Over the past decade, businesses have flocked to the public cloud, with the promise of faster innovation, improved scalability — and of course, cost savings.

Yet for many companies, the reality of cloud migration has been a different story.

CFOs are blindsided by high costs and uncontrolled spending. Meanwhile, engineering teams struggle to justify and explain their spend — often frustrated that finance doesn’t understand, even when spend is growing healthily along with the business.

As a finance professional myself, now immersed in the cloud cost world — I’ve experienced this disconnect between engineering and finance firsthand. It usually stems from a lack of shared language and metrics. Finance sees a big, unpredictable number on a bill, but has no context for whether the investment is driving growth and how much is “too much” — while engineering is ordering off a menu with no price tags.

However, when the two teams are able to successfully bridge the gap and create a shared understanding of cost, the business benefits. Everyone can make decisions to drive better business outcomes, higher margins, and resilient growth.

In this article, I’ll cover the key metrics that finance and engineering can use to create a shared cloud cost language — which can serve as the foundation for optimizing spending or proactively building more cost effective products, without disrupting innovation.

The article will answer the following questions:

- What levers should management focus on to drive the business?

- How can we get all of our teams on the same page?

- What can be improved about how we look at cloud cost?

- What is the impact on cash and profit/loss?

The Cloud Flipped Procurement Upside Down

Before diving into specific recommendations, I’d like to start with why there’s such a disconnect. Much of it starts with the fact that the costs in the cloud are variable, whereas on-premise, costs were fixed.

In an on-premise data center model, when an engineering team needed to purchase more servers, they needed to go through a full procurement process. Finance had complete visibility and control over purchases. At the same time, engineering needed to either use what they had or request, then wait for, more servers.

While this forced them to think about ensuring their software was efficient, it also made it nearly impossible to grow rapidly because it took time to procure and set up servers needed to scale.

Today, engineers working in the cloud choose the resources they need in order to do their work and finance gets the bill after the fact. Then, as customers interact with the software, the bill is driven higher as more resources are used.

To put it into real-world context — in the on-premise days, if your website unexpectedly went viral, it crashed. In the cloud, it doesn’t crash, but you will receive a bigger bill. There’s a tradeoff in the cloud: With unlimited scale, there’s also unlimited cost.

Whether Your Bill Goes Up Or Down Isn’t A Good Measure

The cloud gives you the flexibility to grow and contract with your business — and helps you quickly spin up resources you need to innovate and grow.

For that reason, tracking whether or not your bill is growing, isn’t a good measure of whether or not you’re spending too much. If you’re growing your customers and revenue and adding new functionality to your product, your bill should be growing too.

I often hear from finance leaders, “Our cloud bill is huge!” or “Our cloud bill grew 30% — we need to do something about it.” But what those two statements are missing is business context.

On one hand, those companies might be wasting money because their engineers build inefficient architecture and leave all their R&D instances on. On the other, they could be spending 30% more because they improved their user experience, drove up customer utilization rates, and significantly reduced churn as a result.

Cloud Economics: Putting Cost Into Business Context

So how can you start putting your cost into context and start answering these questions? The answer is Cloud Economics.

Cloud Economics is the study of cloud production, consumption, and distribution. When done correctly, it can improve interdepartmental communication, increase visibility, and enable you to optimize cloud spending.

When you’re looking at your bill from a cloud economics standpoint, you’re not simply reacting to whether it went up or down. You’re looking at the variables that could be impacting the bill before jumping to conclusions. This could include agents, markets, interactions, and outcomes of those interactions.

The Cloud Efficiency Metric

The first and most obvious context to apply to your cost is your company’s growth. In other words, you’ll want to know whether you’re growing efficiently and achieving economies of scale as your company grows.

The metric we recommend is cloud efficiency. Cloud efficiency not only tells us whether our cloud spend is “healthy” for our business, but it can provide valuable intelligence for go-to-market decisions, like how to price and package products for maximum cash flow and net income.

Here are some examples of the insights you may want to investigate as you track cloud efficiency.

What to do when you’re becoming less efficient:

When your cloud efficiency metric increases (meaning, you’re becoming less efficient), you’ll want to start by looking at your cost per customer.

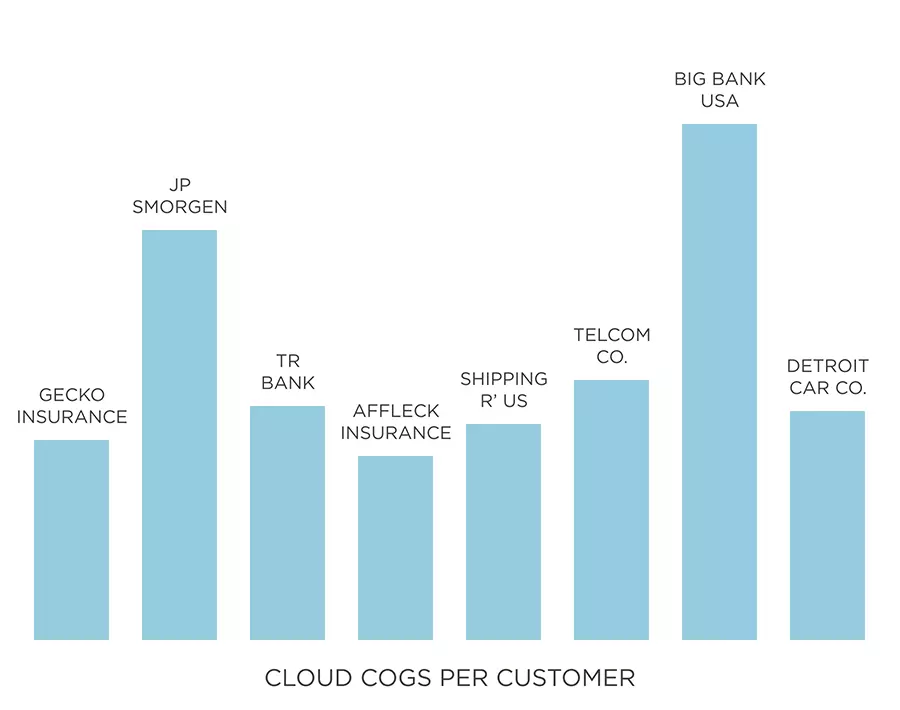

For example, let’s say your customer base resembles this:

You have two clear outliers. You may want to ask yourself:

- Does our current contract with these customers have wide enough margins? Should we adjust at renewal?

- Is there anything unique about these two accounts? Are they new customers or has their cost per customer changed over time?

- Is there anything specific about the banking vertical that’s driving these costs up? Should we consider packaging differently for this vertical? Or should we not sell to banks in the future?

There are any number of directions you may take your investigation to understand what’s driving the cost — and what you should do about it.

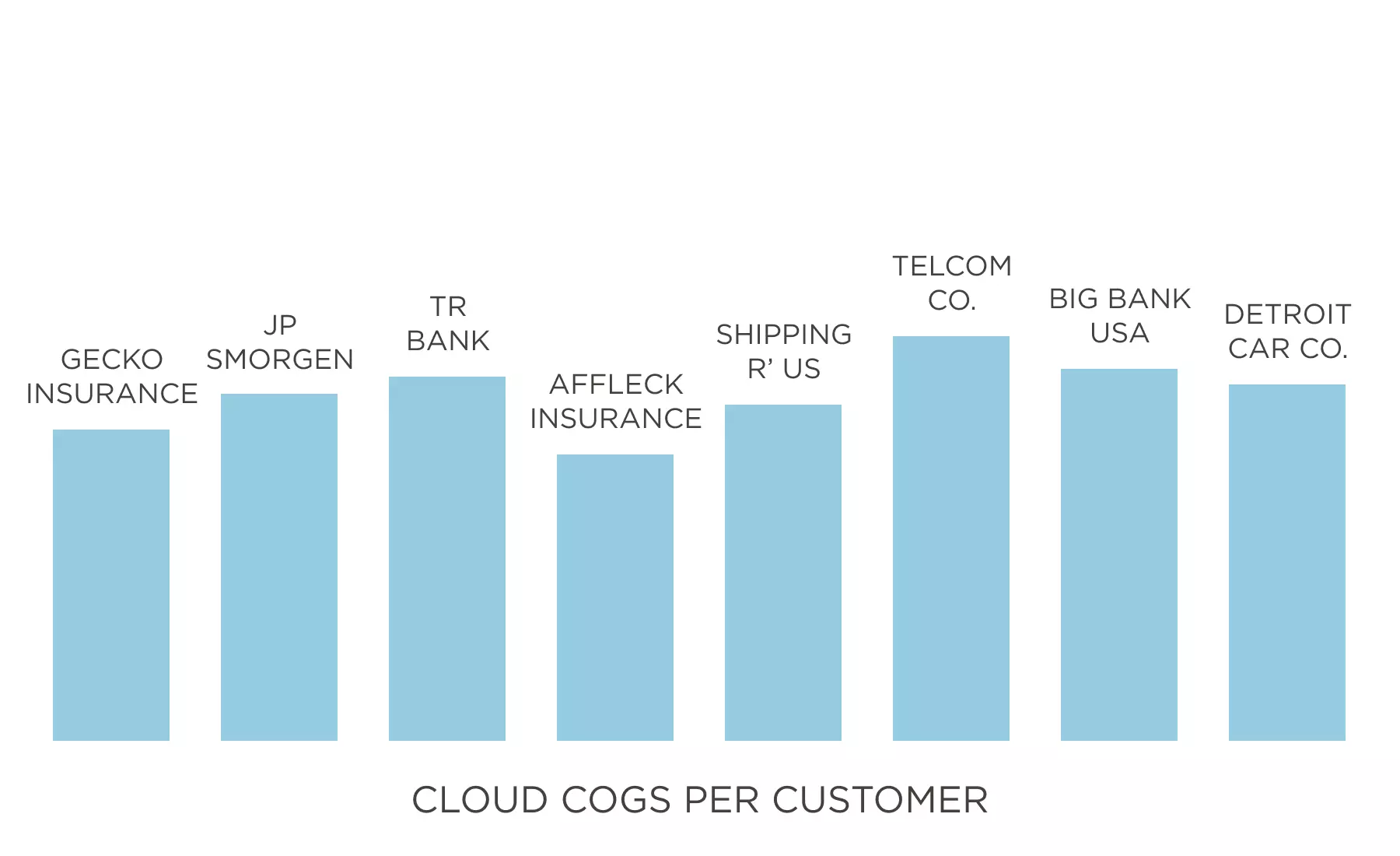

On the other hand, your cost might look something like this, without much variability from customer to customer and an increase across the board.

In this case, you may want to ask:

- Have we added new features that are driving additional cost?

- Has engineering changed its deployment or governance strategy?

Similarly, if your cloud efficiency is improving, you may want to question whether there are specific customers engaging with the platform less — and why. Or, you may want to investigate whether engineering has made changes to make your cloud more efficient.

We should also note that while cost per customer is the best metric for many companies, there are business models where it makes sense to choose a different metric to represent growth. For example, if your company is a payment platform, you could choose cost per transaction or revenue per transaction.

The cloud efficiency model is the easiest way to determine whether or not your cloud spending is healthy or not. If your organization has multiple products, it might make more sense to look at your customer cost on a per product basis.

This metric can also be an easy, useful way to explain to a board of directors or shareholders why your cloud bill changes — and put into context how cloud spending correlates to revenue.

Cloud Research And Development

Another metric you can use to put cloud cost into business context is the return on investment (ROI) of your research in development (R&D). This one is simple and easy to calculate.

Historically, companies have used chargeback and showback to drive accountability in cloud spending – both of which have limitations. Chargeback — which means teams or business units essentially “pay” for their own resources — can create tension between departments and cause accounting nightmares. Showback — which means costs are made visible without actually charging the department — tends to be toothless and reactive.

Either way, businesses are looking at how much, arbitrarily comparing spend between departments, rather than the why and the ROI.

Instead, we recommend comparing the revenue of a new feature to how much it cost to build it.

This isn’t a perfect way of calculating ROI, and as with any project, it will never be 100% accurate. However, it’s a better way of comparing spend across business initiatives, products, and teams, instead of just looking at which were more or less expensive.

Once you understand which projects were more or less efficient, you can start to understand why. For example, you can investigate which engineering practices made them more efficient, so you can encourage other teams to adopt those practices.

Business Partnering And Data Accuracy

Now that we’ve covered a couple of metrics — you might be wondering how to get started. It’s important that you start with clean, accurate cost data, which requires partnering with engineering.

As a former finance professional, I know it’s not easy to get other departments on board with changes that will impact their day-to-day operations. The thought of tagging and allocating shared resources makes engineering teams cringe. So how do we get there?

The facts are simple—engineering needs to benefit from any solution on the table to get to cloud economics. Otherwise, engineering is unlikely going to buy in and keep the data clean and accurate. Then you’re right back where you started with miscommunication between departments, disputes about processes, meetings about meetings.

The best answer is for finance to be the best business partner it can be. Find a solution that works for Engineering, rather than one designed for finance.

If you shift the costs and visibility left to engineering, the most significant benefactors will sit in finance. This shift will ensure more data accuracy and make it easier for everyone to understand and discuss their cloud economics.