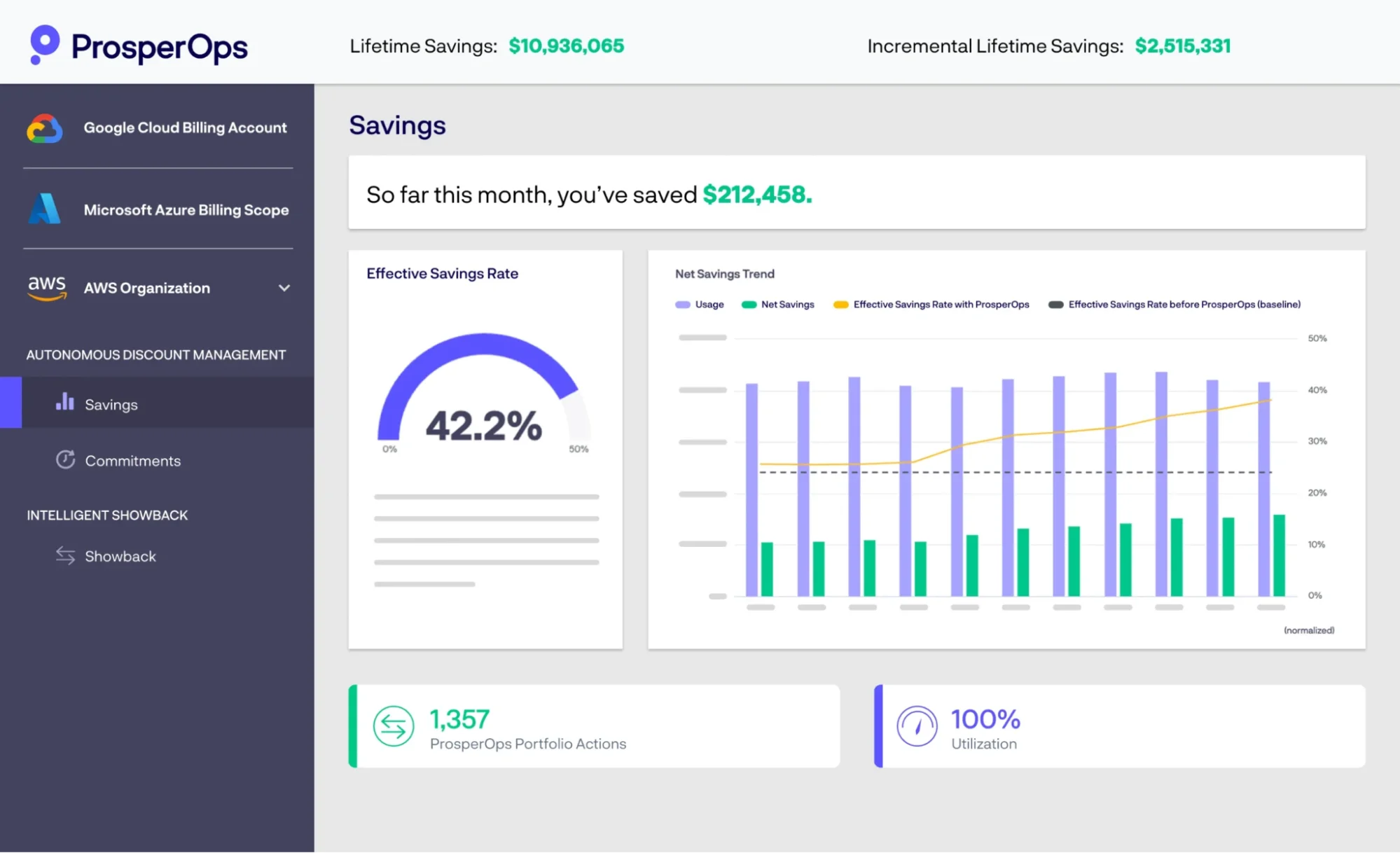

2. ProsperOps

ProsperOps autonomously orchestrates your instances to take advantage of the most cost-effective Savings Plans and Reserved Instances (RIs) — using algorithms, advanced techniques, and continuous execution.

Another benefit is that ProsperOps charges you only a percentage of the savings it generates, not a percentage of your spending like other tools.

Year founded: 2018

Category: Autonomous Savings Management

Pricing model (as of 2/2021 according to AWS Marketplace): $0.05 per dollar saved on compute and $0.35 per dollar saved on purchased/optimized convertible reserved instances

Best for: Companies looking for a new, modern approach to AWS savings plans and reserved instances

3. CloudZero

CloudZero provides accurate, granular, and actionable cost insights for finance, engineering, product teams, C-Suite, the board, and investors.

- Engineers can view costs per product or software feature, deployment, environment, team, project, Kubernetes cluster, and more.

- Finance can see cost per customer, product, project, COGS, and more.

- The executive, board, and investors can assess the organization’s competence, gross margins, and profitability with metrics like COGS, gross profit, and cost per customer.

- FinOps can allocate 100% of the cloud spend in minutes, leverage real-time cost allocation to be audit-ready, and generate insightful forecasts to prevent cost surprises.

- Product owners can tell exactly where their cloud budget is going so they can decide where to increase spending to maximize returns and where to cut spending to minimize costs.

CloudZero is the first cloud cost optimization platform to deliver accurate data to support unit economics without endless tagging. Additionally, you can view your costs of tagged, untagged, and untaggable resources and cost per tenant in a multi-tenant environment.

Besides, CloudZero uses real-time cost anomaly detection to send timely, noise-free, and context-rich alerts straight to your inbox or Slack. This enables you to identify the root cause of the cost issue and fix it before it becomes costly.

Year founded: 2016

Category: Cloud Cost Intelligence

Best for: Companies looking to understand who, what, and why their cloud costs are changing so they can make confident, data-driven decisions to optimize their cloud costs.

Pricing Model: CloudZero pricing is custom to your environment.

to see CloudZero in action. One of our Certified FinOps professionals is waiting to engage your team and provide insider tips and tricks to get you from Crawl to Walk to Run in days to weeks — not months or years.

to see CloudZero in action. One of our Certified FinOps professionals is waiting to engage your team and provide insider tips and tricks to get you from Crawl to Walk to Run in days to weeks — not months or years.

FinOps FAQs

Here are some answers to some frequently asked questions about adopting FinOps.

What is the difference between FinOps and DevOps?

DevOps, a combination of development and operations, is all about automation, breaking down silos, collaboration, and “shifting left,” which means finding and resolving potential engineering issues before they become problems.

Like DevOps, FinOps aims to transform cultures and practices and uses various tools. However, while DevOps emphasizes delivering high-quality software at speed, FinOps focuses on optimizing engineering cost efficiency.

Is FinOps about reducing cloud costs?

The end result of FinOps can be savings — but it doesn’t need to be. The FinOps Foundation says, “FinOps is about making money.” FinOps-based decisions can range from pinpointing where to cut costs to improve overall margins to which high-margin products to invest more money in to maximize ROI.

Who should be involved in a FinOps team?

A FinOps team includes finance, engineering, product, IT asset management (ITAM) representatives and the C-Suite (CEO, CFO, CTO). Each member ensures cost accountability, alignment with business goals, and efficient cloud usage.

What businesses benefit from implementing a FinOps program?

FinOps benefits SaaS companies, e-commerce platforms, media services, enterprises using multi-cloud strategies, and scaling startups. Any business relying on cloud services can use FinOps to optimize costs and align spending with business goals.

What is Engineering-Led Optimization (ELO)?

ELO empowers engineers to make cost-efficient decisions by integrating cost data into their workflows. With real-time cost insights, engineers can optimize resources, reduce waste, and align cloud spending with performance and innovation goals.