As Azure grows more complex, the need for Azure FinOps tools that simplify financial management increases.

In this guide, we’ll explore the best Azure FinOps tools. These tools can turn your cloud spending into a strategic asset and help you tackle the common challenge of rising cloud costs.

What is FinOps in Azure?

FinOps (financial operations) is a collaborative strategy in Azure designed to reduce cloud spending and boost efficiency. It brings finance, tech, and business teams together, fostering a sense of involvement and value.

This teamwork helps companies understand and control their cloud expenses in real-time, ensuring they get the best value from every dollar spent on Azure services.

Azure FinOps isn’t just about cost management. It’s also about getting more value from Azure by making smart decisions that align with financial and operational goals. It focuses on cost transparency, budget accountability, and spending efficiency.

This ensures resources are used wisely and strategically, improving business performance. This approach reduces waste and supports growth and innovation by linking spending to business results.

Why is FinOps Important in Managing Spend in Azure?

Here’s why incorporating FinOps into Azure management is important:

- Cost visibility. FinOps provides clear visibility into Azure costs, helping organizations understand where and how their money is spent. This transparency is vital for identifying wasteful spending and opportunities for savings.

- Enhanced collaboration. FinOps fosters collaboration between finance, operations, and development teams. This cross-functional teamwork ensures that all stakeholders are aligned on budgeting, forecasting, and spending, which is crucial for managing cloud costs effectively.

- Budget optimization. With FinOps, companies can more accurately forecast and manage their Azure budgets. This proactive approach prevents budget overruns and ensures financial resources are allocated effectively.

- Cost allocation. FinOps helps attribute cloud spending to specific departments, projects, or teams. This detailed allocation supports accountability and can drive more responsible spending behaviors.

- Operational efficiency. FinOps enables organizations to balance cost with cloud performance by integrating financial metrics with operational performance. This ensures that cost savings don’t compromise service quality or user experience.

- Value maximization. FinOps isn’t just about cutting costs — it’s about maximizing the value from Azure investments. It ensures that spending aligns with business objectives and that companies get the most out of their cloud services.

- Scalability. As organizations grow, their cloud usage typically increases. FinOps provides the frameworks and tools to manage this growth sustainably, preventing costs from spiraling out of control.

- Regulatory compliance. Managing cloud expenditures with FinOps also helps adhere to compliance and regulatory standards by maintaining accurate and transparent financial records.

- Strategic decision making. With better insights into cloud spending and usage, executives can make more informed strategic decisions about technology investments and innovations.

- Cost predictability. FinOps introduces greater predictability into Azure spending. This predictability is crucial for long-term planning and investment in technology initiatives.

Best Azure FinOps Tools

Azure FinOps tools help manage and optimize cloud spending on Azure. They provide cost visibility, enable cost allocation, and support budgeting and forecasting. Here are the best Azure FinOps tools:

1. CloudZero

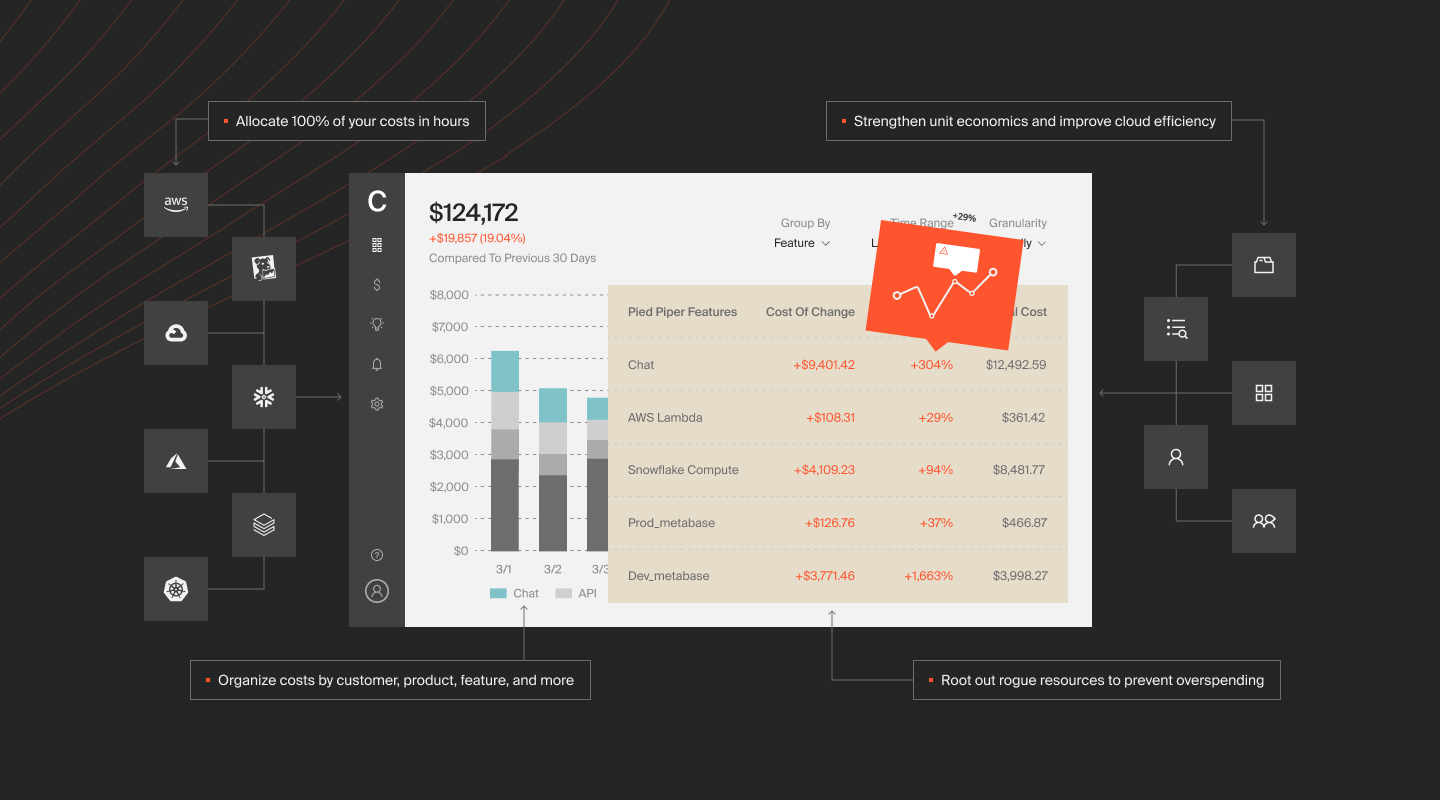

CloudZero is a cost intelligence platform that offers clear visibility into cloud expenses. It links costs to specific resources without extensive tagging. By embedding cost allocation within the code, CloudZero ensures precise tracking of every dollar spent. This is crucial for financial oversight in multi-cloud and software environments.

CloudZero provides business-oriented cost analysis and control measures. The platform alerts teams to unusual spending patterns via Slack, allowing immediate action to curb unnecessary expenses.

Granular insights benefit finance and engineering teams, product managers, executive leadership, and investors. CloudZero breaks down costs by product, feature, team, and project, giving stakeholders a clear view of financial data.

The platform also offers advanced forecasting tools and real-time cost tracking. It sends anomaly detection alerts to Slack or email, helping avoid budget overruns.

CloudZero’s integration with Azure is essential for enhancing cloud financial management. It aligns cloud spending with financial goals, maintaining budget discipline and operational efficiency. By providing actionable insights and proactive alerts, CloudZero supports effective cloud financial management.

2. Azure Cost Management and Billing

Azure Cost Management and Billing is a native Microsoft tool. It helps organizations manage and optimize their Azure spending by offering clear visibility and control over cloud expenses.

Its major features include a total cost of ownership (TCO) calculator, budget alerts, and a migration assessment tool. This suite is invaluable for cloud finance and DevOps teams. It provides visibility into cost responsibilities.

The tool integrates into the Microsoft Commerce system to manage billing accounts and Marketplace offerings. It also works with Power BI for detailed financial reviews and strategic planning.

Additionally, it can track AWS spending, merging data for a comprehensive view of cloud expenditures. This feature is crucial for organizations using multiple cloud services.

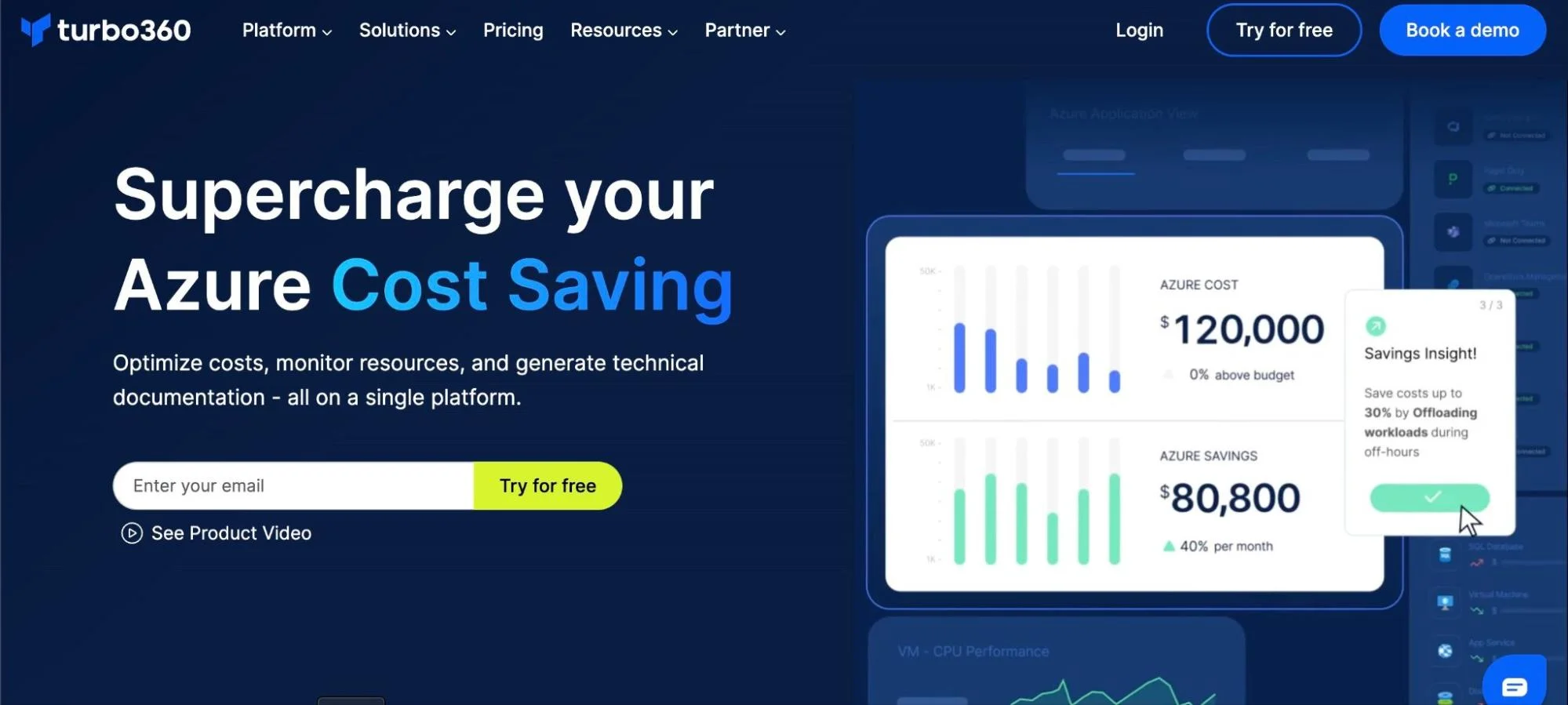

3. Turbo360

Formerly known as Serverless360, Turbo360 is an Azure cloud management platform ideal for serverless setups on Azure. It offers real-time visibility and cost control for organizations.

Turbo360 provides detailed Azure service costs, helping financial managers control expenses. It excels in predicting monthly costs and invoices, which is crucial for planning. Beyond basic cost management, Turbo360 breaks down expenses, showing where the money goes. Its real-time monitoring capabilities are key for proactive cost management.

The tool uses AI and machine learning to analyze usage patterns and suggest savings. It shares cost information across technical and financial teams, ensuring informed, strategic decisions.

Turbo360 also sets budget limits and alerts for critical spending levels. This fosters a cost-aware culture and strong FinOps practices.

4. VMware CloudHealth

VMware CloudHealth supports Azure financial management with budget management, cost allocation, and tracking features. It provides clear visibility and control over cloud costs, helping manage spending effectively. It identifies wasteful spending and suggests ways to reduce costs.

The platform allows precise budgeting, sets spending limits per cost center, and accurately allocates costs. Its predictive tools forecast future spending based on past trends, aiding financial planning.

CloudHealth also offers detailed reports and analytics for transparency and accountability. It updates cost management strategies with new Azure services and pricing changes. Automated policies for budget management and resource optimization ensure ongoing improvements and cost efficiency.

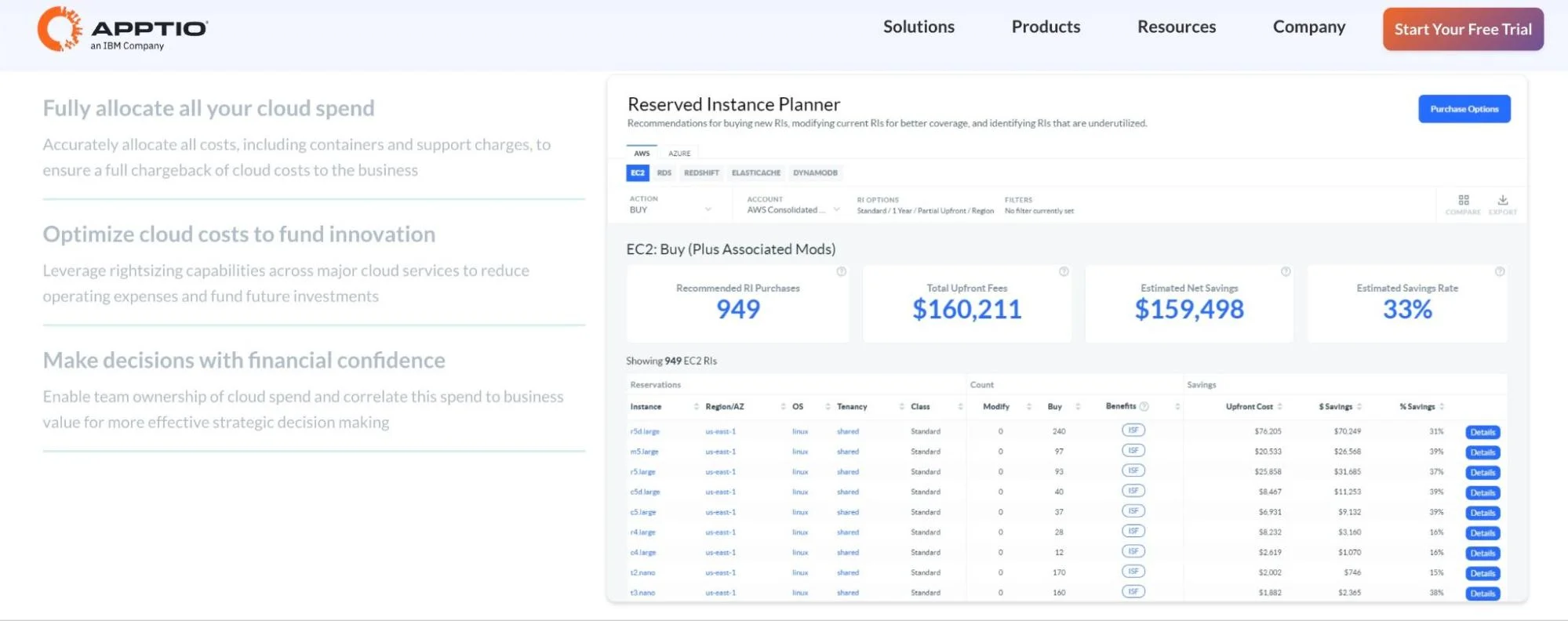

5. Apptio Cloudability

Apptio Cloudability is a key tool for managing cloud spending using FinOps. It provides visibility into cloud costs on platforms like Azure, AWS, and Google Cloud.

The platform supports budgeting, forecasting, and financial governance. Its features improve cloud efficiency and reduce unnecessary spending. It also gives detailed recommendations for Azure Savings Plans. For further savings, it works with Google Cloud Committed Use Discounts.

Apptio Cloudability is great for organizations with unpredictable needs, often leading to overprovisioned resources. It helps right-size infrastructure, preventing overspending and ensuring adequate resources for customer service. This makes it perfect for developers and cloud providers managing fluctuating demand.

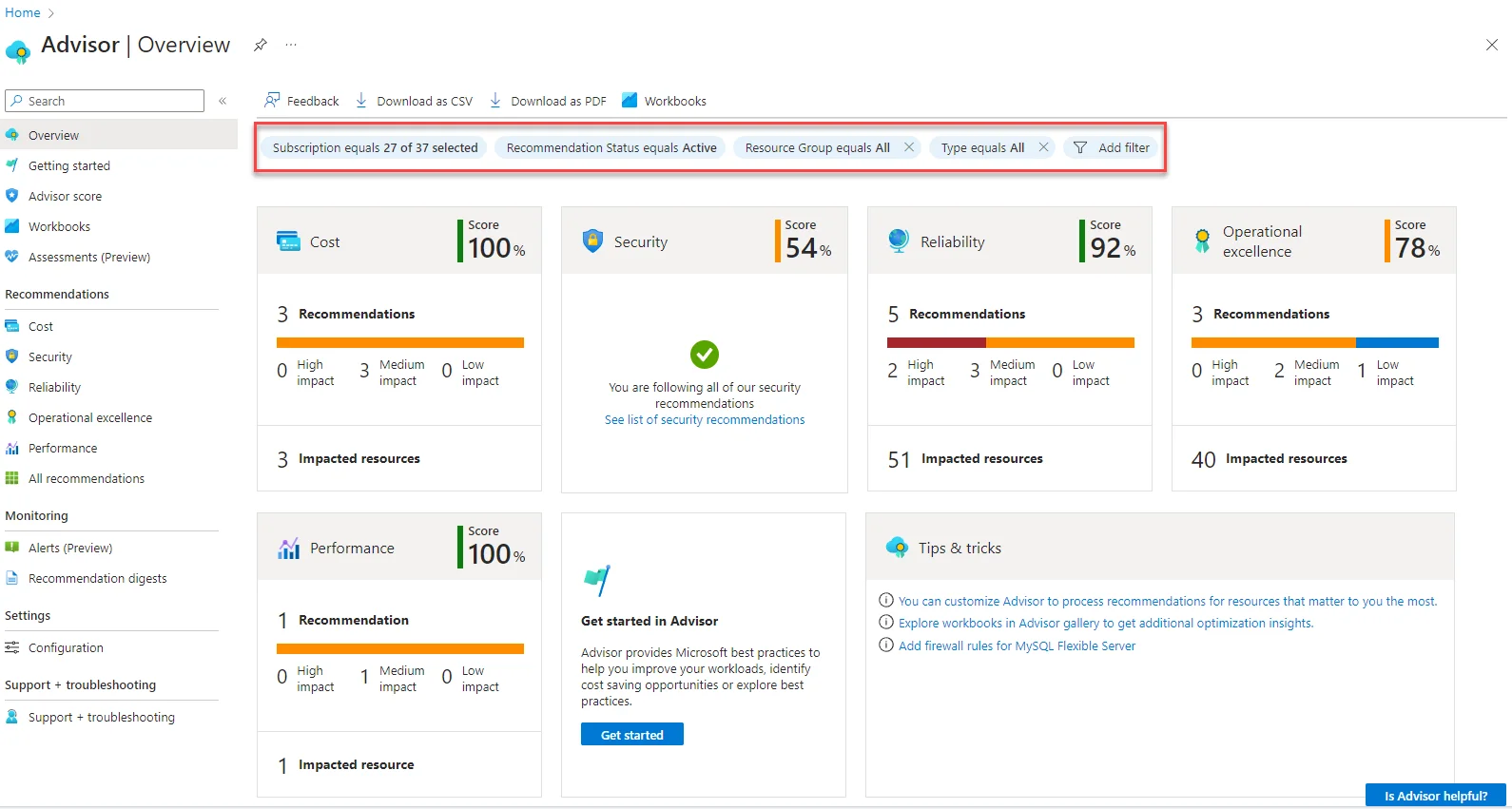

6. Azure Advisor

Azure Advisor is an essential cloud consulting tool for enhancing Azure operations. It guides users in adopting best practices to fine-tune their Azure setups.

Azure Advisor is accessible through the Azure Portal dashboard and available to every customer. It provides tailored recommendations across subscriptions, including suggestions for account consolidation and configuration changes.

Azure Advisor’s key features include proactive, personalized recommendations that enhance cost management, performance, security, and reliability. The tool offers useful insights aligned with its assessments, allowing organizations to make quick and effective changes. It covers many resources, from virtual machines and storage accounts to databases, providing data-driven insights for informed decisions.

7. Azure Pricing Calculator

The Azure Pricing Calculator helps users input their needs, such as virtual machines, storage, and networking. It allows location and expected usage adjustments and provides detailed cost estimates. This helps organizations anticipate expenses before deployment.

The calculator models complex architectures, enabling financial teams to explore different scenarios and their costs. It aids in creating cost-effective solutions without sacrificing performance. This is essential for effective financial operations management.

Though limited to Azure services, it integrates real-time data to ensure financial strategies are based on the latest information. This promotes informed decision-making and financial transparency in cloud projects.

8. Harness Cloud Cost Management

Harness Cloud Cost Management offers visibility and control over cloud expenses.

The platform provides insights into spending patterns, helping teams eliminate waste. By right-sizing Azure resources, Harness ensures you only pay for what you need. This reduces unnecessary spending and improves efficiency.

Its budget management features enable teams to set financial limits and receive alerts before exceeding them, preventing cost overruns.

The tool’s user-friendly interface simplifies cloud billing data, making it easy for non-technical stakeholders. This fosters collaboration between finance and technical teams, aligning financial and operational decisions.

9. CloudCheckr

Using CloudCheckr for Azure FinOps gives businesses the insight and agility needed for sustainable growth. It provides detailed insights into resource use and identifies potential savings.

Its advanced reporting tracks spending trends, forecasts expenses, and sets budgets. This approach prevents unexpected billing spikes. CloudCheckr also offers tips for resource optimization, such as instance right-sizing and using reserved instances.

Additionally, CloudCheckr automates FinOps tasks like cost allocation and compliance monitoring. This saves time and improves accuracy.

10. Finout

Finout excels in cost allocation, allowing organizations to assign costs to projects, teams, and more. This improves budget management and accountability. Users can set and track budgets in Finout, ensuring spending stays within limits. The tool sends alerts when budgets are close to or exceeded, preventing unexpected costs.

Custom dashboards in Finout help users monitor spending trends and find cost-saving opportunities. This proactive approach supports financial health and informed decision-making. Finout integrates with DevOps workflows, ensuring that financial data is always current and aligned with operations.

Finout generates detailed reports on cloud spending. These reports offer insights that help with financial planning and optimization. They help organizations make informed decisions and maximize their Azure investments. Finout provides clear visibility into expenses, supporting financial control and efficiency.

Supercharge Your FinOps Maturity With CloudZero

Managing cloud costs is crucial for any organization using Azure. The right FinOps tools can transform your cloud spending into a strategic asset, addressing common challenges like rising costs and complexity.

CloudZero is a FinOps-certified platform offering clear cost visibility and precise tracking without extensive tagging. With CloudZero, you can achieve 100% cost allocation, create a common language for all cloud stakeholders, and get ongoing advice from FinOps experts.

Schedule a demo today to see how CloudZero can optimize your cloud financial management and drive sustainable growth.

FAQs On Azure FinOps Tools

1. Why are FinOps tools important for Azure?

FinOps tools are essential for managing Azure’s complexity. They help control costs, improve budget efficiency, and ensure spending aligns with business goals.

2. How do Azure FinOps tools optimize costs?

These tools offer insights into cloud usage and expenses. They identify wasteful spending, suggest optimizations, and enable proactive cost control with budgets and alerts.

3. Can FinOps tools track spending across multiple clouds?

Yes, some tools, like CloudZero and Apptio Cloudability, track spending across multiple clouds, including AWS and Google Cloud, providing a comprehensive view.

4. What is cost allocation in Azure FinOps?

Cost allocation means attributing cloud spending to specific departments or projects. It helps with accountability and budget management.

5. Do FinOps tools support compliance?

Yes, they help maintain compliance by providing accurate and transparent financial records, which is essential for meeting regulatory standards.

6. How do FinOps tools foster collaboration?

They bring finance, tech, and business teams together, ensuring all stakeholders align on budgeting, forecasting, and spending.

7. What features should I look for in an Azure FinOps tool?

Look for cost visibility, real-time tracking, budget alerts, forecasting, and cross-cloud support. These features help manage and optimize cloud spending.

8. How does CloudZero help with cost allocation?

CloudZero links costs to specific resources and projects, providing detailed insights into spending. This helps organizations allocate costs accurately and manage budgets effectively.

9. How does CloudZero support proactive cost management?

CloudZero offers real-time alerts for unusual spending patterns and advanced forecasting tools. This helps organizations take immediate action to prevent budget overruns and optimize spending.

10. Is CloudZero suitable for large organizations?

Yes, CloudZero is ideal for organizations of all sizes, including large enterprises. It provides detailed financial insights and supports collaboration across finance, tech, and business teams.