The Chief Financial Officer (CFO) role has expanded significantly due to technological advancements. Today, CFOs have more responsibilities than ever, managing everything from payroll to IT and software expenses. This requires new processes and the right tools to get the necessary cost data for making smart decisions and ensuring the company’s profitability.

With so many financial software options available, choosing the right one for each financial task can be challenging. Whether it’s for payment processing, payroll management, or analyzing cloud costs, each area of financial management needs a specific tool.

This guide introduces 35 tools for CFOs, organized by financial category, to help you effectively manage software operating costs and support strategic decision-making.

Cloud Cost Management Tools

CFOs whose companies are either migrating to or operating in the cloud must fully understand all the associated costs. Yet, optimizing your cloud costs and/or seeing exactly how costs relate to business outcomes can be nearly impossible from simply reading the bill provided by your cloud platform.

These tools help you understand, measure, and optimize your cloud spend.

1.CloudZero

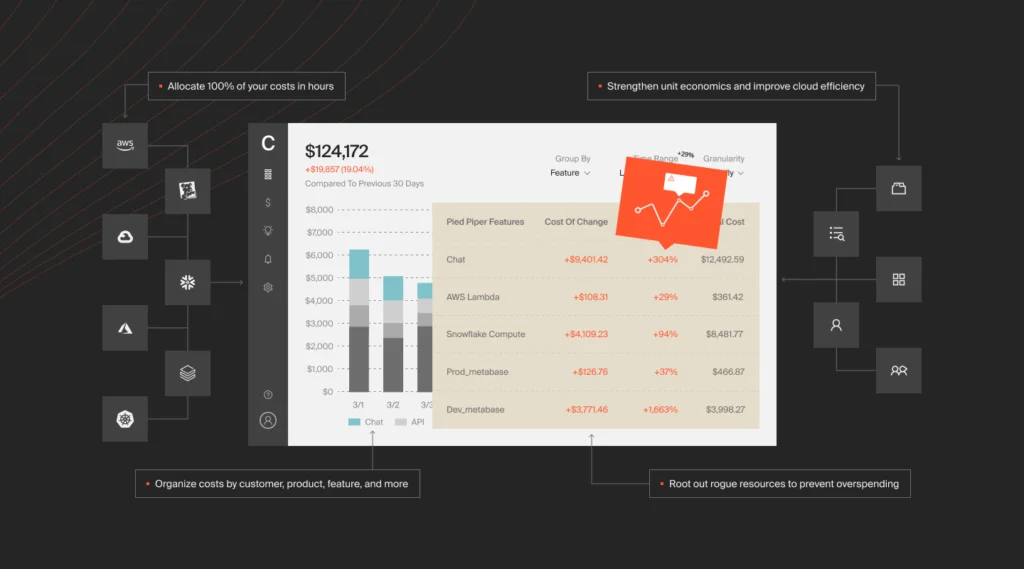

CloudZero is not your traditional legacy cloud cost management tool. Rather, CloudZero is a full-fledged cloud cost intelligence platform that enables SaaS and tech brands to map their cloud spend to business outcomes.

With CloudZero, teams can see exactly what they are spending on AWS and why and map cloud spend to products, features, customers, dev teams, environments, and more.

CFOs and finance teams can finally answer questions like:

- Who are our most expensive customers?

- What is our average cost per customer?

- How much does this specific feature cost our business?

This is important because part of a CFO’s job is to present financial data to support decision-making. With this information, companies can make decisions to:

- Adjust pricing across different customer segments to ensure profitability

- Rearchitect software to optimize costs for different segments

- Remove features from specific pricing tiers that drive added costs

CloudZero is the cloud cost intelligence platform you need to make informed business decisions. To see it in action, schedule a demo today.

Pricing: Upon request

2. ParkMyCloud

ParkMyCloud is a cloud cost management solution that allows you to optimize your public cloud spend. It monitors your usage data to reveal idol and over-provisioned resources. ParkMyCloud then automatically takes action for cost optimization.

You can use ParkMyCloud to manage AWS, Azure, Google Cloud, and Alibaba Cloud.

Pricing: Free plan, Standard plan – $3 per instance per month, Pro plan – $4 per instance per month, Enterprise plan – Pricing provided upon request

3. ProsperOps

ProsperOps helps CFOs get the most out of AWS. The tool helps AWS customers manage their reserved instances and optimize cloud spend. Optimizing your AWS costs takes a lot of knowledge and time; ProsperOps makes it easier.

Pricing: AWS Savings Analysis – Free, Autonomous Cloud Savings – Upon request

Enterprise Resource Planning Systems (ERPs)

Enterprise resource planning systems (ERPs) give CFOs a unified view of all enterprise data in real-time. They enable you to evaluate your business’s performance against key performance indicators (KPIs) and identify trends through predictive analytics. You can use this information to make timely and effective business decisions.

The following ERPs will help you ensure revenue growth, rationalize costs, keep up with regulatory change, and meet your financial goals.

4. Acumatica

Acumatica is a 100% web-based ERP and requires no plugins. This makes it accessible from anywhere. It has a clean, slick interface that utilizes a flat design, and the software supports multi-factor authentication.

Acumatica allows you to control and manage your organization’s finances, banking, sales, purchases, and receivables. You can view and alter your budgets, financial statements, processes, and preferences through one solid user interface.

Pricing: Feature-based. Contact Acumatica for more details.

5. FinancialForce

FinancialForce is a cloud-based ERP service that’s been around for over seven years. FinancialForce helps organizations connect their front and back offices. This facilitates a seamless hand-off from sales, service delivery to finance. The platform allows you to easily automate any and all revenue streams as your business grows.

FinancialForce’s main selling point is that it is customer-centric. It offers flexible billing solutions for any product or service. You can forecast and measure projects with exceptional visibility.

FinancialForce makes it all possible with its powerful resource and project management tools.

Pricing: Upon Request

6. Infor SyteLine

Infor SyteLine provides you with easy access to timely information about your business, customers, and the shop floor. It also allows you to collaborate with your fellow employees quickly. As soon as you log into Infor SyteLine’s cloud application, you are presented with your production homepage, where you can find detailed information about your operations.

It will show you the value of your jobs, resource utilization, hotlists, and more. The user interface is clean, slick, and easy to navigate. Infor has been in business for two decades. If you’re looking for an ERP solution from a company with experience, you should consider SyteLine.

Pricing: Upon request

7. NetSuite

NetSuite provides a cloud-based ERP solution tailored for fast-growing businesses. The platform includes applications that handle finances, orders, production, and supply chains.

It integrates all aspects of a multi-channel, multi-location business into one system.

Pricing: Custom pricing.

8. Microsoft Dynamics 365

Microsoft Dynamics 365 merges CRM and ERP with AI tools and productivity apps. It transforms business processes and enables personalized customer engagement. This spans sales, customer service, and marketing.

Pricing: Varies depending on the selected modules. Basic Dynamics 365 apps start at $50/user/month.

9. SAP ERP

SAP ERP is a leading financial and human capital management software. It helps large enterprises streamline operations and analyze real-time business data.

Pricing: Upon Request

10. Workday

Workday provides enterprise cloud applications for finance and human resources, helping customers adapt and thrive in a changing world. While it offers strong human resource management capabilities, its scope extends beyond HR to include finance, planning, spend management, and analytics. Its suite of enterprise cloud applications supports a wide range of business functions, making it a versatile tool for managing various aspects of an organization’s operations.

Pricing: Custom pricing

Accounting Platforms

CFOs need access to the best accounting tools to manage company finances effectively. Excel spreadsheets and manual data entry are outdated. Not only do modern accounting platforms help you keep track of your ledger balance, but they also allow you to create quotes, invoices, and financial reports, as well as keep track of projects.

A well-built accounting platform may even replace the need for separate ERPs or payment processing tools. If your business can’t afford a dedicated in-house accounting team, some of these platforms allow you to outsource. Nevertheless, here are three of the best.

11. Xero

Xero has been around since 2006, and since then, it has been at the forefront of cloud-based accounting software. Xero’s dashboard is designed to show your business at a glance.

It will instantly show you how much cash you have in the bank, which customers haven’t paid their invoices, and which bills you still owe. It will also help you monitor important figures such as revenues and wages. Xero is arguably the best accounting software for CFOs.

Pricing: Starter – $20 per month, Standard – $30 per month, Premium – $40 per month

12. Accountancy Cloud

In terms of accounting software and services, Accountancy Cloud is relatively new. The software provides a live view of your business’s financial health and a dashboard focused on simplicity and ease of use.

Additionally, they have an in-house finance team that will support you with any questions or issues. Accountancy Cloud makes bookkeeping, payroll, tax, and year-end reviews easy.

Pricing: Core – $565 per month, Plus – $750 per month, Growth – Custom Pricing

13. FreshBooks

Freshbooks is an online-based accounting software that allows you to organize your business’s finances. It is mainly targeted at small businesses and start-ups. However, large organizations may also benefit from using Freshbooks.

The software features comprehensive invoicing where you can set up payment and link it to your various accounts. Additionally, you can add your daily expenses and categorize them according to specific account titles. Freshbooks also allows you to generate detailed reports, including financial reports, collection reports, and accounts receivable reports.

Pricing: Lite – $6 per month, Plus – $10 per month, Premium – $20 per month, Select – Custom Pricing

14. Spendesk

Spendesk is a smart spend management platform for businesses. It automates expense reports, manages company cards, and provides spending visibility. This empowers teams with real-time budget control and thorough expense tracking.

Pricing: Plans start from $100/month, with custom pricing for larger enterprises.

15. Expensify

Expensify automates expense reporting, from receipt scanning to reimbursement. This simplifies expense management for your company.

It also makes tracking and organizing expenses easier without manual entry.

Pricing: Starts at $5/user/month for the team plan, with a corporate plan available.

16. Rydoo

Rydoo helps finance teams manage expenses from submission to reimbursement. The tool provides real-time control over company spending. This automates expense management, reducing tasks and improving compliance.

Pricing: Various pricing plans

17. Pennylane

Pennylane is a finance management solution that helps CFOs oversee business finances. It rationalizes data consolidation on a single platform by integrating with third-party services for banking, receipts, and billing.

Additionally, it offers fintech products like professional banking and payment cards, providing a one-stop solution for financial management.

Pricing: Custom pricing

Payment Processing Tools

Payments are the lifeblood of business. As such, picking the right payment processing tool for your organization is important. A good payment processing solution should offer mobility, cost-effectiveness, and be connected to all aspects of your business.

However, despite the name, modern payment processing tools aren’t limited to facilitating the trade of legal tender. Some also offer reporting, inventory management, invoicing, and website building. Here are three of the best.

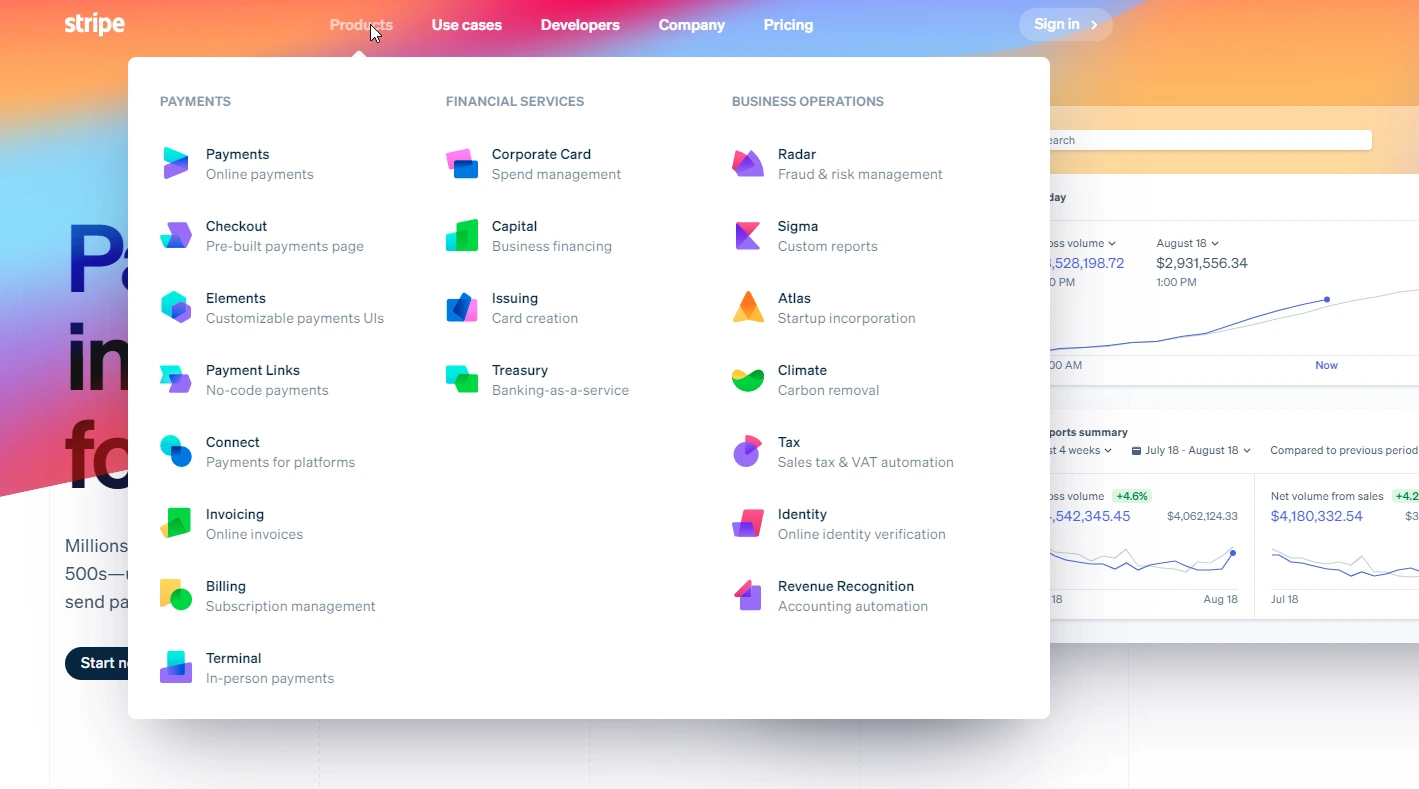

18. Stripe

Stripe powers payment processing for companies such as Amazon, Google, and Uber. It’s currently used by over 100,000 websites globally, processing over 100 different currencies.

Stripe has become the industry standard at this point.

Pricing: Integrated – 2.9% + 30¢ for every successful card charge, Customized – Contact sales

19. Square Point of Sale

Square Point of Sale is perfect for lean start-ups. It allows you to convert any mobile device into a point-of-sale device. All you need to do is download the app, sign-up, login, and then create a list of all your items and products. They’re displayed in a simple 5×5 grid.

Creating new items is a breeze. All it requires is a series of taps. Square Point of Sale’s user interface is seamless and intuitive. Not only does it facilitate physical payment processing, but it allows you to build a website and process payments online.

Pricing: Offers free plan and custom pricing

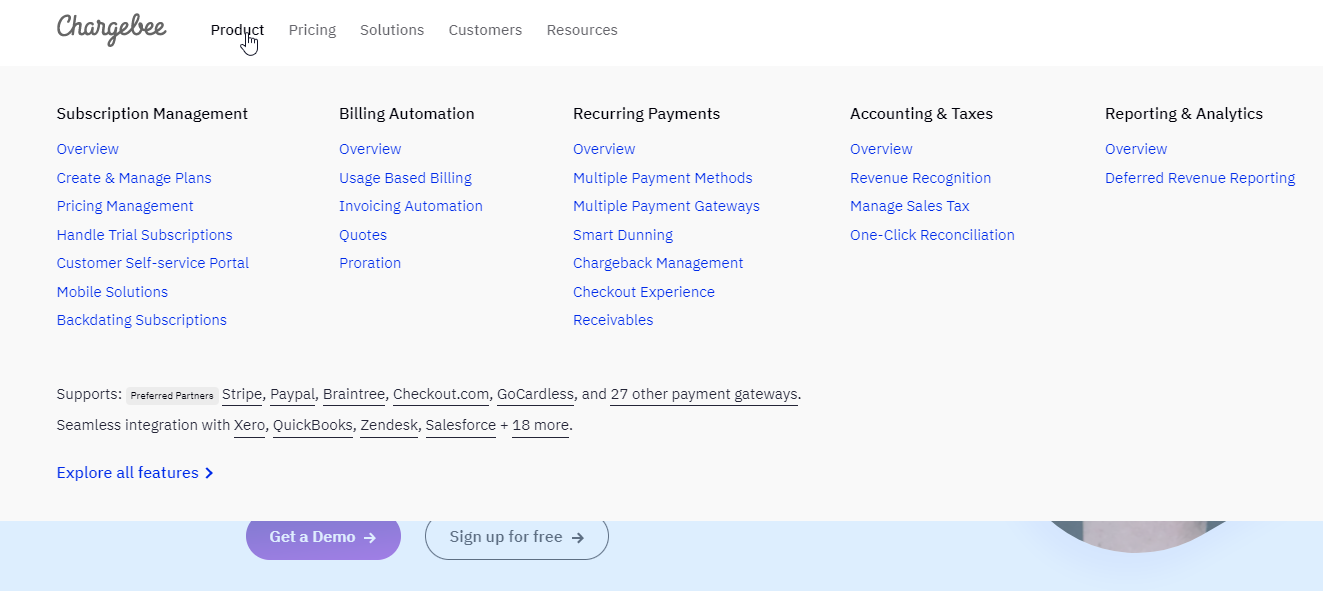

20. Chargebee

Chargebee is a cloud-based software solution that enables you to manage your subscriptions, billing, and revenue operations. It is a great tool for SaaS and subscription businesses. The platform automates and optimizes the subscription billing and management process for you.

Chargebee also helps businesses with reconciliation. It will automatically import transactions from your payment gateway into your accounting software. Additionally, it automates the entire invoicing process, including tax management and prorations, so customers always receive wholly accurate and compliant invoices wherever they are.

Pricing: Launch – $0, Rise – $249/month, Scale – $549/month, Enterprise – Custom Pricing

21. Wise

Wise provides borderless banking with live rates and low fees. Businesses and people can send, spend, and receive money globally.

Wise integrates with your financial workflow, making international transactions more transparent and cost-effective.

Pricing: Pay only for what you use, with upfront fees and no subscriptions.

Payroll And Human Resource Platforms

The bulk of a company’s capital is often distributed among its technology and personnel. It is pretty common for a CFO to be involved in a company’s talent management, considering how much of its success hinges on it. Even if they’re not responsible for hiring or vetting, CFOs still need to understand that capital is distributed among human assets.

Among other things, the following platforms allow CFOs and managers to track employee performance and gauge how much each one costs or benefits the organization.

22. CloudPay

CloudPay is a global payroll platform that uses advanced analytics and robotic process automation. It features a unified calendar to organize your entire global footprint. It also allows you to view your payrolls within the payroll cycle. This includes deadlines and information for required activities.

You can select which payrolls you want to view on the calendar, allowing you to focus on a particular location or get a complete global view. CloudPay can also be integrated with HCM platforms like BambooHR. It will receive data automatically when a submission deadline nears. This will allow you to easily manage and view the payroll for all your company’s employees.

Pricing: Upon request

23. ADP Workforce Now

ADP Workforce Now is a cloud-based HR suite that makes it easier to manage your workforce. As you look for ways to enhance value within your organization, Workforce Now gives you the visibility you seek. In addition to time and attendance, talent management, and benefits administration, ADP Workforce Now features payroll management.

You can access all payroll features through a single unified user experience. It helps you complete routine tasks or specialized payroll runs with extraordinary accuracy and speed.

Additionally, it enables you to summarize data quickly through presentable visualizations.

Pricing: Upon request

24. Gusto

Gusto is an online platform that can be used to run your business’s payroll. Payroll and benefits systems today can be overly complex. They require too many manual tasks and use language that only payroll and tax experts can understand.

Gusto was built to be intuitive and straightforward. It uses a simple, clean, and organized user interface.

Pricing: Core – $39 per month (+$6 per person), Complete – $39 per month (+$12 per person), Concierge – $149 per month (+$12 per person)

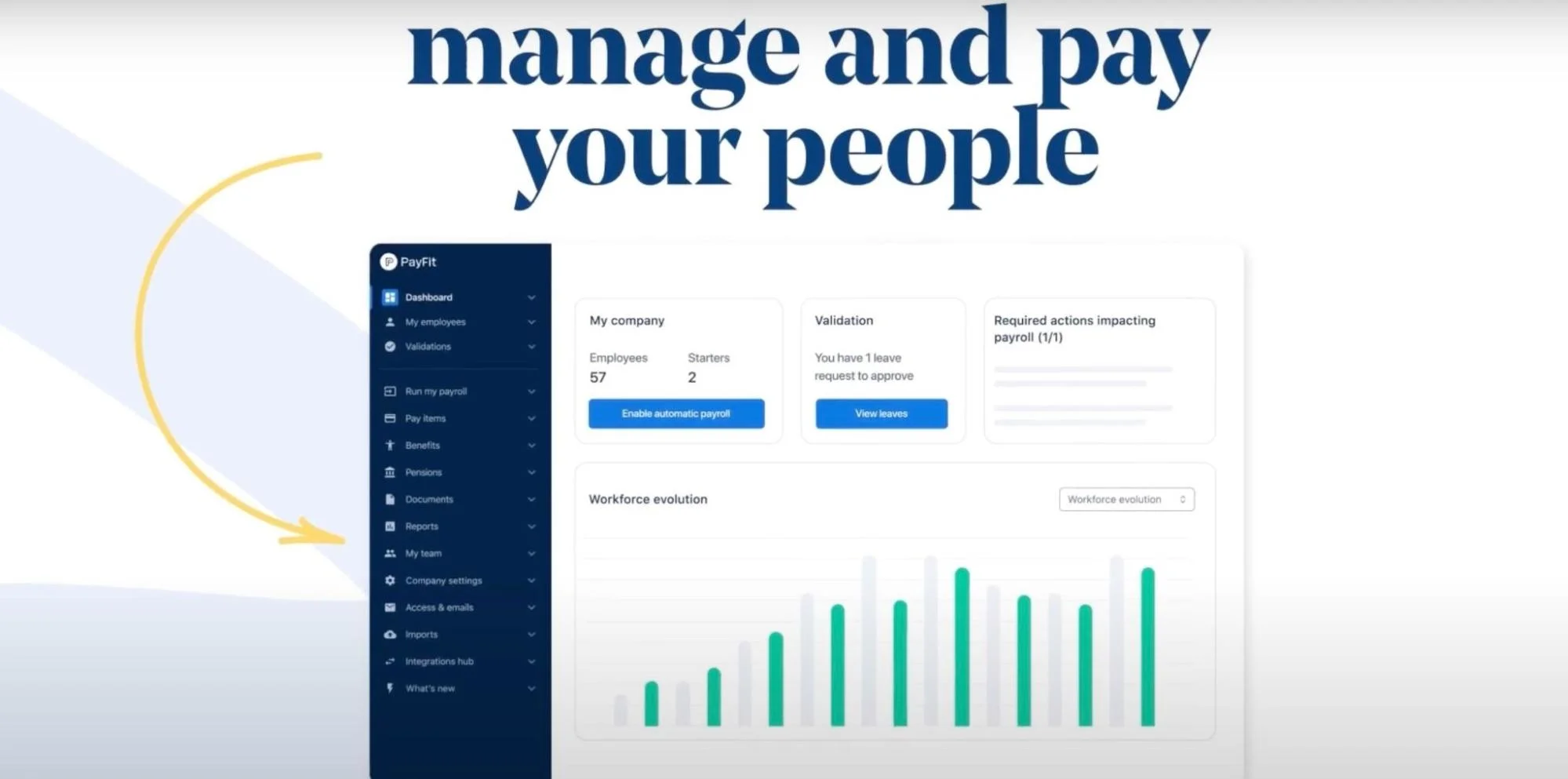

25. Payfit

Payfit is an innovative HR management solution that digitizes and breaks down payroll processing.

Businesses can use Payfit to automate payroll operations. Payfit ensures compliance with local tax and social security regulations, improving efficiency.

Pricing: Custom pricing

26. BambooHR

Bamboo HR specializes in HR software for small and medium-sized businesses. It offers tools for onboarding, compensation, culture, and analytics.

BambooHR optimizes employee data, enhancing the hiring process for more efficiency.

Pricing: Custom Pricing

27. Personio

Personio is an all-in-one platform that automates HR processes for modern businesses, enhancing workplace productivity. It delivers an exceptional employee experience by ensuring efficient and user-friendly management across all HR aspects, including onboarding, payroll, and performance tracking.

Its acclaimed feature is the ability to connect with over 180 apps, providing flexibility that improves workflows and data management across HR functions.

Pricing: Flexible pricing

28. Breezy HR

Breezy HR is an applicant tracking and recruiting solution that modernizes the entire hiring process for companies of any size. By transitioning from traditional paper resumes to a fully digital hiring approach, Breezy HR enables businesses to automate labor-intensive tasks.

Breezy HR offers customizable pipelines, allowing for detailed planning of various hiring stages, from phone interviews to on-site evaluations. Its visual workflow ensures candidates do not fall through the cracks, enhancing team collaboration on each candidate’s progress.

Pricing: Free starter plan available, with paid plans .

29. Paychex

Paychex offers solutions that simplify handling HR, payroll and benefits. By combining advanced digital HR technology with expert advisory services, Paychex efficiently addresses the changing needs of employers and their employees.

Paychex is renowned for its human capital management solutions, including payroll, benefits, human resources, and insurance services, marking it as an ideal partner for businesses seeking effective workforce management strategies.

Pricing: Custom pricing based on services selected and company size.

30. Patriot

Patriot is a software provider that caters to small businesses with a variety of services, including payroll, accounting, HR data management, and time tracking.

The payroll service allows for unlimited runs for various pay schedules and rates across multiple U.S. locations. An upgrade to the Full Service plan provides businesses with the convenience of tax filing and payment services at the federal, state, and local levels, making financial and HR tasks more manageable for small business owners.

Pricing: Payroll starts at $10/month + $4 per employee, with a free trial available.

Data Analytics and Business Intelligence Tools

Data analytics and business intelligence tools are essential for CFOs aiming to steer their organization’s strategy and financial performance. These platforms transform raw data into actionable insights, facilitating informed decision-making and offering a competitive edge. By enabling detailed analysis, enhancing data visualization, and simplifying data preparation, these tools help finance leaders identify trends, optimize operations, and accurately forecast financial outcomes. Here are the best tools.

31. Microsoft Power BI

Microsoft Power BI pools reports for CFOs, offering a detailed view of finances. The reports include actual and budgeted figures from the General Ledger.

It also covers bank balances, revenue distribution, customer credit, expenses, purchasing patterns, and more. Power BI helps CFOs make informed decisions, cut costs, boost revenue, and enhance profits. It also aligns financial operations with the organization’s strategic goals.

Pricing: A free version, with Power BI Pro, starting at $10/user/month. Check out other pricing plans here.

32. Tableau

Tableau equips finance departments with the tools needed to make timely, major decisions and improve resource allocation. It simplifies financial analysis, providing deep insights and greater value from data. This enhances organizational strategy, reducing costs and increasing revenue, thus improving the bottom line.

With an intuitive interface and powerful analytics, Tableau helps finance leaders cultivate a data-driven culture emphasizing informed decision-making.

Pricing: Plans start at $15 per user per month for Tableau Viewer. Advanced options are also available.

33. Rudderstack

Rudderstack (previously Blendo) is one of the top ELT platforms. It collects data from various sources into one warehouse.

Rudderstack helps CFOs combine sales, marketing, and product data into financial analyses. It creates smooth connections between the data warehouse and business tools. This integration capability removes the requirement to search different databases manually.

Pricing: Open-source with free usage tier; custom pricing for enterprise features.

Travel and Expense Management

CFOs use advanced tools to manage travel budgets, replacing manual tracking. Travel and expense management tools offer detailed insights into spending patterns for financial planning.

These tools improve employee travel, ensuring safety, comfort, and meeting financial goals. Here is the best.

34. TravelPerk

TravelPerk provides businesses with an all-in-one platform for travel management. It combines ease of use with powerful functionality. It covers booking flights, managing itineraries, and providing real-time data for financial decisions.

CFOs can use TravelPerk to manage their travel effortlessly. It supports the company’s bottom line and employees’ well-being.

Pricing: Features various plans

Equity Management

Equity management tools facilitate a company’s asset and liability balance. They also handle issuing equity, maintaining compliance, and managing cap tables. CFOs use these tools as a central hub for all equity-related activities. This reduces the need for constant legal oversight.

They aid in decision-making by offering clear insights into the company’s capital structure. Here’s the best.

35. Capdesk

Capdesk, (now Carta) is an equity management software that helps companies manage their equity, stock options, and cap tables. The platform assists CFOs, finance teams, and founders track ownership, manage equity, and ensure compliance.

Capdesk also benefits startups and growth-stage companies by providing accurate, real-time equity data.

Pricing: Features various pricing plans

Picking The Perfect CFO Software Stack

The role of a CFO is exceedingly demanding, especially in the tech and SaaS industries. CFOs must manage employee, accounting, business, operating, and software financials. Tools like Gusto and Xero are well-known platforms that make it simple and easy to manage payroll and your accounting books, respectively.

However, for tech and SaaS brands operating in the cloud, determining your COGS, unit cost, cost per customer, and other important financial metrics related to your cloud spend is a much more complicated task.

Cloud providers, such as AWS, provide a monthly bill showing how much you’ve spent that month on their services but not how and why. Additionally, seeing how those costs translate to the business metrics you care about is impossible with the tools offered by your cloud provider.

That’s where a cloud cost intelligence platform, like CloudZero, can help.

CloudZero enables companies to drill into cost data from a high level down to the individual components that drive their cloud spend — and see exactly what AWS services cost them the most and why.

What’s particularly helpful for finance teams and CFOs is the ability to answer complex questions around cloud spend. Finance can measure their software COGS, cost per customer, feature, team, and more.

Ultimately, CloudZero enables your engineering teams to see the cost impact of their work and gives finance the cost data it needs to make informed business decisions.

to see how CloudZero can translate cloud spend to the business outcomes and metrics you care about.

to see how CloudZero can translate cloud spend to the business outcomes and metrics you care about.