Many companies migrate to the cloud and overlook costs in favor of innovation, speed, and flexibility. They assume that the cloud is inherently more cost-effective than on-premises infrastructure.

However, the organizations soon realize that the same characteristics that make the cloud such an enticing and flexible resource can also lead to unexpectedly higher usage bills than expected.

The challenge is to find the right balance between optimal system performance, engineering velocity, and cost. Cloud financial management can help with this.

What Is Cloud Financial Management?

Cloud Financial Management identifies, measures, monitors, and optimizes cloud costs. This process includes cloud best practices, procedures, and tools that enable an organization to manage cloud spending and maximize in the cloud.

Why is this important?

Here is the thing. Unexpected cloud spending remains one of the top barriers to realizing the cloud’s business value. In an IDG Cloud Computing survey, cloud users admitted that rising service bills consistently disrupted their cloud operations.

According to 40% of the enterprises surveyed, a lack of adequate cost control was the leading obstacle to gaining value from the public cloud.

This comes as more than two-thirds of organizations across all industries have already adopted cloud computing. Many focused so much on cloud innovation that they neglected to consider the real cost implications of scaling cloud resources from the start.

That’s precisely what Cloud Financial Management tries to remedy.

This strategy aims to maintain a favorable balance between improving customer experiences and managing cloud resource usage costs. Cloud Financial Management aims to optimize cloud costs, usage, and resource scaling.

Cloud Financial Management is not solely about cutting cloud costs. Reducing cloud costs is only one objective. It can also improve business agility, operational resilience, and staff productivity.

In 2022, 451 Research surveyed 1000 IT decision-makers globally. They found that organizations implementing CFM practices increased their revenue (48%), profitability (52%), and investment in the cloud.

The study was done in collaboration with Amazon Web Services (AWS), the world’s largest public cloud provider. Among the findings were:

- 50% of organizations reported exceeding their expected cloud budget by more than 25%.

- Organizations utilizing cloud services for more than four years saw unit cost savings of more than 40%, highlighting the significant savings that come with sustained CFM efforts.

AWS’ involvement is interesting. Let’s talk more about it.

What Is AWS Cloud Financial Management?

This approach tailors CFM specifically for organizations with applications, data, and other workloads in the Amazon Web Services (AWS) public cloud. The aim is to help these organizations plan, manage, and optimize their cloud costs in the AWS public cloud infrastructure.

AWS Cloud Financial Management is also ideal for companies that are building native cloud applications, migrating some of their workloads to the cloud, or expanding their use of public cloud services.

The AWS platform provides various features, cost tools, and best practices that can help with this. For example, using AWS rightsizing capabilities, teams can allocate just the right amount of resources to specific infrastructure components or applications to increase business value indicators, such as productivity and better customer experiences, while reducing AWS cloud costs.

Cloud Financial Management in AWS is a continuous process. AWS billing is also based on usage. Consequently, the more efficient your cloud workload, the fewer resources you need to run it — hence, the lower the operating cost.

What are the four key areas of AWS Cloud Financial Management?

AWS enables companies to SEE where costs come from, RUN operations with minimal cost surprises, PLAN for dynamic cloud usage, and drive COST SAVINGS while maximizing business value.

In AWS, Cloud Financial Management covers three aspects: use case, capability, and ideal tool/ resource. By using them, you can:

- Manage cloud financial planning

- Forecast and budget costs

- Use consolidated billing for cost control

- Reduce your AWS bill using AWS pricing optimizations

In other words, AWS Cloud Financial Management also involves forecasting, budgeting, monitoring, and controlling cloud spend.

However, as many organizations have figured out, not everyone has been happy about their surprise AWS bill.

What are some AWS Cloud Financial Management challenges?

In addition to poor cloud cost visibility, understanding AWS billing and overcoming endless tagging are some challenges of practicing Cloud Financial Management in AWS.

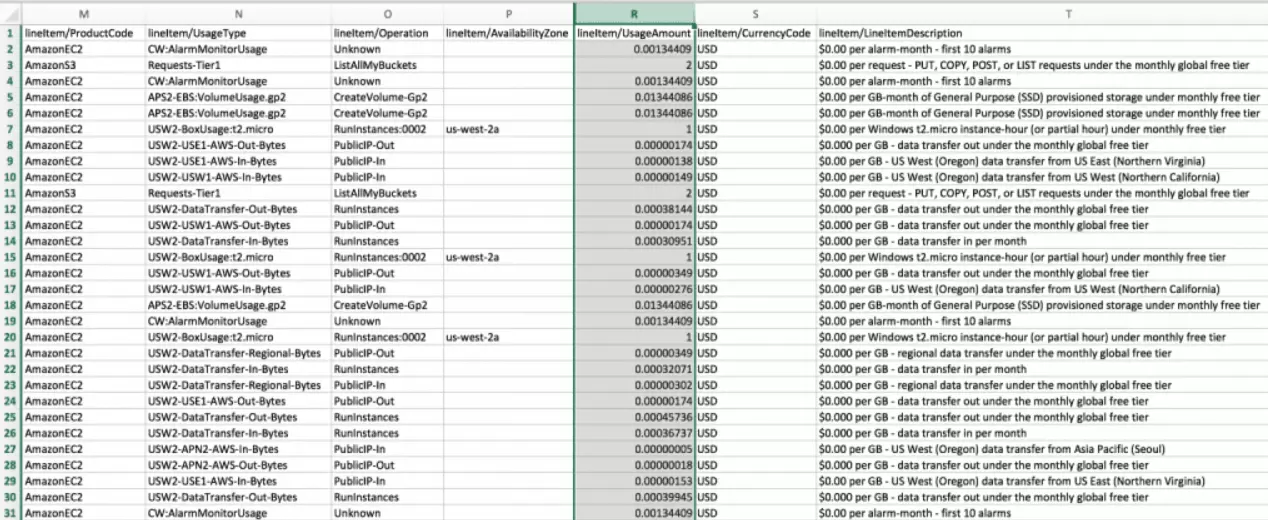

For example, many companies do not understand how AWS comes up with its monthly AWS bill.

Now, picture this:

Rather than provide actionable insights to help businesses understand what, where, who, and why their cloud spend is as much as it is, this AWS billing invoice reads like a computer programming script.

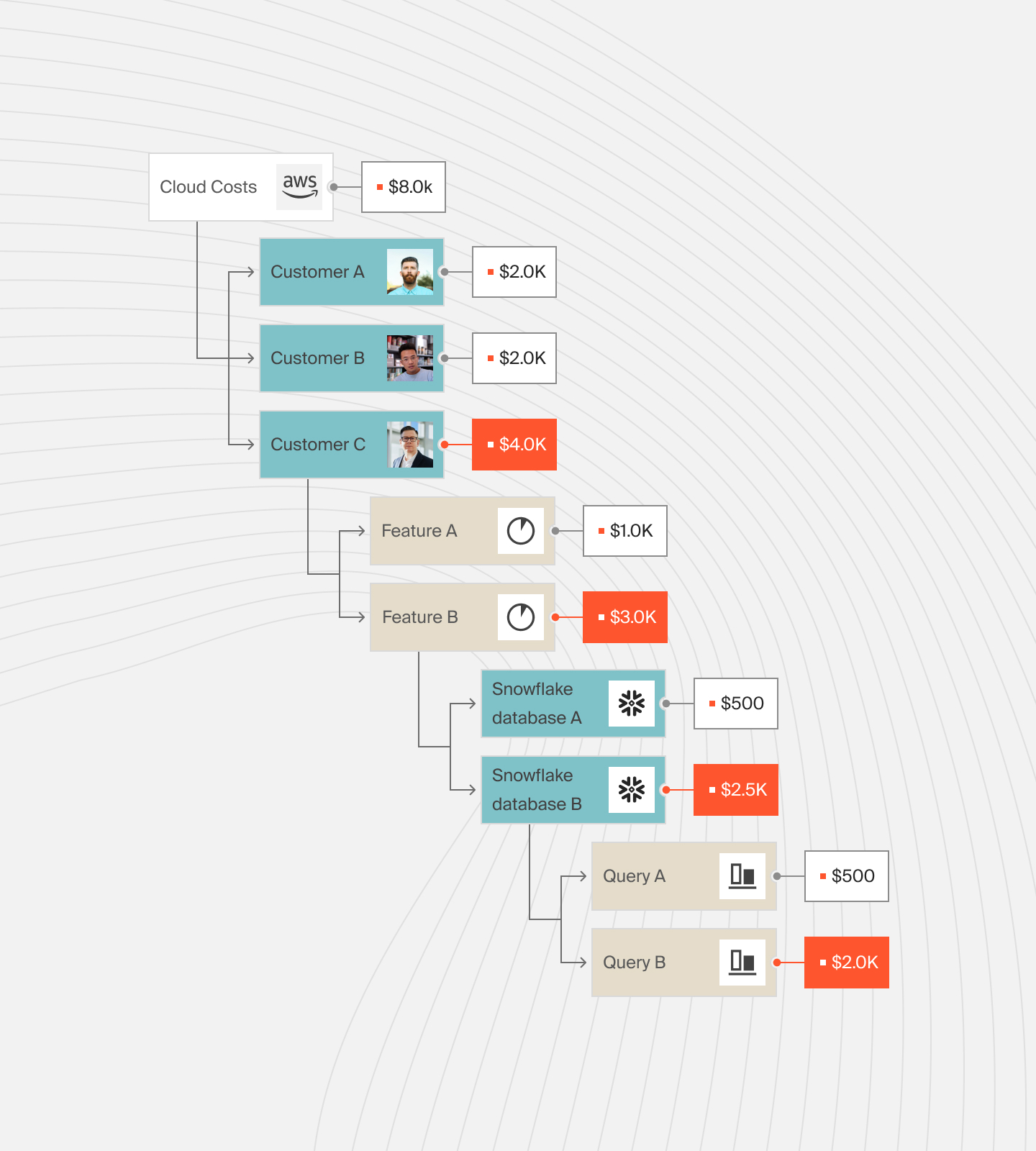

In contrast, using a platform like CloudZero, you can break costs down into meaningful metrics like cost per customer, per product, per feature, and more.

With this detailed yet easily digestible cost insight, you can determine the most expensive features to run and maintain and then consider including them in your premium pricing tiers or decommissioning them.

CloudZero’s cost per customer analysis can also help you determine how much it costs to support a particular customer.

With this level of cost intelligence, you can identify which customers to assess at renewal — because they consume more resources than you expected when you onboarded or first discussed pricing.

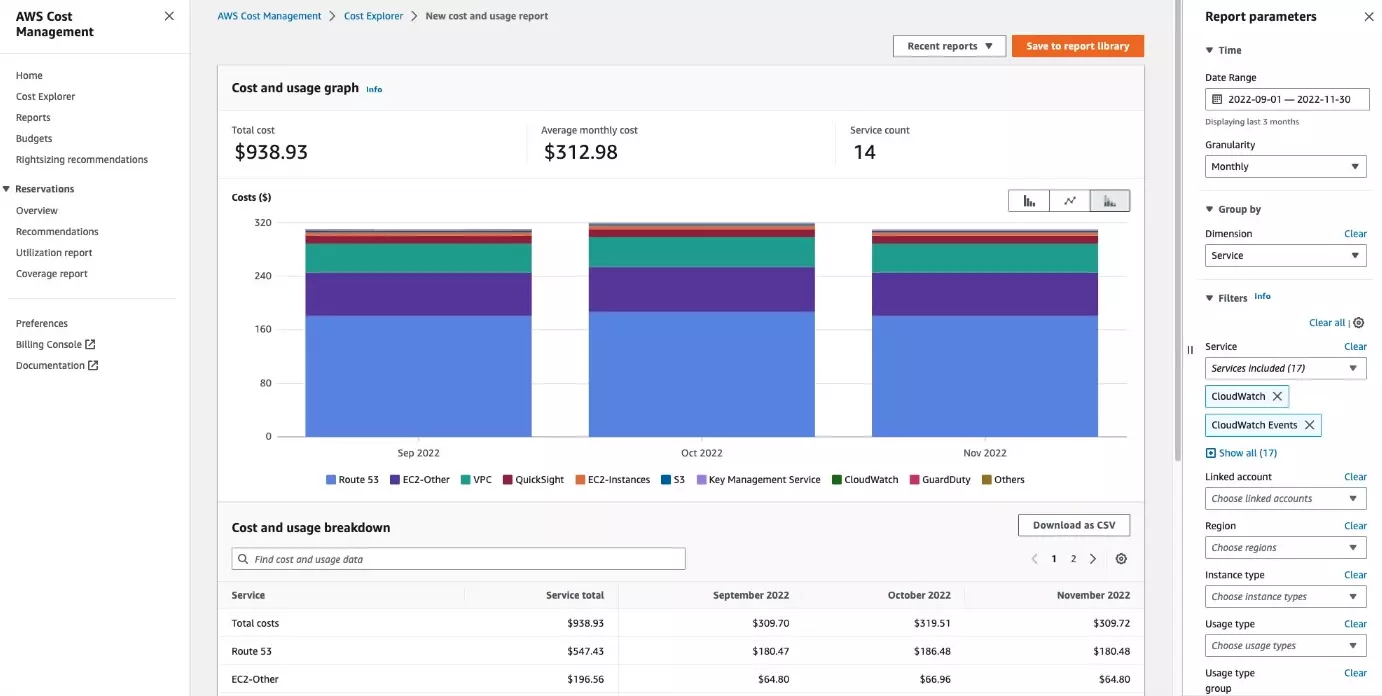

But if you just want to see the basics, for now, you can get a quick sense of cost and usage with tools like AWS Cost and Usage Report and AWS Cost Explorer, like this:

Credit: AWS

However, DevOps and finance teams need to develop and implement a near-perfect AWS tagging strategy to get this view in AWS. If you’ve tried creating a unified and comprehensive tagging plan, you know it can be one of the most challenging parts of AWS cost management.

In that case, we’ve compiled a handy guide to help you learn more about creating an AWS tagging strategy step-by-step.

Cloud Financial Management Benefits: How Can CFM Help Organizations?

Implementing cloud financial management properly offers the following benefits:

1. Keep track of your cloud spend

With Cloud Financial Management, you can monitor your service usage bills and the operations, tasks, and resources that underlie them.

This should enable you to monitor a wide range of cost factors related to your cloud environment. You can use this insight to identify the specific applications, projects, teams, and departments driving your cloud costs.

Budgeting is another area where this insight could be impactful. You can review past usage patterns and cost information to help you predict future usage patterns.

2. Cloud cost optimization

Once you’ve identified key metrics from your usage bills and cloud operations, CFM can help you control, optimize, or reduce cloud-related costs.

Optimizing costs involves identifying and removing unutilized resources, redundant integrations, and wasteful processes. Yet, if you don’t have enough visibility into your cloud resources, you won’t be able to know where you can pull strings to cut costs without sacrificing system performance. But, full visibility can help you identify multiple options for cost minimization.

With this granular cost insight, you can easily group and consolidate different resources, downscale packages, share resources across different departments, or even build a cost-efficient hybrid system like this:

3. Create and stick to a cloud budget

You can define an accurate cloud budget based on your past usage patterns and business growth plans. Once you set a budget, automated tools check your spending against your predefined limit to ensure you don’t exceed your budget.

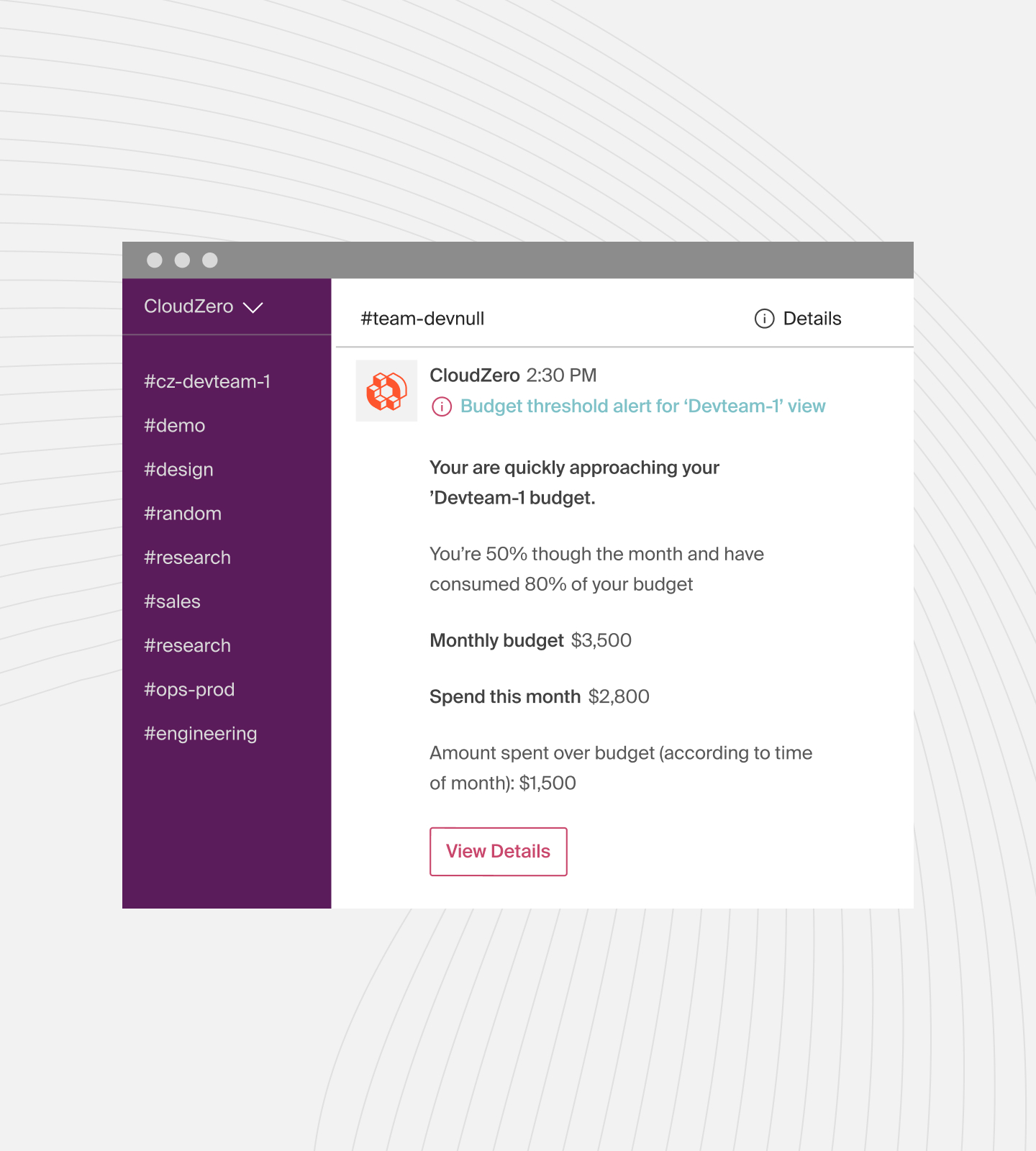

But, if costs increase, some CFM platforms, like AWS, provide cost anomaly detection. This alerting feature detects trending cost metrics in your infrastructure, flags them, and sends an email alert to the designated individual or team.

Other advanced platforms, like CloudZero, allow engineers, finance, or DevOps teams to receive timely cost alerts via Slack, email, or text.

Cloud Financial Management Vs. FinOps: What’s The Relationship?

As you might have noticed from our FinOps guide, Cloud Financial Management and FinOps share many characteristics.

How do the two differ, then? Do they have a connection, or do they run on their own?

FinOps, short for Financial Operations, combines procedures and tools that continuously seek to balance performance, innovation, software quality, and cost savings in the variable cloud spending model.

Yet, monitoring cloud costs doesn’t necessarily have to be your principal focus. Instead, you could structure your FinOps to prioritize business productivity parameters, like delivery speed, with cloud costs as a secondary consideration.

Regardless of which priority sequence you follow, FinOps’ fundamental objective is to provide business stakeholders with comprehensive cost insight and visibility into cloud operations.

Using that insight, you can then make strategic decisions on what to optimize to increase your profit margin.

The FinOps Foundation summarizes all of this as a cycle of three fundamental phases:

- Inform

- Optimize

- Operate — covered in full detail here

As the FinOps Foundation explicitly indicates, FinOps is a short form for “Cloud Financial Operations,” “Cloud Financial Management,” or “Cloud Cost Management.”

What Cost Factors Should Teams Monitor?

FinOps teams should prioritize the following during Cloud Financial Management processes:

The business value of the cloud

CFM’s primary objective is to help organizations realize the cloud’s business value. Therefore, your system must balance quality, cost, and performance.

For example, rather than reducing costs by randomly downscaling resources, you should target specific areas that, when cut, will still ensure optimal performance, operational resilience, and business agility.

Avoid overspending

You need a budget to guide your cloud services usage. Cloud budgets can be tricky to create because there are many unknowns. For example, the cloud is highly dynamic, with parameters and resource needs that are constantly changing.

However, you can use a cost tool to collect cost and usage metrics in your cloud environment. By analyzing that historical data, you can better allocate resources at the start of the next AWS billing cycle to avoid guessing how the following cloud bill will turn out.

To further prevent overspending, you can set up an automated alert system informing you of changing real-time cost indicators before you exceed your budget.

About shared costs

Cloud Financial Management isn’t just about optimizing the costs of dedicated resources and assets; it should also encompass shared resources. Yet cloud platforms typically don’t provide functionality for viewing and managing shared costs.

AWS Cloud Financial Management offers some tools for tracking shared costs. However, FinOps teams can use advanced solutions like CloudZero to track separate user groups, review each group’s usage costs, and allocate resources accordingly.

Cloud waste

The more you track resource use and corresponding bills, the more you can spot cloud waste. Cloud waste refers to underutilized, overutilized, or unused cloud resources progressively adding to your bills.

While some cloud waste instances are apparent, others are not. You might see a resource allocation as underutilized, only to see it negatively impact your overall performance after terminating it.

Be careful not to jump to conclusions. Instead, you’ll want to rely on solid CFM data to inform your decisions.

Cloud Financial Management Best Practices

Organizations never follow the same CFM procedures. They differ considerably in structure, architecture, scope, tools, and goals among cloud users. Still, there are some standard best practices that organizations in any industry can use to improve their Cloud Financial Management efforts.

Here are some of the best practices that can make all the difference and help you succeed in Cloud Financial Management in AWS or another platform:

1. Establish clear goals

Each organization has different goals and priorities. So, the first step is to establish a clear set of goals based on your business’s unique needs, such as operational scale, technical expertise, and budget.

As a startup, you might need a cost-effective CFM plan that focuses on launching products to drive market penetration.

A fast-growing company on AWS may want to create a CFM strategy that prioritizes scalability with cost controls to protect margins.

More established enterprises in highly competitive industries might prioritize cost savings and feature release optimization.

There are countless possibilities here. So, don’t settle for a generic plan when you can create one that caters to your specific growth and profitability needs.

2. Always collaborate

It takes more than one person to implement a solid CFM strategy. It isn’t an operation for a single team or department, either. It is an entire organization’s effort.

For example, the cloud strategy team determines the business results of adopting the cloud.

The cloud governance manager mitigates cloud risks by developing and managing cloud usage policies. Engineers innovate new features to attract and retain customers. Finance teams are responsible for ensuring cloud investments return a healthy ROI. Yet these interests tend to conflict, especially between them.

One way to solve this is to align the organizations’ different stakeholders. Here’s how to effectively align engineering and finance teams.

3. Automate your way to increased productivity, fewer errors, and quicker cost savings

As public clouds grow, they become more complex and dynamic. For example, AWS offers On-Demand Instances, Spot Instances, and Reserved Instances, which are different pricing models for AWS compute services.

While users appreciate these choices and the resulting flexibility, taking advantage of the right plans for specific needs in real-time can be challenging. Automated software tools can help here.

A robust cost tool can help you automate cloud cost monitoring, reporting, and cost anomaly alerting. That’s not all.

You can also automate the entire lifecycle — from goal setting and resource tracking to cost optimization and incident resolution — when you combine a cloud provider’s native tools with advanced third-party tools.

4. Trade traditional cost management for cloud cost intelligence

Most cloud cost management tools get a bad rap for over-relying on clunky traditional approaches that do not make CFM easier, faster, or more actionable.

In contrast, cloud cost intelligence is a modern approach to Cloud Financial Management that enables cost-conscious teams to detect, monitor, and control cloud costs with precision.

Instead of simply viewing their total cloud costs, teams can use this method to view how much each individual customer, development team, engineering project, or product feature cost them in a given month.

AWS does offer several native tools that can be helpful for CFM. Notable examples include AWS Cost and Usage Report (CUR), AWS Budgets, and AWS Cost Explorer. These are also free if you operate in the AWS cloud.

The problem with them is they do not provide granular costs that can help:

- Engineers identify which engineering projects, teams, or product features are driving cloud cost changes.

- Finance professionals set the right pricing to cover their cost of goods sold (COGS) and improve profitability.

- CTOs and CFOs identify who, what, where, and how their cloud budget is spent.

- Executives compare their cloud costs with similar companies to improve their gross margins and attract investors.

AWS billing and usage reports are also quite complex, particularly when tracking shared resources and tenants. AWS cost management tools also struggle to analyze cost metrics from untagged and untaggable resources, as well as multi-tenant environments.

But, there is a better way.

Leverage Cloud Cost Intelligence To Modernize Your AWS Cloud Financial Management

Using CloudZero, a full-featured cloud cost intelligence platform, you can discover cost metrics that are hard to measure using traditional AWS cost management tools.

The CloudZero platform empowers engineers, finance, and executives to measure unit costs, such as COGS, cost per customer, cost per product, cost per feature, cost per development team, and more.

Using CloudZero’s real-time cost analysis, engineers can make cost-effective architectural decisions during development, ensuring they proactively build cost-effective solutions.

Cost-conscious engineers can also easily align with finance and participate in cloud decision-making.

Engineers almost always notice cloud cost anomalies before finance teams do. CloudZero empowers engineers to understand costs and receive anomaly alerts so they know what to do when they notice abnormal indicators—rather than waiting until finance can no longer do anything about it.

And you won’t be going it alone, either. You also get access to ongoing advice from an expert Cost Intelligence Analyst. This will be your personal FinOps expert to consult and support you with setting up and getting the most out of CloudZero.

Whether you’re a startup looking to grow revenue, a scaleup looking to attract investors, or an enterprise seeking higher profits, CloudZero’s approach fits every budget and scale.

Upstart was able to reduce cloud costs by $20 million. MalwareBytes now saves 6 to 9 hours weekly on managing costs. Drift’s savings are nearing $4 million. Here’s your chance, too.  to experience CloudZero for yourself.

to experience CloudZero for yourself.