Financial reporting tools help businesses of all sizes manage budgets, track performance, and make informed decisions. By automating repetitive tasks, they save time, reduce errors and improve accuracy.

The demand for these tools is skyrocketing. In 2024, the market was valued at $14.94 billion and is expected to reach $37.56 billion by 2031. The rise of cloud-based solutions and the need for real-time financial insights are major drivers behind this growth.

But with so many options out there, it can be challenging to choose the right one. That’s why we’ve put together a list of the best financial reporting tools to help you find the perfect fit for your needs.

But first things first — what features should your tool offer?

Features To Look For In Financial Reporting Tools

Not all tools are created equal. Here’s what you should look for.

Automation

Automating tasks such as expense reports or tax calculations saves time and reduces errors. For small businesses, it eliminates hours of manual work, allowing owners to focus on growth.

Large organizations rely on automation to manage complex operations across departments or regions. Without it, tasks like reconciling accounts across subsidiaries could take weeks, leading to delays and costly mistakes.

Collaboration features

Shared dashboards and real-time collaboration features ensure teams stay aligned. For example, a finance manager and a department head can review budgets together, avoiding back-and-forth emails.

Cloud accessibility

Cloud-based platforms platforms enable businesses to access financial data anytime, from anywhere. This is essential for remote teams or companies with multiple locations. During the COVID-19 pandemic, many businesses relied on cloud platforms to manage their finances while working remotely.

Budgeting and forecasting

Look for tools that support future planning by offering budgeting and forecasting features. These help businesses predict financial outcomes and set realistic goals.

Advanced security

With cyberattacks on the rise, protecting financial data is essential. Tools such as encryption and multi-factor authentication ensure that sensitive information stays secure. Imagine the damage a data breach could cause to a company’s reputation and finances…

Real-time data updates

With real-time data, businesses can detect and address issues such as unexpected expenses or revenue drops before they escalate. It also helps spot financial trends as they occur and identify unusual financial activity.

Integration

Your financial tool should be able to smoothly connect with accounting software, CRMs, or even project management platforms. Without integration, data silos would slow down decision-making.

Scalability

Your tool should grow as your business expands. For example, a startup might start with a small user base but add new employees and projects over time. A scalable tool avoids the hassle of switching systems mid-growth.

Other features to look out for include:

- Data visualization

- User-friendly interface

- Customizable reports

- Compliance features

Top Tools To Enhance Your Financial Planning

Consider the following:

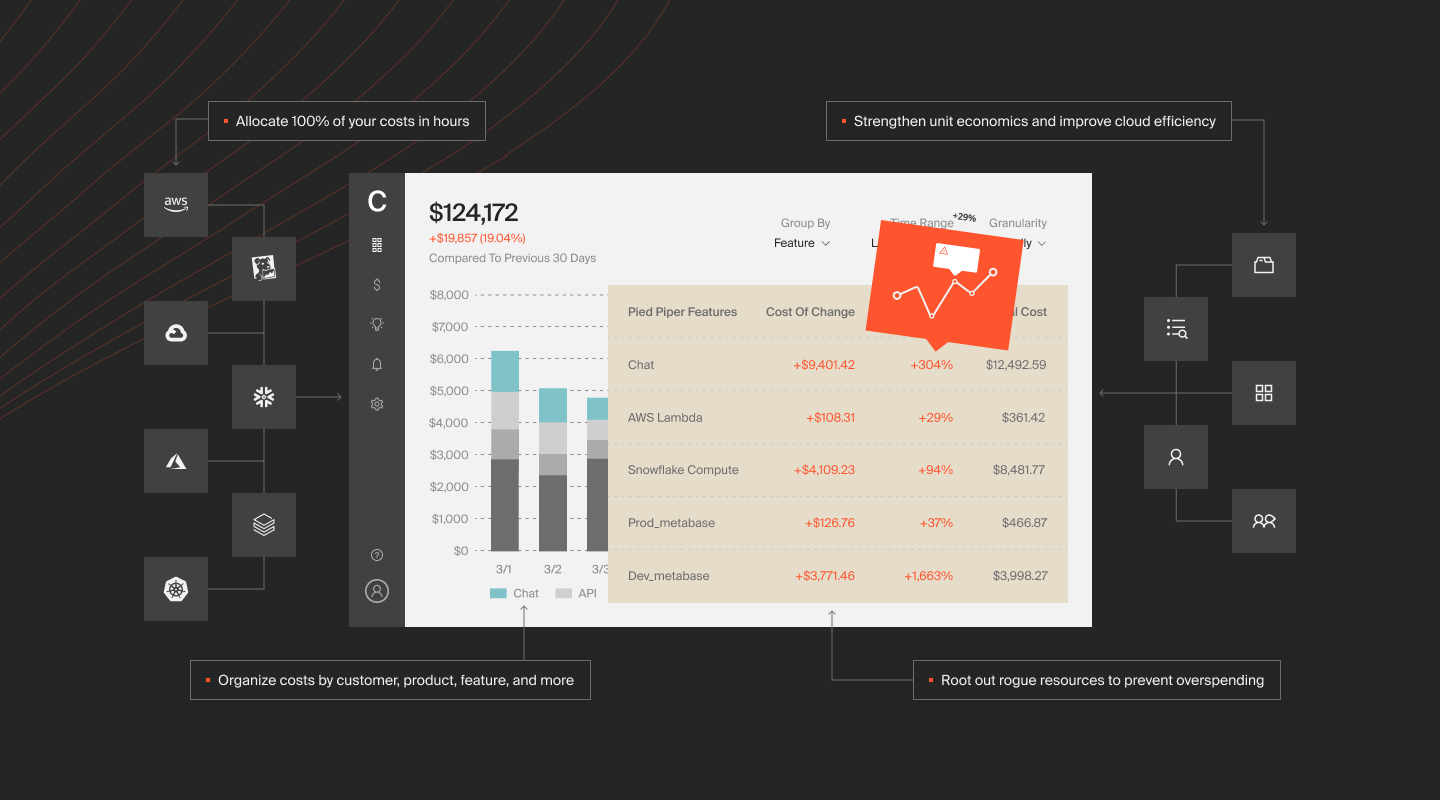

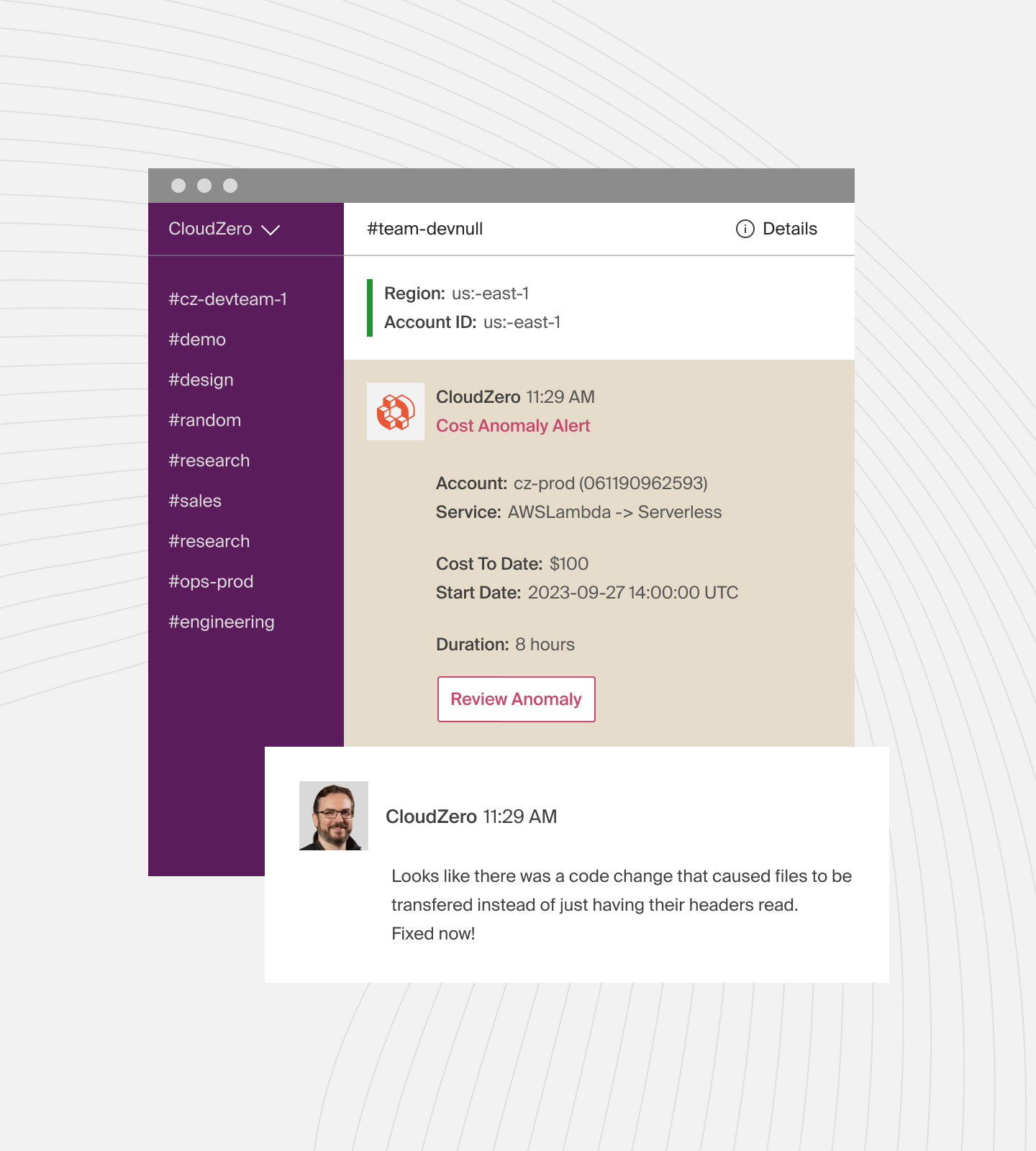

1. CloudZero

While not a traditional financial reporting tool, CloudZero delivers actionable financial insights for SaaS organizations using cloud infrastructure.

CloudZero offers:

- Real-time cost monitoring. Track cloud costs as they happen to prevent unexpected charges.

- Precise cost allocation. Assign cloud costs to specific teams, products, or customers for clear financial insights.

- Anomaly detection. Receive alerts for unusual spending patterns to address issues promptly.

- Budgeting and forecasting. Set budgets and predict future cloud costs to manage finances effectively.

- Dashboards and visualizations. View spending data through intuitive charts and graphs for easy understanding.

- Integration with Slack. Get cost insights and alerts directly in Slack for seamless team communication.

- Kubernetes cost tracking. Track Kubernetes costs by clusters, namespaces, and pods to see exactly where resources are used.

- Support for multiple cloud providers. Manage costs for AWS, Azure, and GCP from a single platform.

- Customizable reporting. Generate reports tailored to your business needs for detailed cost analysis.

- FinOps collaboration. Align engineering and finance teams with shared cost data to drive cost-efficient decisions.

Pros

- Bridges finance and engineering teams, helping them work together to control costs

- Identify waste and optimize resources to scale efficiently without overspending

- Clear cost visibility helps leaders decide where to invest and how to price effectively

- Eliminates cost surprises through real-time monitoring

Cons

- Limited to cloud-heavy organizations

2. Quickbooks

QuickBooks is an all-in-one accounting tool developed by Intuit. It is ideal for small businesses, freelancers, and startups that want to manage their finances without requiring a dedicated finance team.

With QuickBooks, you can send invoices, accept payments, and track payment statuses. It categorizes expenses by linking to bank accounts and simplifies payroll with automatic tax filing and payments.

You can also generate profit and loss reports, manage inventory, and track billable hours. Quickbooks also supports real-time insights via a personalized dashboard or mobile app.

Pros

- Choose between the cloud version for access anywhere or the desktop version for offline use

- The intuitive interface makes it simple for non-accountants to manage finances

- Integrates with tools such as PayPal, Shopify, and Square for smoother operations

- Multiple pricing tiers make it suitable for both small businesses and growing organizations

Cons

- Costs can add up, especially for businesses needing more users or capabilities

- There may be a learning curve for advanced features

3. NetSuite

NetSuite automates general ledger, accounts payable, accounts receivable, and tax management. As a CRM platform, it also manages customer interactions, sales, marketing, and support.

NetSuite also supports HR functions such as payroll, recruitment, and employee records.

Pros

- All users get the latest features and security updates instantly

- Tracks progress, resources, and budgets in real-time

- Manages customer interactions, sales, and support in one platform

Cons

- At a starting price of $999 per month, plus $99 per user, NetSuite can be an expensive option for small to medium-sized businesses

- Deploying NetSuite can be complex and time-consuming

4. Centage

Centage is a popular FP&A software that streamlines complex budgeting, forecasting, and reporting processes. Its appeal stems from its “what-if” scenarios, which enable users to assess the impact of different factors on revenue and cash flow.

Centage helps businesses align budgets with company goals, forecast financial performance, and create GAAP/IFRS-compliant reports.

Pros

- Built-in GAAP compliance reduces errors and simplifies reporting

- Integrates with GL, ERP, and CRM tools for consistent data

- Scales with business growth for long-term usability

Cons

- Some users report constraints when exporting data, which can hinder data sharing and integration with other systems

5. Workday

Workday helps businesses manage finances, HR, and planning in one place. It handles tasks such as payroll, budgeting, and tracking employee performance.

Workday also aggregates data from different departments, thus ensuring everything is accurate and up to date.

It also integrates with ERP and CRM platforms, enabling users to share data seamlessly.

Pros

- Simplifies benefits enrollment with simple setup and vendor integrations

- Mobile-friendly, enabling employees to manage benefits on the go

- Integrates with 600+ third-party tools, including payroll systems like ADP

Cons

- Workday implementation may take longer

6. Cube

Unlike most FP&A tools that require weeks of setup and ongoing maintenance, Cube gets teams started in under 10 days. It integrates with popular tools such as Excel, Salesforce, Xero, and QuickBooks, enabling users to work within systems they already know.

The platform combines enterprise-grade financial modeling, data consolidation, and real-time validation. It also pulls data from multiple sources, including ERP, CRM, and HRIS, into one reliable system.

Pros

- Easy to use with Excel and Google Sheets

- Quick setup

- Automates data consolidation from multiple sources, reducing manual errors

- Responsive customer support praised by users

Cons

- At $1,250/month, Cube can be an expensive platform

7. Anaplan

Anaplan’s Corporate Financial Planning supports rolling forecasts, enabling businesses to explore multiple scenarios easily. Combined with Anaplan’s other enterprise financial solutions, it allows companies to consolidate, sync, validate, and analyze vast amounts of data from a single, reliable source.

The platform empowers teams to build scalable financial models using enterprise-level formulas and fosters real-time collaboration across departments.

Pros

- Highly customizable models tailored to specific business goals

- User-friendly interface similar to Excel, making it easier to adopt

- Robust customer support and an active user community for guidance

Cons

- Performance may slow down when handling very large datasets

- High cost, making it less accessible for smaller businesses

8. Xero

Xero helps with invoicing, bank reconciliation, and expense tracking. Businesses can manage inventory, handle multiple currencies, and generate real-time financial reports.

Xero also integrates with bank accounts and works on mobile, making it easy to manage finances anywhere.

Xero also integrates Stripe, Shopify, PayPal, and Hubdoc to simplify workflow and connect and organize data. The Xero App Store offers smooth access to apps that enhance accounting efficiency.

Pros

- Allows unlimited users on all plans at no extra cost, supporting team collaboration

- Integrates with over 1,000 apps for better functionality and customization

- Automated bank feeds update transactions daily, saving time and reducing errors

Cons

- Does not support inventory assemblies, limiting complex product management

- Time tracking must be tied to projects, reducing flexibility

9. Datarails

Datarails integrates data from ERPs, CRMs, and accounting software to provide a single source of truth.

Once the data is consolidated and validated, you can analyze it directly in rows and columns or through an interactive dashboard. Both options enable you to explore the data and share FP&A insights with stakeholders. You can also zoom into specific details in real time to answer questions quickly and accurately.

Datarails also supports budgeting, forecasting, and scenario modeling.

Pros

- Users praise Datarails for its intuitive interface

- Supports real-time reporting

- Seamless integration with Excel

Cons

- The initial setup process can be complex

10. Sage

Sage offers a range of solutions designed to meet different business needs.

Sage Intacct offers cloud-based management for finances, HR, and payroll. For manufacturers and distributors, Sage X3 delivers customizable ERP features tailored to industry needs.

For financial processes, Sage 100 automates accounting, payroll, and operations, while Sage 300 handles complex multi-entity and multi-currency accounting. Sage Intacct Planning supports budgeting and forecasting, ensuring businesses can plan effectively.

Additionally, Sage Inventory Planner helps forecast inventory needs and streamline purchases.

Pros

- Affordable compared to popular alternatives

- The higher-tier plan supports unlimited users

- Robust inventory management features

Cons

- It lacks features for tracking mileage or time

Understand And Optimize Your SaaS Cloud Spending With CloudZero

SaaS companies often waste money on unused or underutilized resources without effective cloud financial management. Research shows that nearly 30% of SaaS spend goes to waste, meaning significant funds that could be reinvested into growth are lost. Poor visibility into spending also leads to unexpected costs and inefficient budgeting.

CloudZero helps SaaS CFOs take control of their cloud costs. The platform enables CFOs to allocate costs per customer, team, products, environment, and more, clarifying spending patterns.

Through its anomaly detection, CloudZero helps SaaS companies spot unusual cloud spending in real-time. This early detection enables teams to address issues quickly, avoiding budget overruns and reducing resource wastage.

These and more benefits are why SaaS brands like Shutterstock, Coinbase, and Drift trust CloudZero to manage over $5 billion in total cloud spend. Better yet, businesses like Upstart and Drift saved over $20 million and $3 million with us. So you, too, can unlock savings without losing your mind.