You may have heard that keeping an existing customer is five times cheaper than acquiring a new one. But that isn’t always true. “Hidden costs” often accompany customer retention, loyalty, and increasing “share of customer”.

Could you be spending more on retaining customers than on winning new ones?

This quick guide will walk you through the meaning of Customer Retention Cost (CRC), why it’s important to calculate, and how to calculate CRC.

You’ll also learn how to cut customer retention costs without losing customers, so you can recoup your investment and increase your profit.

Table Of Contents

- What Is Customer Retention?

- What Is Customer Retention Cost?

- What Does Customer Retention Cost Include?

- Why Is It Vital To Measure Customer Retention Cost?

- Customer Acquisition Cost Vs. Customer Retention Cost: What Is The Difference?

- How To Calculate Your Customer Retention Cost

- Will CRC Decrease Over The Lifetime Of A Customer?

- How To Improve Your Customer Retention Rate

- Understand Your Cost Per Customer With CloudZero

- Frequently Asked Questions About Customer Retention

What Is Customer Retention?

Customer retention is the ability of a business to keep its customers over time. Essentially, it involves interacting with customers to ensure they continue to purchase, use, and enjoy goods and services from the company.

It is a critical metric for businesses, as it indicates customer satisfaction and loyalty. In general, retaining customers can be more cost-effective than acquiring new ones, as it requires fewer resources and effort to do so.

Here’s the deal. Customers must be satisfied with your products or services to make repeat purchases.

Understanding your customers’ needs, anticipating them, and fulfilling them is the key to high customer retention. Besides, providing excellent customer service, personalized experiences, and loyalty incentives can further encourage loyalty to your brand.

What Is Customer Retention Cost?

Customer Retention Cost (CRC) is how much you spend to keep one customer buying from you for as long as possible. CRC is the cost of customer retention over a specific time.

SaaS businesses typically track crucial metrics like monthly recurring revenue (MRR), customer acquisition cost (CAC), churn, payback time, and lifetime customer value (CLV). Additionally, most companies invest heavily in reducing their churn rate. Chances are your company does this as well on the following activities.

What Does Customer Retention Cost Include?

Customer retention costs include all of the costs to maintain and support that customer. Retention costs include:

- Providing training/tutorials and professional services for customer success.

- Costs related to customer service, such as salaries for customer service agents, renewal team members, engineers, and executives. Some SaaS companies count customer service costs as Cost Of Goods Sold (COGS) instead of customer retention costs.

- Various examples of customer loyalty programs.

- Account management team’s costs.

- Programs and tools for customer engagement such as chatbots and adapting new features.

- Customer usage of your product, software, features, etc.

Why Is It Vital To Measure Customer Retention Cost?

It has historically been easier to cross-sell or upsell to an existing customer than to a new prospect. You can increase the lifetime value of a customer by keeping them for longer.

The shift to Software-as-a-Service (SaaS) requires businesses to keep customers for as long as possible to maximize profitability.

For businesses that rely on recurring revenue, nurturing, growing, and meeting customers needs are criticalto ensuring consistent renewals..

That’s not all.

- By evaluating your investment in a customer over time, you can determine if it is sustainable.

- By determining the cost of keeping a customer, you can find out how much you should price your services and products. By evaluating CRC at renewal time, you can determine whether you should reevaluate a particular customer’s contract.

- Find out whether certain features should be moved to a higher SaaS pricing tier so you can encourage customers to upgrade their subscriptions, thus preserving your margins.

- Explore how your CRC can be optimized without compromising customer experiences.

- A high CRC without increasing customer retention may indicate a product-market-fit problem. In general, the higher the retention costs, the lower the margins and profits because each subsequent sale is actually less profitable.

- Low customer retention costs can indicate that your retention techniques are working. It might also motivate you to invest more in customer retention to improve loyalty.

- CRC can help identify the true Lifetime Customer Value (by comparing the cost of keeping a customer with the value they return of their lifetime).

Customer Acquisition Cost Vs. Customer Retention Cost: What Is The Difference?

Customer Acquisition Cost (CAC) is the amount of money a company spends over a particular period to win a new customer, but the Customer Retention Cost (CRC) is the amount of money a company spends after signing up that customer.

A business can use CAC to determine when it will recoup the costs of sales and marketing used to acquire a new customer. CRC is useful for determining if it makes sustainable profits from keeping all or specific customers.

So, how do you calculate CRC?

How To Calculate Your Customer Retention Cost

You need to add up all the sales and marketing costs of both new and existing products and services to your current customers for a set time. Depending on how much visibility you want, you can add up all the investments every month, quarter, or year.

But, is there a Customer Retention Cost formula?

Here are a few helpful formulas:

- Average CRC per customer = Total CRC of all customers / Number of active customers in that period

- Average lifetime CRC per customer = Average CRC per customer X average customer lifetime

This method, however, does not show how much you spend to support a specific existing customer. Rather, it equalizes customer retention costs across the board, which is grossly inaccurate.

That approach makes it hard to determine your most expensive or least profitable customers. In addition, it is difficult to determine what discount rate to offer a customer whose retention cost is low in relation to their revenue.

A smarter approach is to calculate CRC on a case-by-case basis.

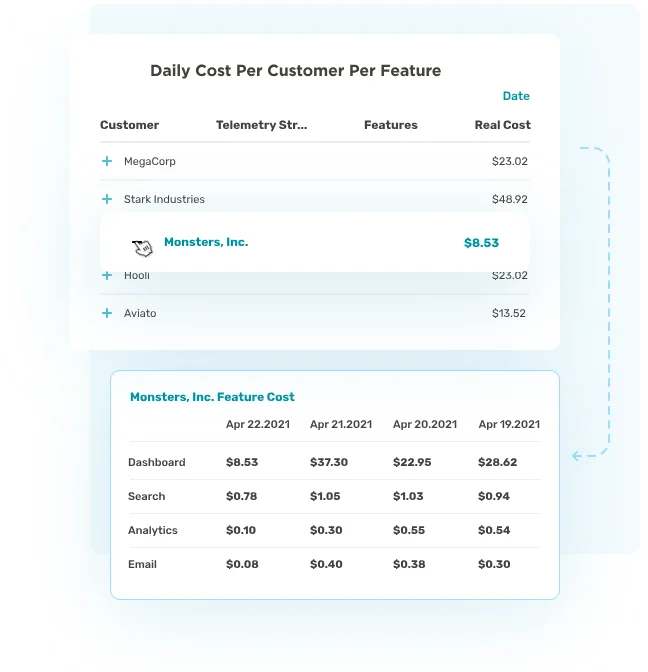

You can use cost per customer to determine if you are making enough from each customer to keep them. A cost intelligence platform can help you measure cost per customer allowing you to make informed decisions on contract renewals, pricing tiers, and go-to-market strategies.

That leads us to the next question most organizations ask.

Will CRC Decrease Over The Lifetime Of A Customer?

With time, a customer’s CRC may decrease as their confidence in your product or service develops, theoretically requiring less input from you to keep their business. However, we don’t recommend factoring in reducing CRC over time. Here are a few reasons why:

- Continuously improve your customer experience and competitiveness will keep your customers coming back.

- Investing in releasing new features leads to upsells and cross-sells (more revenue from existing customers).

- Occasionally, new decision-makers and influencers join your customer’s teams and you may need to encourage them to renew.

Trying to reduce customer retention costs at any cost can damage your customer relationships. You could instead optimize your CRC to protect your margins and profit. Below are some tips.

How To Improve Your Customer Retention Rate

How do you retain customers at the lowest cost? And, how do you cut customer retention costs without losing customers? Try these tips:

Involve your customers more

A solid way to do that is to periodically request feedback from your customers on how they use your service or product. You want to have a good understanding of what kind of needs and goals your customers have when purchasing your product or service. The goal here is to ensure you improve your product or service to serve that particular need or goal.

You can also ask them to be candid about what alternative products or services they use when they are not using yours, and more importantly, why they do. Use the feedback you receive to continually improve your product’s fit to the market.

You want your product or service to be the one to beat, not just another option.

Share. Teach. Optimize.

Your target customers may not be using your product or service they way you intended. Or, perhaps they are struggling to use it as effectively as they had hoped. Either way, they may become frustrated and abandon your brand.

One way to prevent this outcome is to provide easy-to-understand onboarding materials. If you offer boutique, highly competitive, or high-ticket products or services, you’ll want to provide a personalized, guided onboarding and training.

CloudZero, for example, offers a high stakes service; understanding, controlling, and optimizing cloud costs. As such, we assign a human, certified FinOps professional to be your Account Manager.

The expert won’t just help your FinOps team with CloudZero installation and configuration. In addition, your FinOps Account Manager provides ongoing optimization advice and helps you find cost-saving opportunities that do not compromise your growth objectives.

Automate your customer success processes where possible

Perhaps you have a large customer base. This means you may not be able to provide them with personal service all the time, or even on time. If so, consider using customer interaction technologies, such as chatbots and self-help resources.

The bots can handle basic customer inquiries, such as password resets, order status requests, and detect trends in customer behavior or help requests. They can also route customer inquiries to the right people or department.

Overall, automation can help reduce response times, deliver consistent responses, and personalize support — even across different customer segments.

Use cost per customer to offer compelling pricing

A fair way to charge a customer is based on the cost of supporting their needs. Understanding your cost per customer can help you set pricing that’s fair to your customers and protects your margins.

You can also determine how much discount you can realistically offer a particular customer without eroding your margins. A fair price and timely discounts are two surefire ways to keep customers.

Yet, calculating your cost per customer manually can be daunting. Instead, you can take advantage of a robust cost platform to automate the process.

For example, if you are a SaaS company, you can use CloudZero to programmatically collect, analyze, and share your cost per customer with the relevant stakeholders, from engineers to finance to the board

Understand Your Cost Per Customer With CloudZero

CloudZero enables you to connect the dots between cloud spend and your business. While other solutions offer reporting and dashboards that answer, “how much did we spend in total or on average?”, CloudZero also enables you to answer “why did we spend that and where did it go really?”.

Was it because we onboarded a new customer? Did our team push new code? Or did some clever UX changes increase usage of this feature?

You’ll see this in the form of immediately actionable per-unit cost insights; cost per customer, per team, per project, per feature, per product or service, per environment, and more.

By default, you’ll get at least 12 of these cost dimensions. But you can create custom ones, such as cost per feature per customer, to track your cloud spend however is most relevant to your business.

CloudZero delivers this level of granularity like no other cost platform; hourly, per-unit, and mapped to the specific people, products, and processes that drove the costs. This way, you can tell exactly who, what, and why your cloud costs are changing — and actually be able to do something about it.

Plus, CloudZero will be your single source of truth. You can manage your AWS, Azure, GCP, and Oracle Cloud costs, as well as costs of Kubernetes, Snowflake, Databricks, MongoDB, New Relic, Datadog, and more platforms. You can do all of that on a single dashboard, so it’s easier to compare them.

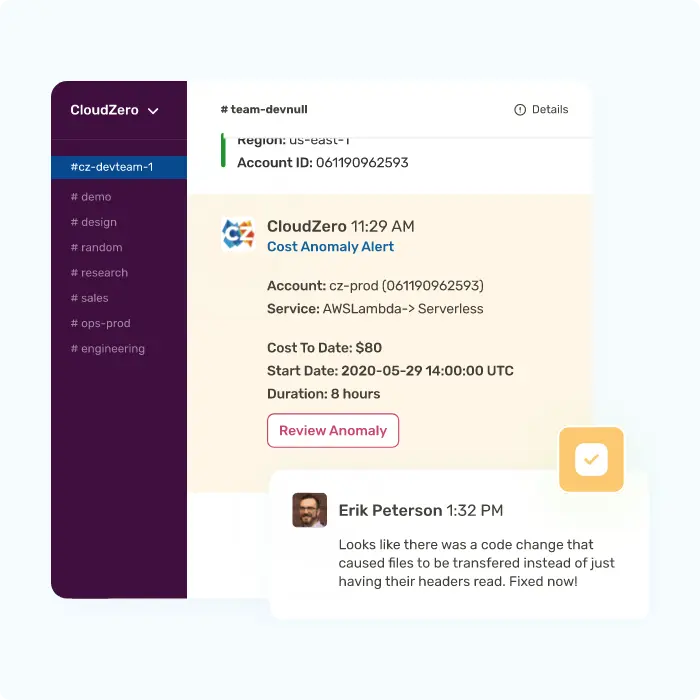

And, to ensure you get no surprise costs, we’ll send you timely, noise-free, and context-rich cost anomaly alerts to your Slack or email. This means the right people in your team can quickly tell what and where to fix in order to prevent cost overruns.

These and more capabilities, such as 100% cost allocation, budgeting, and forecasting, are the same tools our customers, like Drift (saved $4 million so far), Seat Geek (saved 6-8 hours per cloud cost question), and SmartBear (raised revenue after understanding cost per customer), have used to save money on cloud services.

By passing on these savings to your customers, you can lower your prices even further without eroding your margins. Or you can use the savings to further improve your product or service. Both are sustainable ways to retain customers.

Yet reading about CloudZero is nothing like seeing it in action for yourself.

to experience CloudZero first-hand.

to experience CloudZero first-hand.

Frequently Asked Questions About Customer Retention

Here are answers to some of your customer retention FAQs.

What does a good customer retention rate look like?

The higher your customer retention rate, the more the customers of your product or service tend to make repeat purchases without defecting to an competitor or another product/service.

What are the five main factors that affect customer retention?

The five are customer delight, satisfaction level, relationship with the business, the cost of switching, and service standards.

What are the most important metrics for measuring customer retention?

Net Promoter Score measures customer satisfaction, Repeat Purchase Rate (RPR) measures return purchases, and Customer Retention Rate (CRR) measures the percentage of customers who stay with the business over a certain period.

What are the five stages of the customer loyalty lifecycle?

You reach out to your target audience, acquire leads, convert the leads to buying customers, retain them as repeat buyers, and build a solid relationship over time.